Ethereum has been dominating the NFT space. Other blockchains like Solana, Polygon, and BNB Chain have been tagging alongside. However, the list now features a new entrant, Bitcoin.

Ordinals on Bitcoin debuted in January 2023 and they have been an evergreen topic of discussion since then. On one hand, people from the industry have been excited to welcome NFTs to Bitcoin. On the other hand, skeptics have been debating how Ordinals unlock a world of dangers for the Bitcoin network, including malware assaults and soaring transaction costs.

Ordinal Inscriptions are quite similar to NFTs. However, they come with a slight twist. They are digital assets inscribed on a Satoshi, the lowest denomination of Bitcoin. The network’s SegWit and Taproot upgrades that took place to improve the privacy and efficiency of the network opened the doors for Satoshi inscriptions.

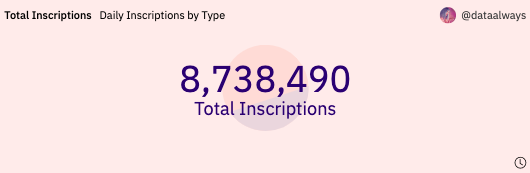

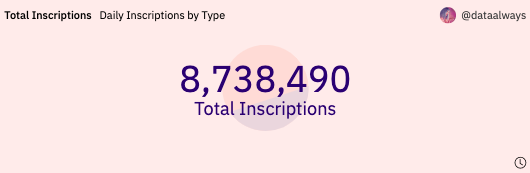

According to data from Dune Analytics, over 153.6k Ordinal Inscriptions have been created to date. Parallelly, users have shelled out $40,913,300 on fees so far.

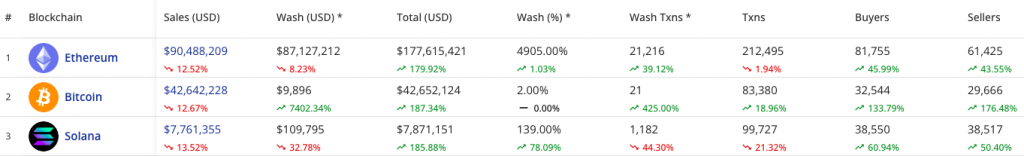

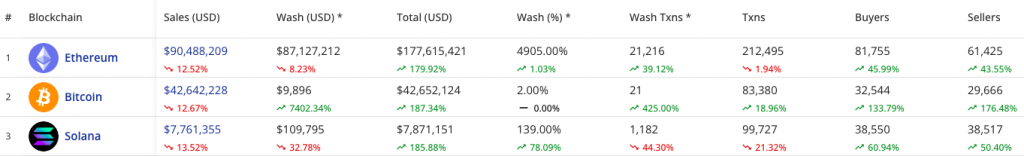

Owing to the increased activity, Bitcoin has already climbed up to the second position on the NFT sales front. Over the past week, $42.6 million worth of NFTs were sold on the Bitcoin blockchain. The aforementioned rise was accompanied by a hike in the number of buyers and sellers. Specifically, the reflected values of 32.5k and 29.6k at press time. Ethereum’s fostered more than double the amount of NFT sales in the same period. The number of buyers and sellers on its platform also doubled.

Also Read: Dogecoin, Litecoin Transactions ‘Spike’ After Ordinals Intervene

‘Flippening’ on the horizon?

Bitcoin’s rise in dominance in the NFT space, on the other hand, is single-handedly attributed to the Ordinals Protocol. In just a matter of a couple of months, Bitcoin has been able to reach the second position. This obviously opens up the “flippening” narrative.

However, that is not something that will happen overnight. NFTs on Ethereum have been there for quite some time and several prominent projects have network based on the protocol. Factors like the high fees have been frowned upon in the past. However, it should not be forgotten that the same is a double-edged sword, for it parallelly serves as a proxy to the increased usage.

Another factor that needs to be considered is wash trading. Simplistically, this kind of trading manipulates the price, for an entity simultaneously sells and buys the same tokens. By doing so, they create a false impression of market activity without enduring risk or changing its market position. As shown below, wash sales on Ethereum have slashed by 8% over the past week. On Bitcoin, however, they have risen by 7402%. However, size-wise, the number is almost negligible for Bitcoin [2%] giving it an edge. On the other hand, the same accounts for 4905% on Ethereum.

The macro picture

On other protocols like Solana, Polygon, BNB Chain, and Cardano, the sales have been mixed. Over the past week, it has shrunk down on the initial two protocols, while on the other two, it has risen.

Even though Cardano’s number has refined by 15% over the past week, it should be noted that it currently occupies the 8th position. NFTs were introduced on Cardano post the Alonzo update in 2021. Thus, given Bitcoin’s rapid rise up the rankings, it can be contended that Ordinals has proven to be a better game changer than Alonzo on the NFT front.