The past week had been quite volatile for Bitcoin. From last Monday’s high of $21.06k, the largest crypto asset’s price dropped down to a low of $15.58k by Wednesday. Nevertheless, some stabilization and recovery were noted after that.

Even though the candles registered during the weekend—on both Saturday and Sunday—were in red, not much downward deviation was noted. By and large, BTC oscillated in the $16k-$17k bracket during the said period.

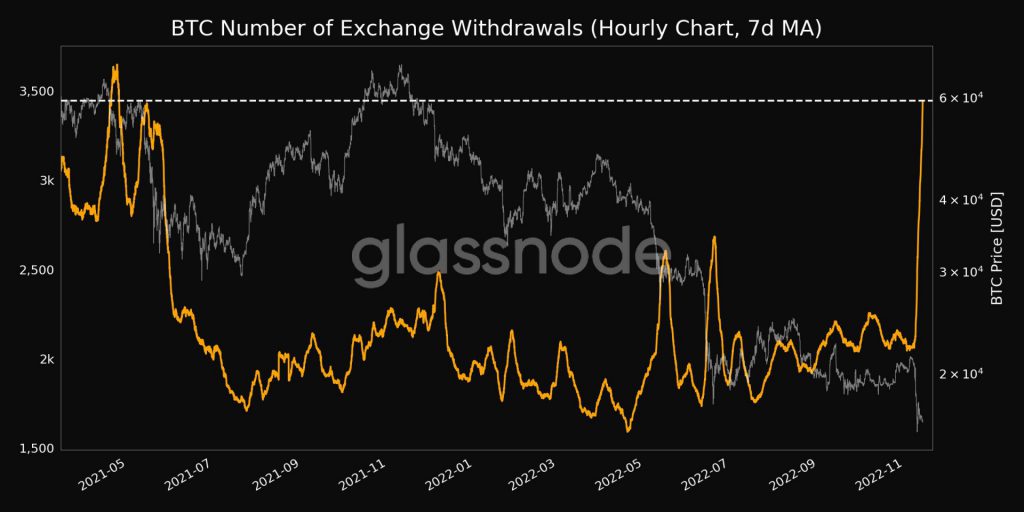

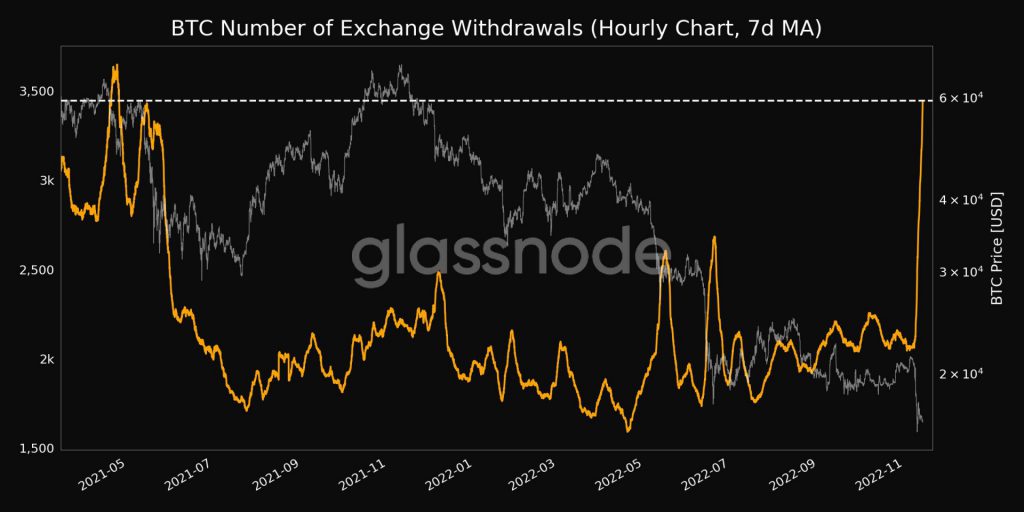

Bitcoin exchange outflows peak

Bitcoin exchange outflows just created a new record high. According to data from the on-chain analytics platform Glassnode, the number of withdrawals on exchanges reached an 18-month high of 3,445.613 on Monday.

