Owing to the bear market extension, miners and mining firms continue to be distressed. Right from defaulting loans to posing quarterly losses, prominent names like Iris Energy and Core Scientific seemed to be in a fix.

On the whole, Bitcoin mining hashrate continues to hover around all-time highs, adding additional burden on the shoulders of miners. Even though a rising hashrate indicated that the network is becoming more secure, it puts pressure on miner profitability numbers. The number is, however, set to slightly ease during the upcoming adjustment scheduled next week.

Chalking the current state of affairs and opining on what it could possibly mean, Senior Analyst at UTXO Management—Dylan LeClair—said,

“Hash rate 7d moving average is now 13.7% off all-time highs; mining difficulty is projected to adjust -9% a week from now. Early stages of another miner capitulation by the looks of it.“

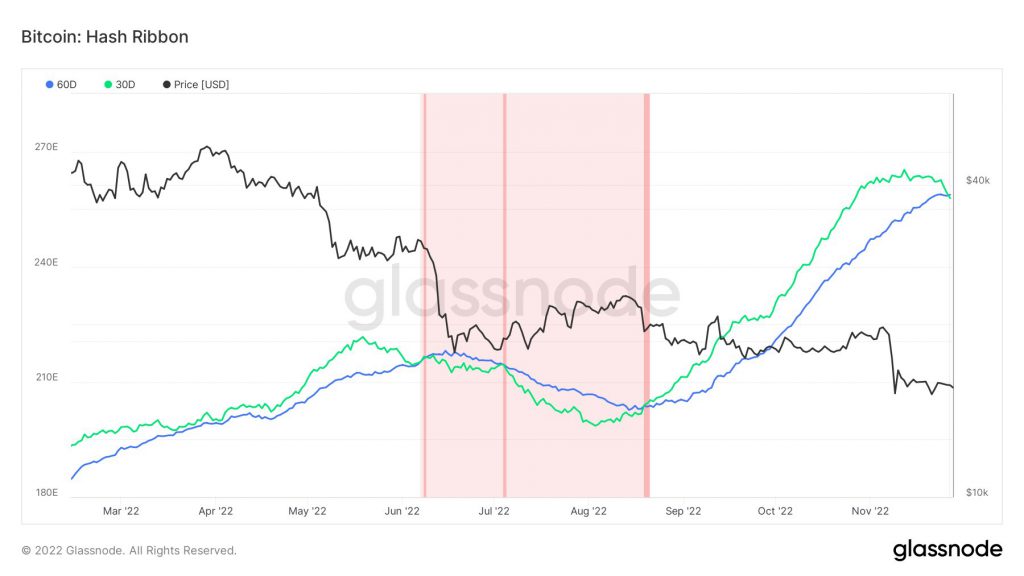

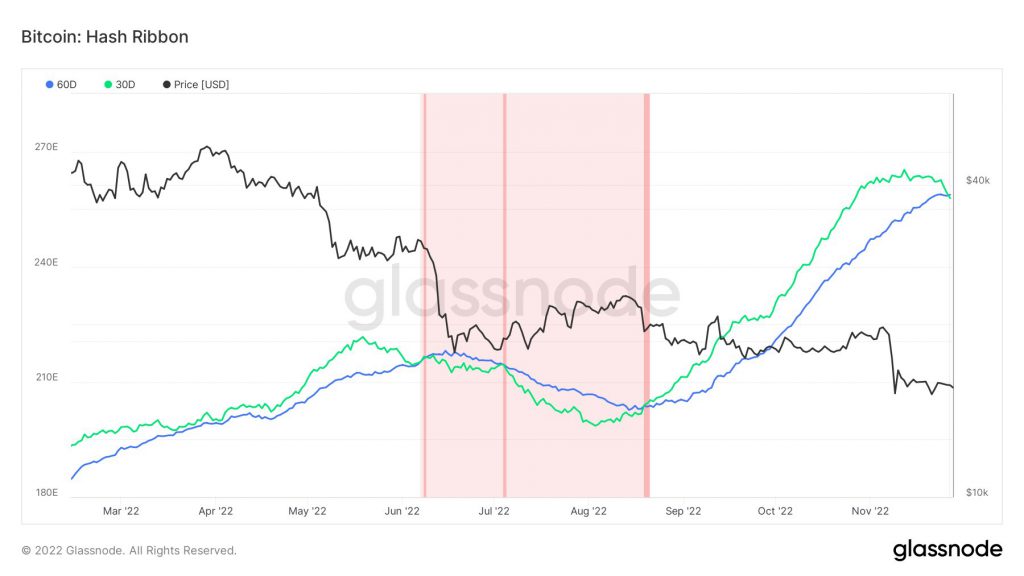

On the Hash Ribbon chart, the short-term average [30D] has already dropped below the longer-term average [60D], signifying continued weakness. Reaffirming the same “miner capitulation” narrative, Co-Founder at Reflexivity Research—Will Clemente—tweeted,

“Hash ribbons have just initiated a bearish cross, historically this has been a leading indicator of miner capitulation.“

In fact, a similar scenario panned out in June this year. At that time, miner margins were getting compressed a bit because of the following mix; a rise in hash rate and difficulty, and a drop in BTC’s price. The same triggered miners to start trimming their HODLings.

