After an eventful January, the cryptocurrency market was seen embracing its corrective side this month. After slumping to a low of $21,460.09 all the way from a high of $24,167.21, Bitcoin [BTC], became a hot topic of discussion. While some expressed fear, a few others were confident that this setback was momentary. As the asset is still looking for a prominent level of support, it managed to rise above $22,000.

After its brief stay in the $21,000 zone, Bitcoin surged to a high of $22,293.14. At press time, the world’s largest cryptocurrency was trading for $22,121.85 with a 1.81% daily increase.

As seen in Bitcoin’s one-hour price chart, there was minimal buying activity despite its latest rise. The Relative Strength Index [RSI] indicator was just a little over the 50 median. This further implied that there were limited purchases in the short term.

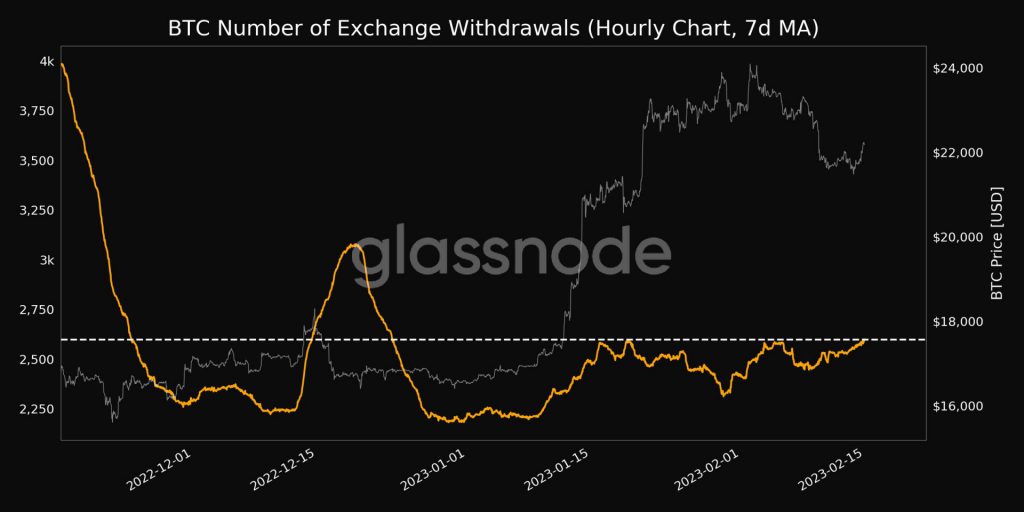

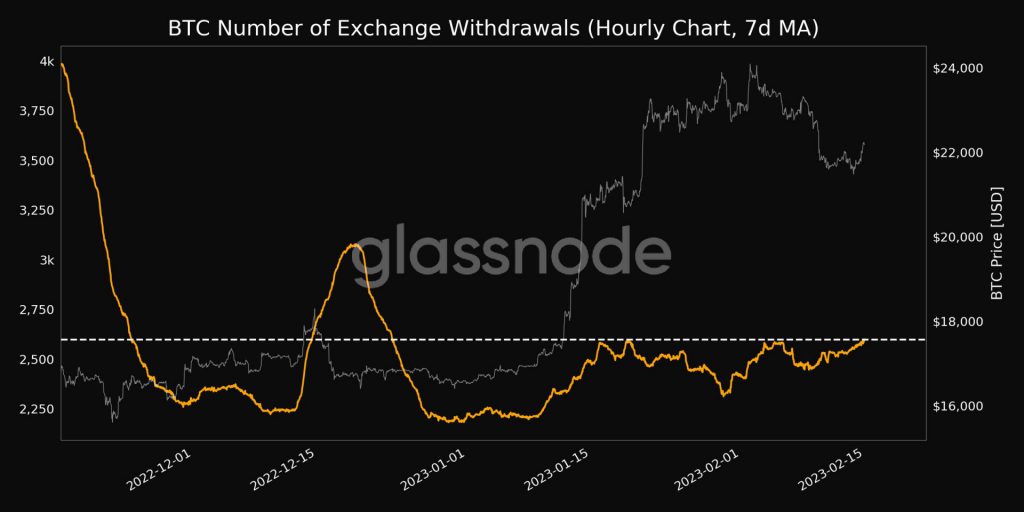

However, the number of exchange withdrawals related to Bitcoin was on the rise. According to on-chain analytics firm, Glassnode, the total BTC exchange withdrawals hit a 1 month high of 2,599.220. The previous high of 2,590.714 was noted on Jan. 19. Back then BTC lingered around the $20K zone.

Furthermore, this indicates that short-term holders could be trying to pocket profits by selling off their holdings.

Are Bitcoin holders currently bagging profits?

With Bitcoin’s latest recovery, about 63% of the asset’s holders were at a profit. According to Into The Block, only 33% were not making money at BTC’s present price.

Currently, 69% of the holders have been owning BTC for over a year. Short-term owners, holding the king coin for less than a year were a dainty 22%. Only 7% entered the market about a month ago.

If BTC prolongs its ongoing hot streak and manages to push past $24K, the asset’s holders will automatically incur more profits.