Bitcoin did note a slight recovery during the weekend. On Friday, BTC registered a daily low of $28.73. Nonetheless, it opened above $30k on Monday and was valued at $30.5k at press time.

On the weekly too, there was a ray of optimism. After noting 8 back to back red candles since the end of March, the one in the making was green on Monday.

Signs of weakness persist for Bitcoin

The afore-highlighted positives should be taken with a grain of salt because Bitcoin is currently hanging around one of its last threads of support. The range between $28.5k to $29.2k has cushioned Bitcoin a couple of times in the recent past and can be relied upon this time too. However, without strong bullish momentum, Bitcoin might not be able to stay afloat for long.

If the floor of the said range is lost as support, then the king-asset would get one more chance to rescue itself around $25-$26k which is more or less in the vicinity of its 1-year weekly low and the 100 DMA. If the said range ain’t clung onto, then not much other than a liquidity injection would be able to stop the king coin’s fall to $20k.

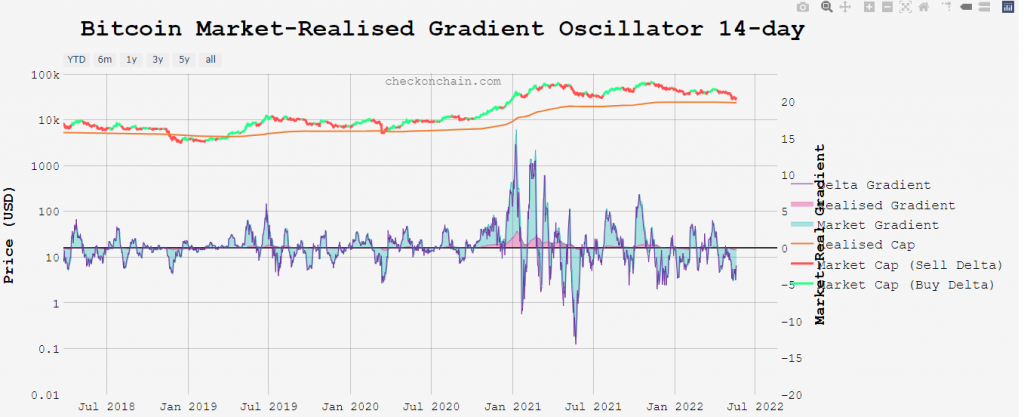

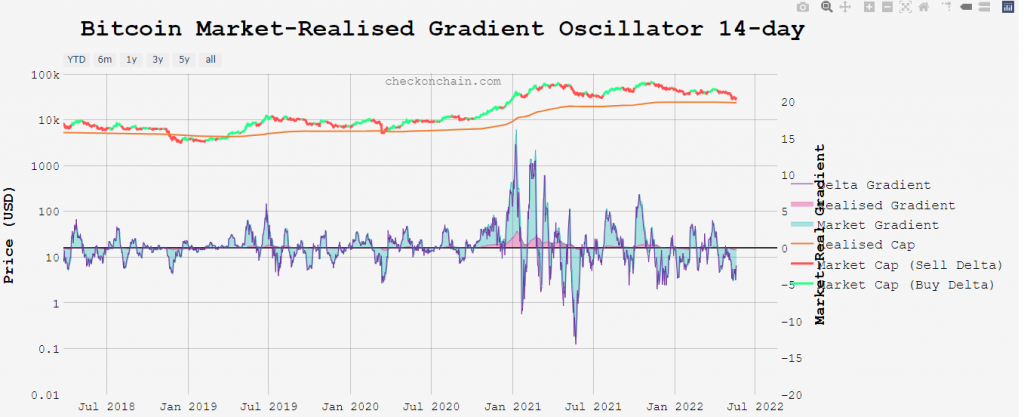

Also, here it is worth noting that despite making a comeback above 0 towards the end of April, the Market-Realized Gradient Oscillator has been hovering in the negative territory of late, indicating another sign of weakness.

This metric, as such, gauges the degree of momentum in market pricing relative to the capital inflows, recorded in the realized cap. Consequent higher/lower peaks indicate increasing momentum to the upside/downside, respectively.

Over the last couple of days, the MRGO has been hovering around -3, indicating that the downtrend is still in play and Bitcoin is still not yet completely out of the bearish woods.