Investors who entered Bitcoin (BTC) more than a decade ago could have made millions if they had stayed invested for the long term.

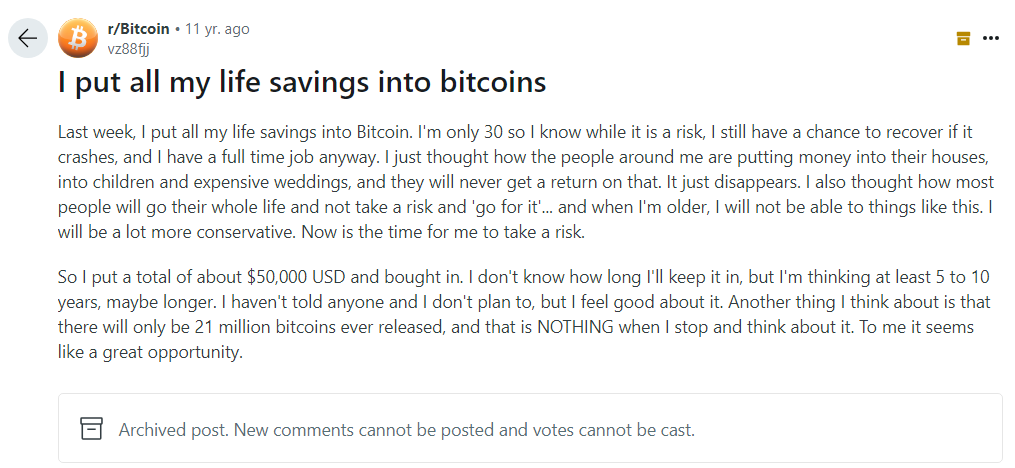

One such investor revealed in 2013 that he purchased $50,000 worth of BTC and plans to hold it for ten years. The revelation was made on a Reddit thread 11 years ago, in which the investor confirmed that he put $50K in BTC and is both nervous and hopeful about the future.

Also Read: Tron Rise Continues as TRX Volume Skyrockets 200%

Bitcoin: $50,000 To $150 Million in 11 Years

Bitcoin Investment in 2013

Bitcoin traded between $20 and $800 in 2013, and the investor could accumulate anywhere between these numbers.

Even if the investor picked it up at its lowest, at $20, it would be an accumulation of 2,500 BTC. The 10-year investment plan could have paid off massively, generating life-changing wealth for himself and his children.

Also Read: U.S. Dollar Falls To New Lows as Local Currencies Rise

Potential Returns on Investment

If the investor had picked up Bitcoin for $20 in 2013 worth $50,000, his wallet could hold 2,500 BTC. The leading cryptocurrency traded around the $60,000 mark on Thursday, attracting bullish sentiments. Therefore, if the investor has held the asset until today, the $50,000 investment is worth $150 million.

Also Read: Cardano (ADA) Forecasted To Reach $3: Here’s When

Wealth Beyond Generations

That’s enough wealth that could last generations without needing to work. However, whether BTC will rise similarly in the next ten years remains questionable. Even accumulating a minimum of 10 BTC is beyond the budget for the average investor. The maximum a middle-class income-level trader could hold is probably 2 BTCs.

Market Impact

The cryptocurrency market has delivered similar returns to several investors who took an early entry position. The others who joined the bandwagon late are mostly sitting on bags with meagre profits. As Bitcoin has peaked, life-changing gains with generational wealth remain out of the box.