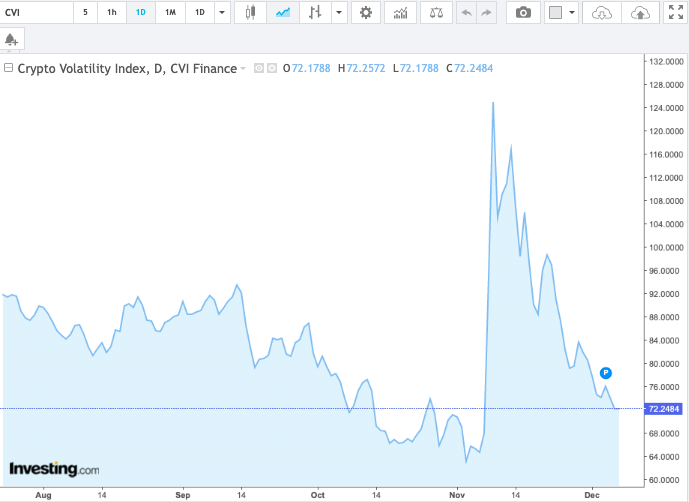

Volatility from the crypto market has gradually been evaporating. In the second week of November, the reading of this index stood at the brink of 125. Post the progressive dip, the same was hovering around 72.2 at press time on Wednesday.

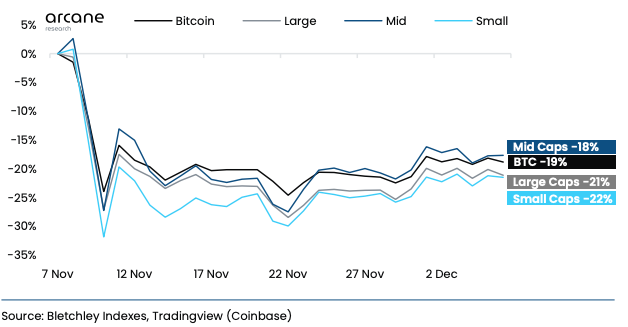

Of late, crypto asset prices have been moving in tandem. Brief recoveries initiated by the leaders have been echoed by the rest of the pack. Similarly, corrections have also coincided with each other. A recent report by Arcane Research highlighted,

“The crypto market has mostly traded as one coordinated organism in the last week,

evident by all indexes trading in a very flat environment.“

The weekly returns of most cryptos currently stand in red. In fact, the performance of market-cap-weighted indexes further hints that the market is trading in consolidation. Highlighting the same, Arcane Research’s report noted,

“The overall flat market is likely caused by a trader exodus following the FTX collapse, as the market trails in deep consolidation accompanied by low trading volumes.“

Ripple Effects

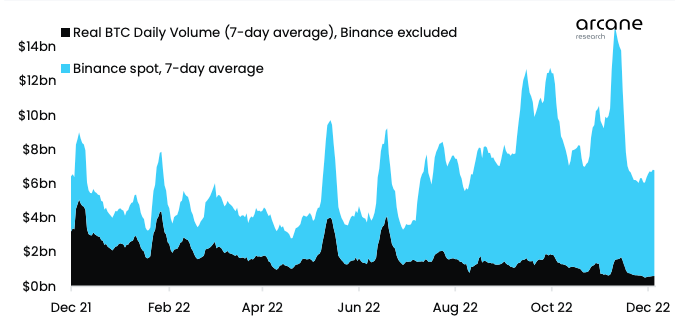

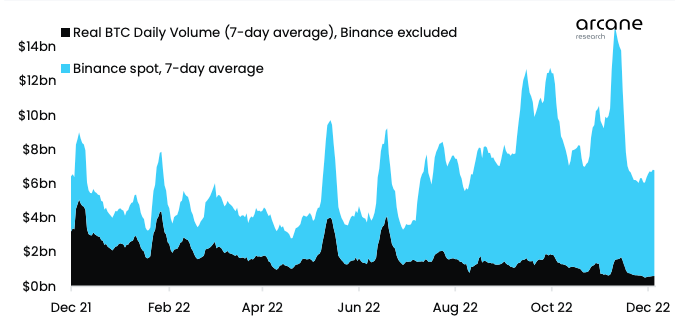

Moving on the same path has essentially not done much good. The cumulative spot volumes have seen a decline. On November 29, for instance, the 7-day average real spot volume in BTC [excluding Binance] reached $510 million. The said level was last seen back in October 2020. The report further highlighted,

