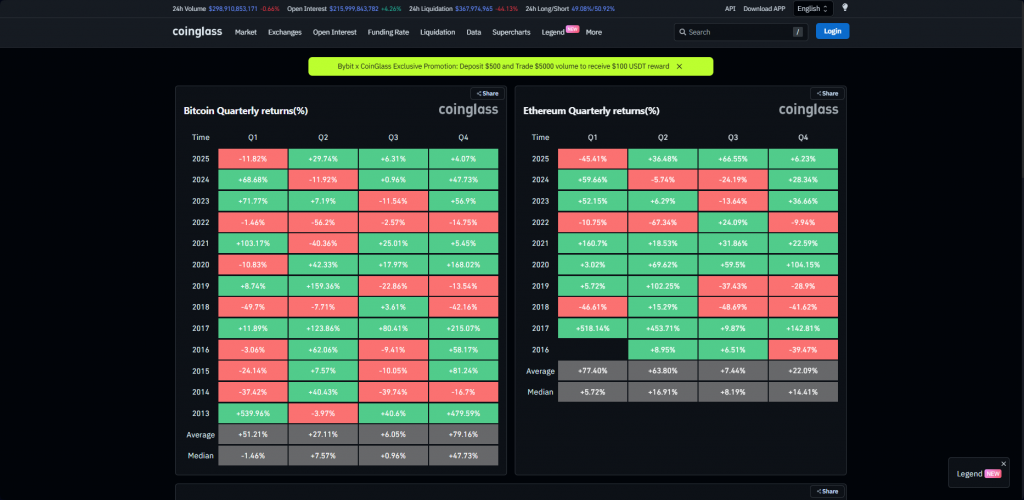

Bitcoin’s Uptober 2025 has pushed the cryptocurrency to $118,000. This surge was driven by over $1 billion in Bitcoin ETF inflows along with heightened demand during the US government shutdown Bitcoin crisis. The Bitcoin price $118k milestone actually reflects surging Bitcoin institutional demand. October continues its historical trend of strong returns right now.

Bitcoin’s Uptober Rally Sparks $1B ETF Inflows Amid Market Surge

Record Inflows Signal Strong Demand

Bitcoin ETF inflows have exceeded $1 billion over the period of October. This is one of the most robust periods since the approval of spot ETF earlier this year. The capital inflow continues to indicate that Bitcoin institutional demand is still rather strong. Big investors are still buying the cryptocurrency via regulated investment products. Markets exhibit certain levels of uncertainty right now.

The Bitcoin Uptober 2025 bubble has been spurred by technical breakouts and increasing trading volumes in the various exchanges. Bitcoin soared to $118K by penetrating the crucial resistance lines. The trend is headed towards a continuous increase over the next few weeks. History records that October will witness good returns to Bitcoin. Even this year is doing better than what is normal on an average day of the month in terms of returns.

Shutdown Drives Safe-Haven Flows

The US government shutdown Bitcoin correlation was very clear. Political uncertainty drove investors to decentralized assets. The shutdown created an issue of fiscal policy and spending, which caused capital to move into the direction of Bitcoin as a substitute to the safe assets. This move contributed to the momentum of Bitcoin Uptober 2025 as retail and institutional investors wanted to be exposed to the currency at the time of writing.

Bitcoin advocate Anthony Pompliano highlighted the timing on social media, stating:

”October 1st hits. Bitcoin rips. Tick, tock. Next block.”

Also Read: Strategy (MSTR) Stock Climbs as Bitcoin Gets IRS Tax Reprieve

Institutional Adoption Accelerates

The enhanced market infrastructure or simply the regulatory transparency surrounding the spot ETFs have boosted Bitcoin institutional demand. The situation of the US government shutdown Bitcoin was an example of how the crypto-economic system can be appealing under the circumstances of political crisis. The subscriptions into Bitcoin ETF inflows are indicators of confidence in the long-run direction of Bitcoin.

Safe-haven demand, cyclical strength and record Bitcoin ETF inflows have now left Bitcoin on the track of further development. The response of the cryptocurrency to the US government shutdown Bitcoin episode has solidified the role of Bitcoin as a growth asset. It even works as a hedge against the conventional marketplace risks according to Bitcoin Uptober 2025 events.

Also Read: Bitcoin October 2025 Price Prediction: Will it Breach $150,000?