Coins leaving exchanges usually indicate that HODLers are buying. However, this time seems to be slightly different. With crypto exchange FTX on the verge of collapse, investors have been moving away from Centralized Finance [or CeFi] lately. Stalwarts from space like CZ have been advocating users to store their crypto on self-custody crypto wallets. The Binance executive recently tweeted,

“Self-custody is a fundamental human right.“

Exchange withdrawals have been supplemented with parallel inflows into self-custody wallets. Take the case of Safe [known as Gnosis Safe before] itself. This smart contract wallet has registered around $800 million in net inflows since last Tuesday.

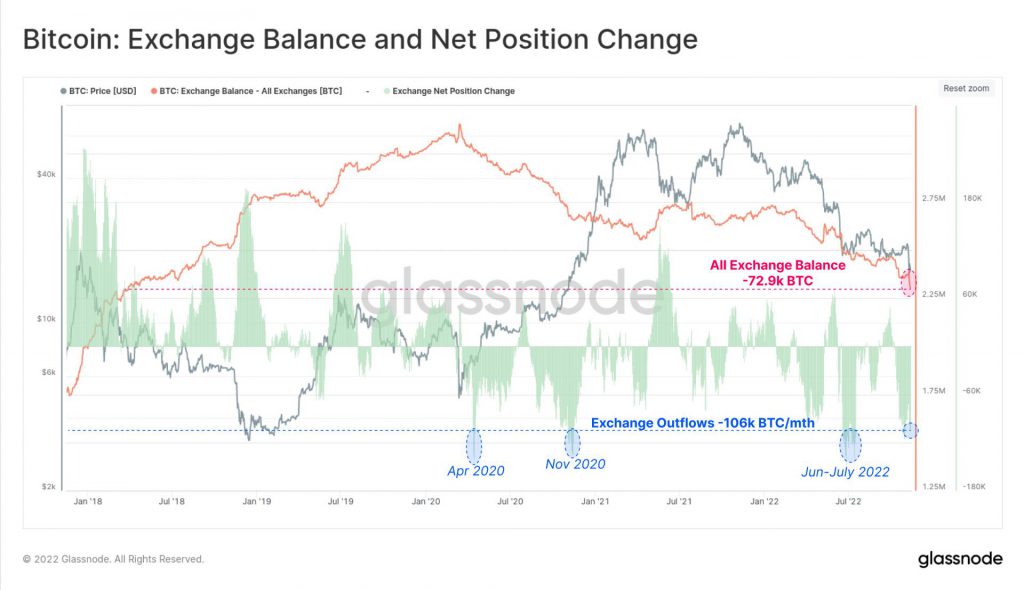

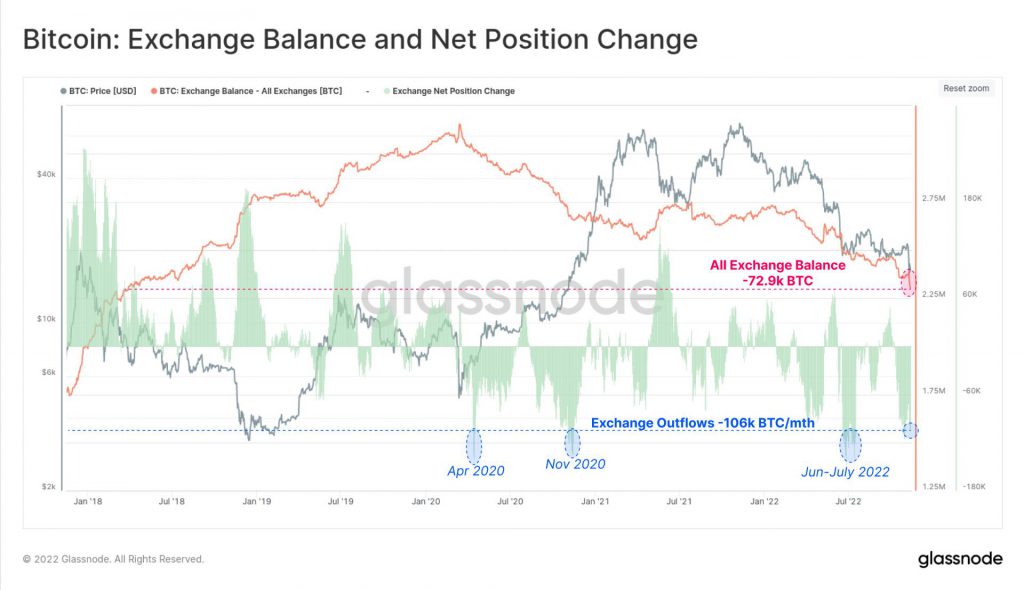

In fact, another tweet from Glassnode reaffirmed that exchange withdrawals pertaining to self-custody have been hovering at a historic rate of around 106k BTC per month. Similar levels have been noted only thrice in the past before this. Elaborating on the same, the analytics platform noted,

“Following the collapse of FTX, Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106k BTC/month. This compares with only three other times: Apr 2020, Nov 2020, June-July 2022.”

