The crypto market is currently in one of its worst patches in history. Despite the sentiment flipping positive post yesterday’s inflation data release, the bullish setup remains to be fractured on the macro frame, implying that Bitcoin has likely not yet bottomed out.

Read More: With U.S inflation easing to 8.5%, will Bitcoin’s rally extend?

Inflation: A blessing in disguise for Binance?

Binance’s Latin America head, Maximiliano Hinz, told Reuters on Wednesday that the exchange was seeing a surge in clients “due to rising inflation and a historically strong dollar that has depressed emerging market currencies.”

Without pinpointing out numbers, the Binance executive said,

“Now that we are seeing inflation ramping up worldwide, we are seeing that more and more people are seeking cryptocurrency, like bitcoin, as a way to protect themselves from inflation.”

Argentina’s annual inflation currently stands at around 90%. Highlighting the same, Hinz said that the country has grown into one of the company’s top markets, alongside Brazil and Mexico. In fact, back in May, when the market was bearing the brunt of the Terra ecosystem collapse, Argentines were seen amassing Bitcoin.

Are Bitcoin and Inflation hedges still synonymous?

Well, it is a known fact that Bitcoin has been bearing the inflation hedge tag for years now. However, has it been able to honor the same of late? Not for now. Being an inflation hedge basically means the asset price and inflation rate move in opposite directions.

Consider this: The US released its inflation numbers yesterday. The overall rate reflected a suppressed value of 8.5%. Now, on the said positive news, if Bitcoin were acting like a true inflation hedge, it would have shed value. However, that was not essentially the case, for the asset ended up rallying.

In fact, per TD Ameritrade Network’s Oliver Renick, it is “painfully obvious” that Bitcoin is not an inflation hedge.

