It has been a concerning few weeks for a host of global markets. A brewing trade war and increased global tariffs from the US have threatened a host of industries, with the cryptocurrency market potentially poised to take the brunt of it. Indeed, Bitcoin has been predicted to crash to levels of $40,000 as China continues to dump BTC.

The ongoing geopolitical tensions have threatened the leading cryptocurrency amid recent action taken by the country. Indeed, it would take the 2025 performance from bad to worse for the asset, as it has failed to break through the $85,000 mark for much of the last month.

Also Read: Ex-SEC Chair Gary Gensler Says Bitcoin Will Last; Most Altcoins Won’t

Bitcoin Crash Incoming? Why Experts Say China Could Drive Price to $40,000

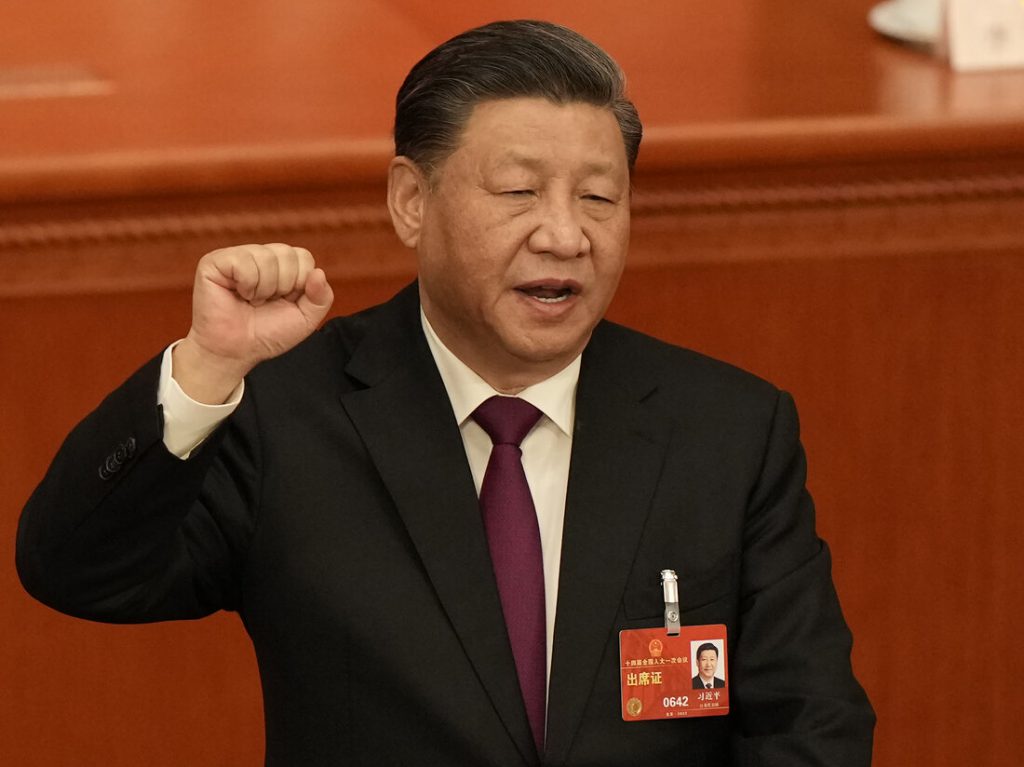

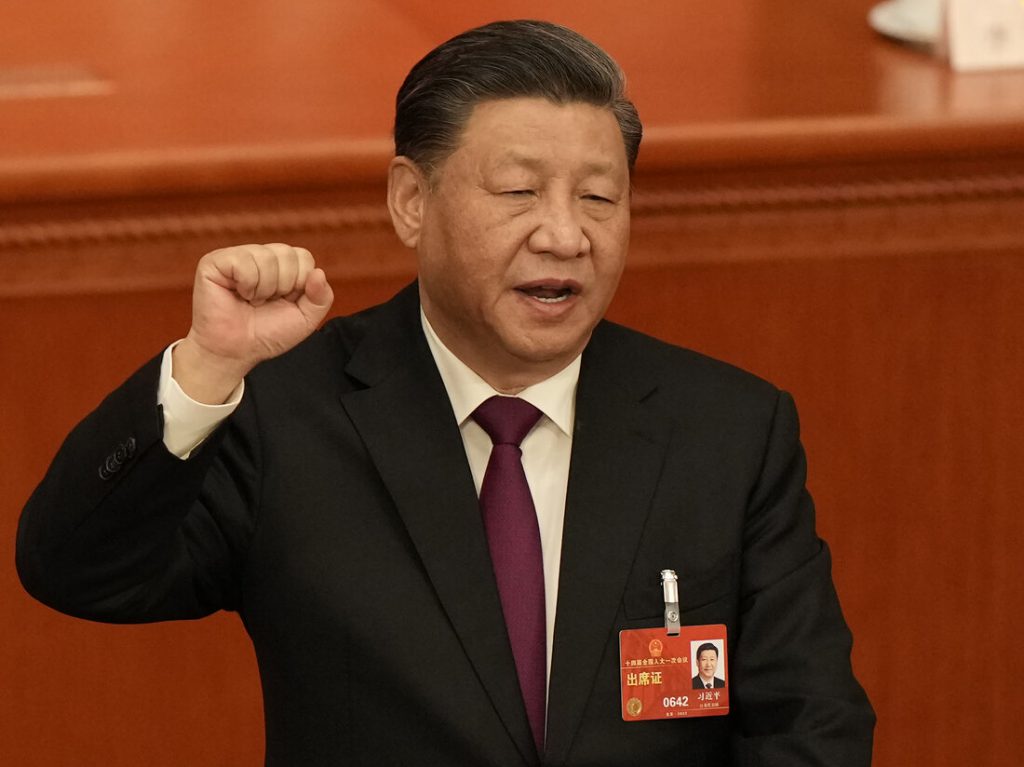

The last several weeks have seen tensions rise between the US and China. Although US President Donald Trump has reiterated his confidence that the two sides will get a deal done, experts aren’t so hopeful. Until they do reach common ground, cryptocurrencies and the US stock market could suffer.

Indeed, there are rumors that the leading cryptocurrency could be a specific target within the growing tariff war taking place between both sides. Specifically, one cryptocurrency expert took to X (formerly Twitter) to theorize that Bitcoin could be poised to crash to $40,000 as China dumps its BTC.

Also Read: Solana Outperforms XRP, Bitcoin: Can SOL Reclaim $150 Next?

According to the analysts, $400 million has already been liquidated from the country. However, they note that this is “only the beginning.” The move would have massive implications for the digital asset and the market. It was late last year that the asset surged to a six-figure price. Moreover, analysts project it to reach heights of $500,000.

The most concerning aspect of the sale is how much BTC China currently has. According to Binance, they stand as the second largest holder of Bitcoin, only to the United States. The US has sought to implement Bitcoin into its economy in a big way. Therefore, a move like this would greatly threaten the economy amid an ongoing trade war.