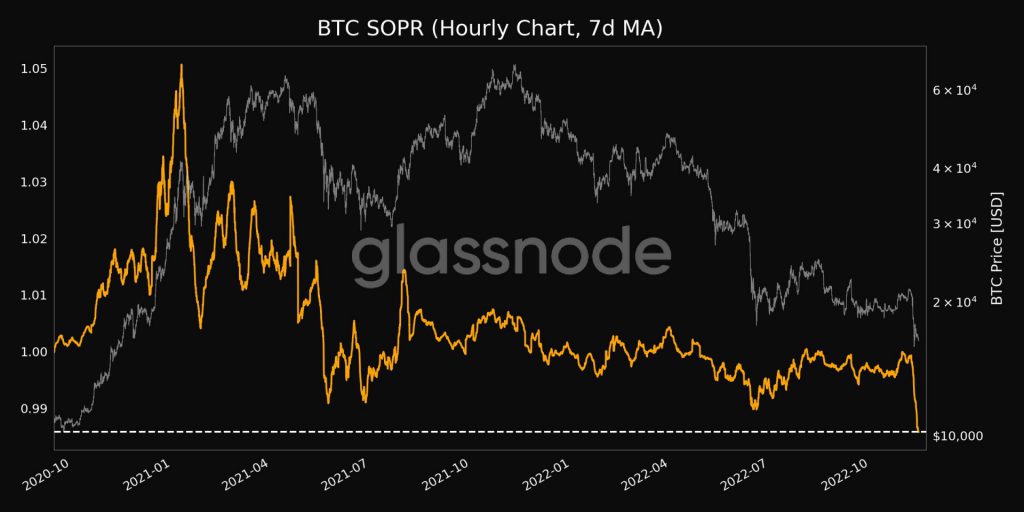

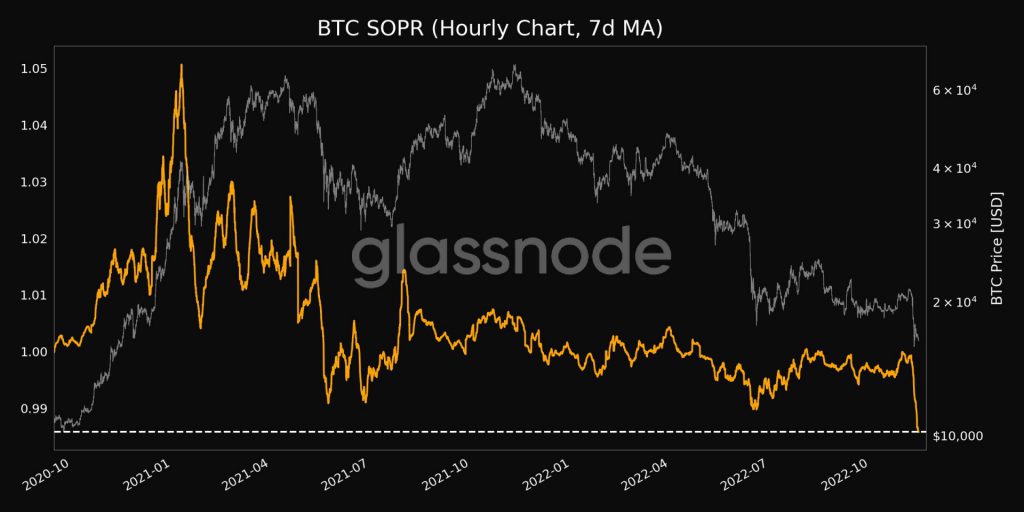

Bitcoin SOPR

However, this does not mean that Bitcoin is not being sold at all. The asset’s Spent Output Profit Ratio reached a 2-year low of 0.98583 on Monday. The current reading below 1 implies that the coins being moved on-chain are mostly being sold at a loss.

This indicator, as such, provides an insight into the macro market sentiment, profitability, and losses borne by investors over a particular time frame. Even though the ongoing downtrend indicates losses are being realized by investors who are selling, it also hints that profitable coins are not being spent.