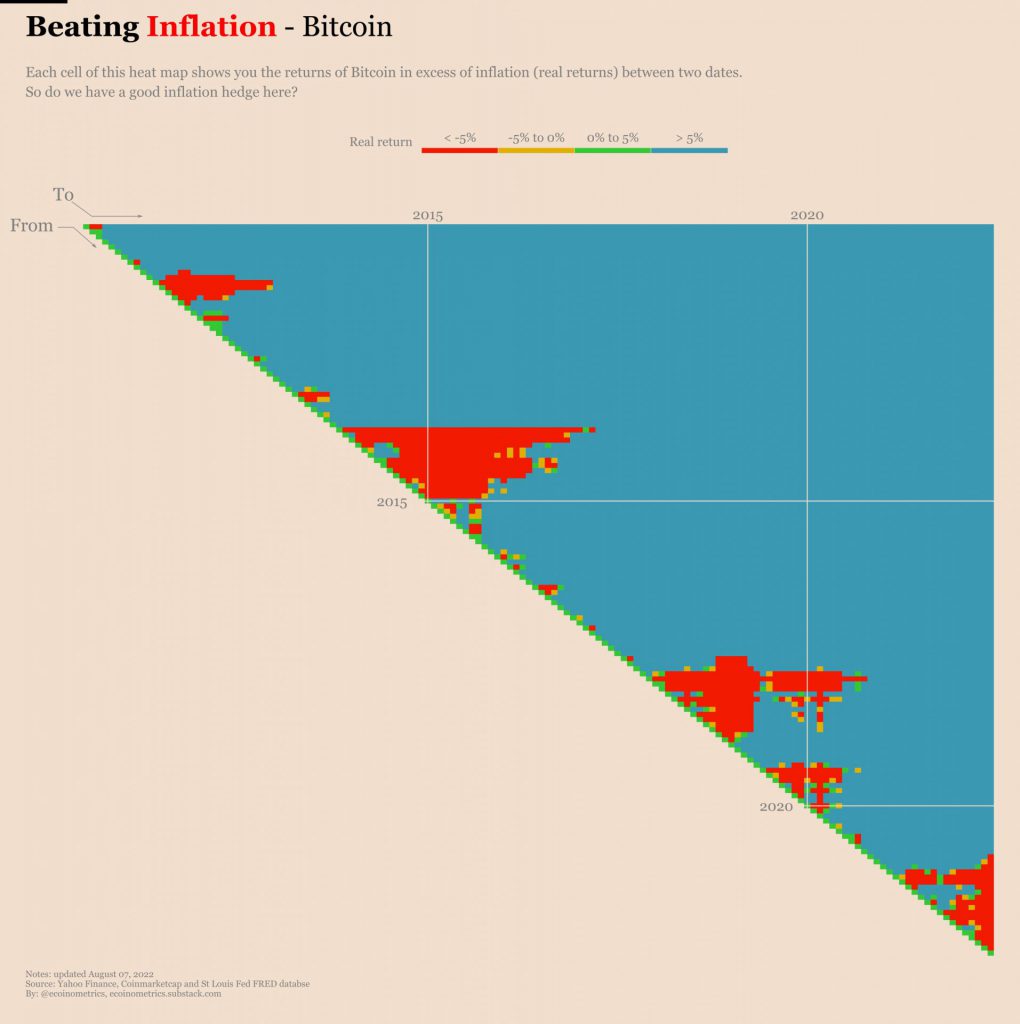

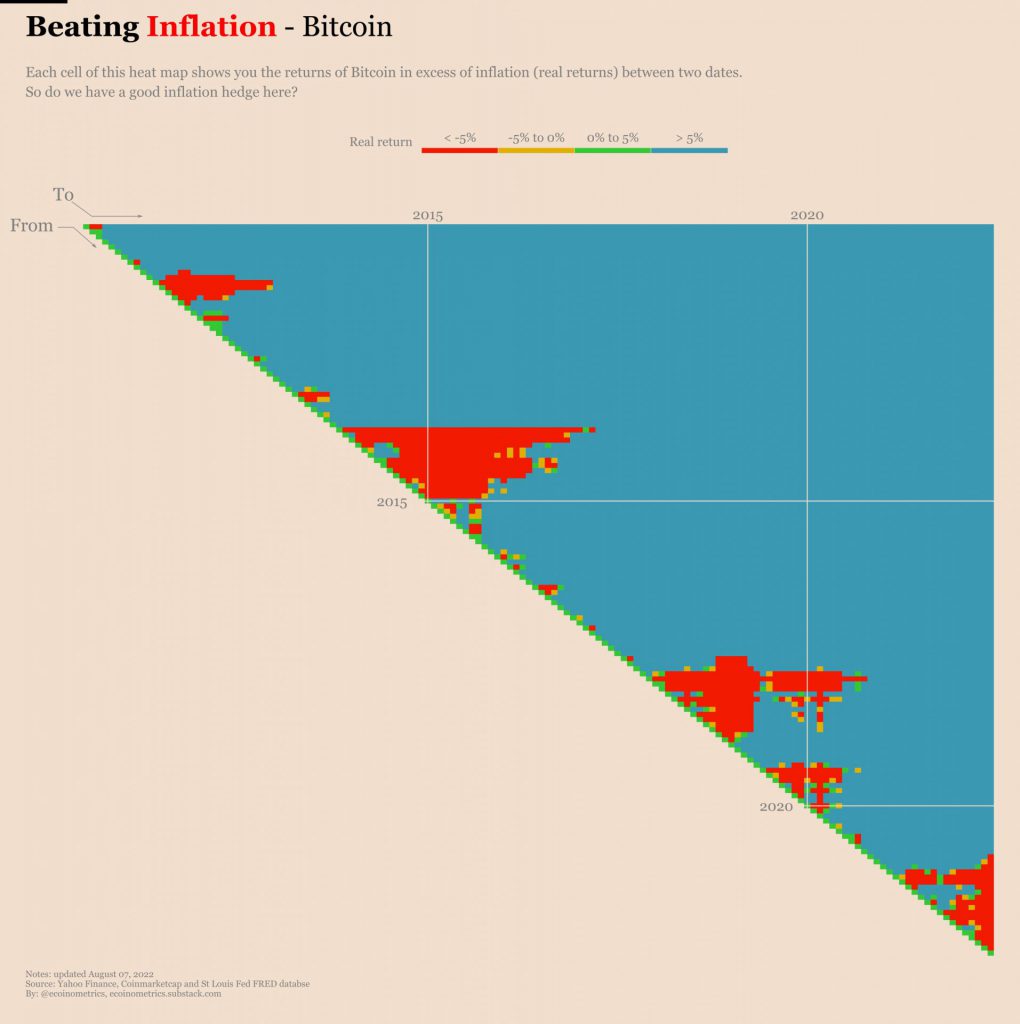

Having said that, it doesn’t mean that it is time to strip Bitcoin of the said tag. Over the long term, it has been able to deliver better results, and the same can be inferred from the chart below.

Elaborating on the same, one of Ecoinometrics‘ recent tweets asserted,

“Bitcoin, like other risk assets, isn’t a great short-term inflation hedge. The long term is a different story… the returns over several years are very much real.”