Bitcoin [BTC], the world’s largest cryptocurrency has garnered a lot of support over time. Several have been embracing the king coin after altering their perception of BTC. But a few others continue to find faults in the asset. Gold bug Peter Schiff has been a critic of BTC for quite some time. He still condemns the cryptocurrency even after it has evolved over the past few years. More recently, he suggested that Bitcoin is a “fraud.”

Recent comments from MicroStrategy co-founder and Bitcoin bull Michael Saylor prompted Schiff to outrightly label BTC as a “fraud” and a “scam.” Saylor uploaded a short clip that contains points on how the financial system is poised to implode and how the US currency is losing purchasing value. In addition to this, it shifts into full-fledged evangelism, with Bitcoiners appropriating ideas from the religious realm.

Tim Draper, a venture capitalist was also part of the video and compared the BTC market. to a decent church. He said, “Anyone can be part of the Bitcoin economy. It’s like a good church.” Saylor added to this and stated, “Because it’s an ethical ideology, there are many people who feel very spiritual about it.”

But Schiff dismissed this narrative and pointed out how Bitcoin is more flawed than the dollar. He urged the market to opt for silver or gold as an alternative to the dollar as opposed to Bitcoin.

Also Read: Bitcoin & Ethereum Ruled as Commodities in Illinois, CFTC Chair Says

Bitcoin’s Current Market

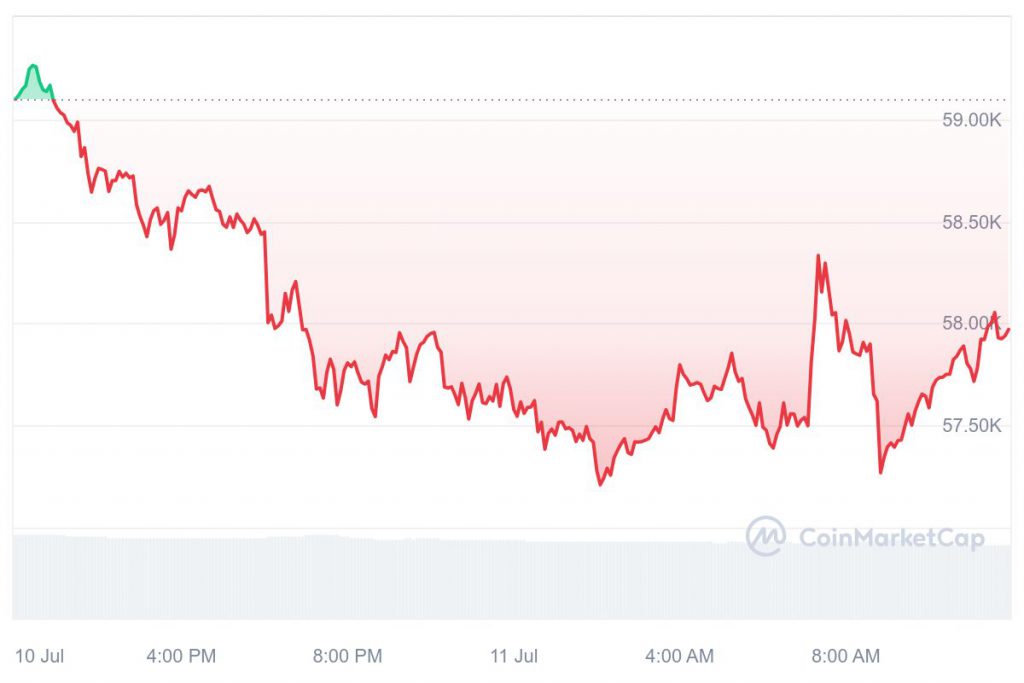

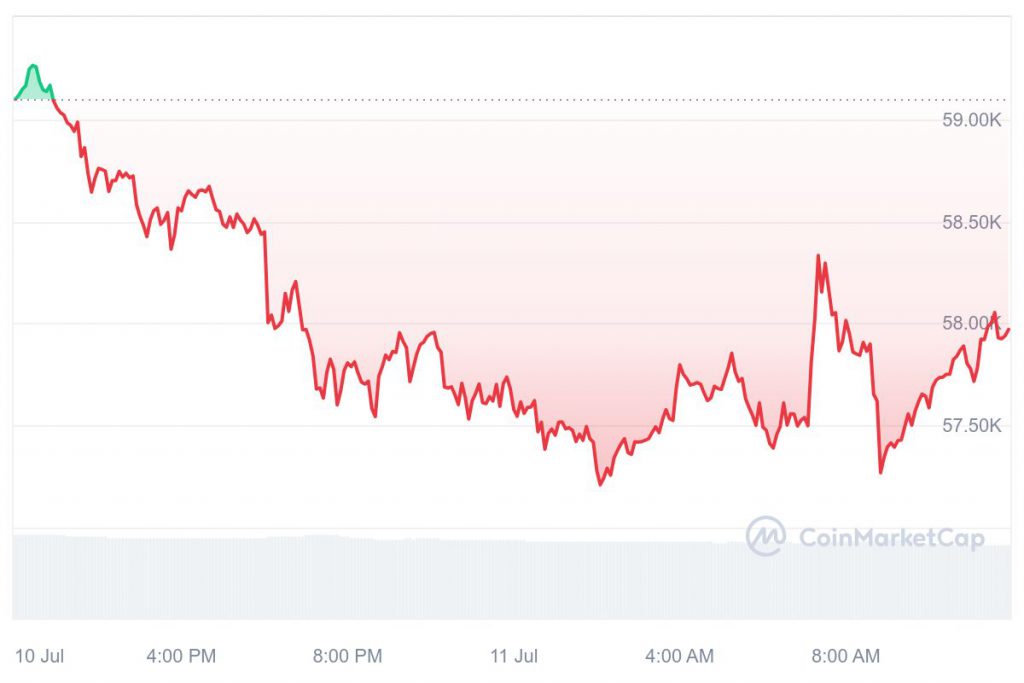

At press time, BTC was trading at $57,932.96 following a 2% drop over the past 24 hours. The king coin currently trades 21% below its all-time high of $73,750. While the asset took a massive hit this week, investors expect BTC to hit a new all-time high later this year.

Changelly projects that by 2024, Bitcoin prices will have increased to $58,498 as the minimum price. The price of BTC can go as high as $84,532.80. It is anticipated that the average trading price will be $71,515.40.

Also Read: Bitcoin ETFs Get $500M Inflows as BTC Approaches $60,000