“Daily trading volumes in BTC spot markets, when excluding Binance, sits 65% below the yearly average.“

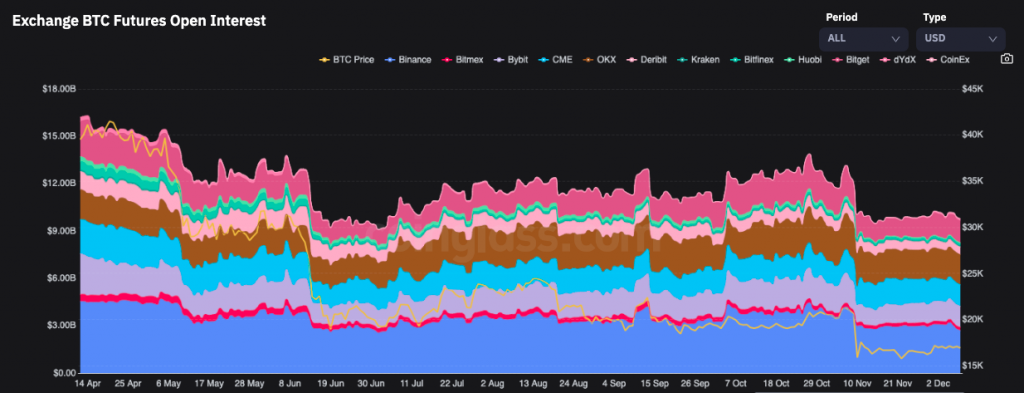

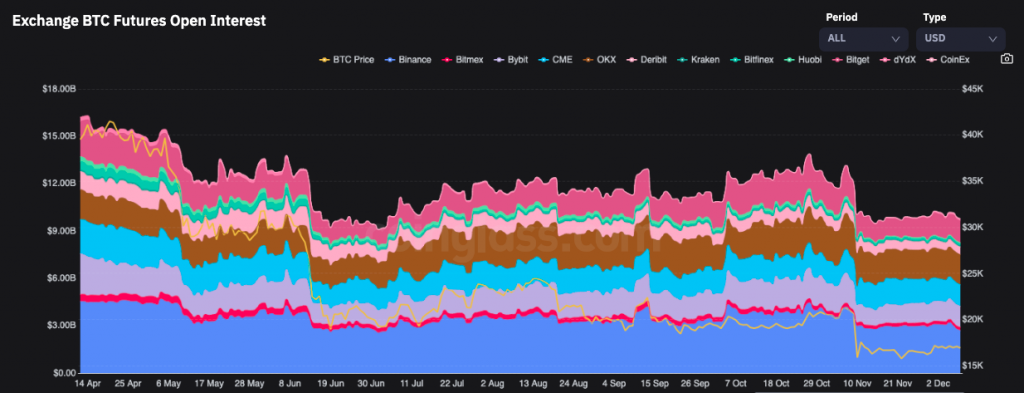

Parallelly, even derivative traders also seem to have taken a break. Bitcoin-specific futures open interest has been trading relatively flat in the $9 billion to $10 billion bracket over the past few weeks.

Alongside, the estimated leverage ratio has also been on the fall and is currently revolving around levels last registered in mid-2022. Evidently, with the lack of volatility in the market, traders are hesitant to take high-leverage risks in derivatives trading.

Thus, keeping the mutual co-dependency in mind, it becomes evident that until and unless the leader takes a lead, the fate of the market will not alter.