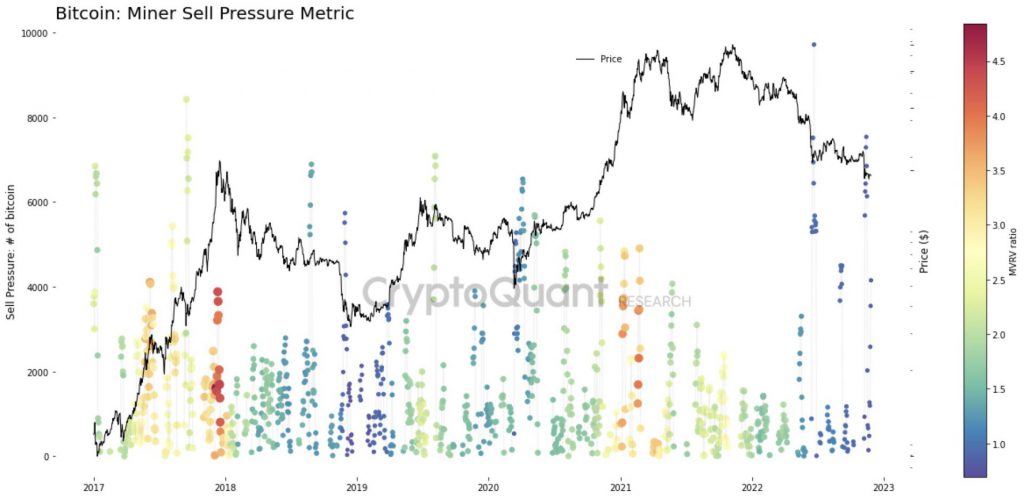

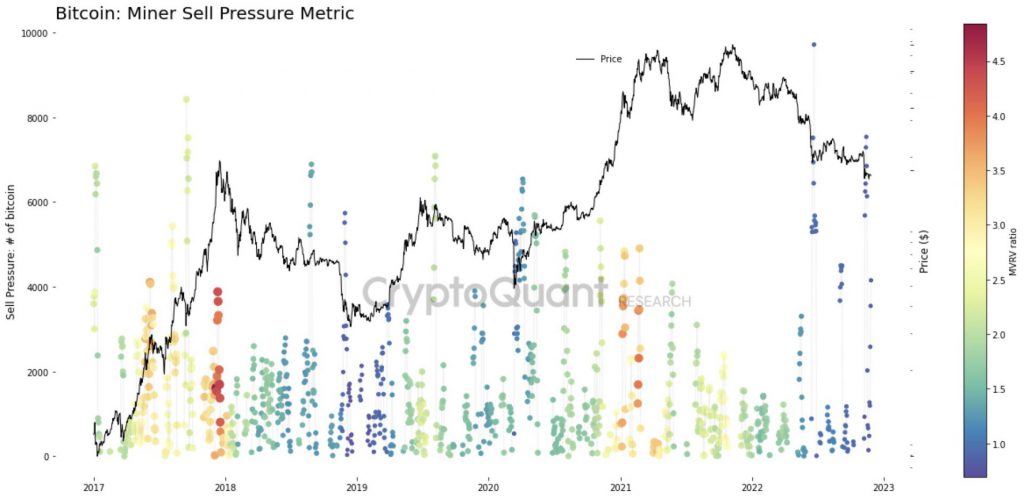

Bitcoin Miner Sell Pressure Bubbling

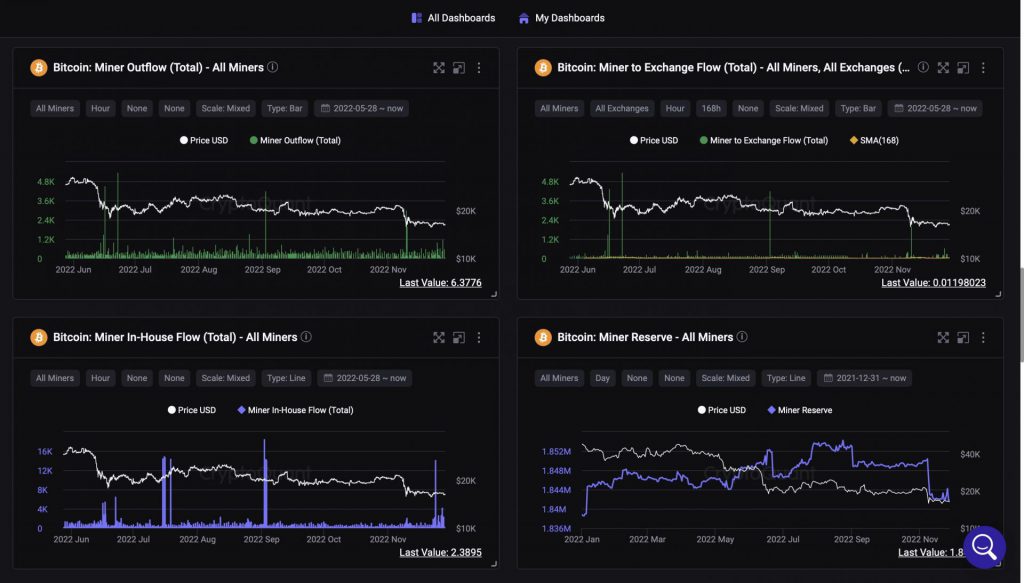

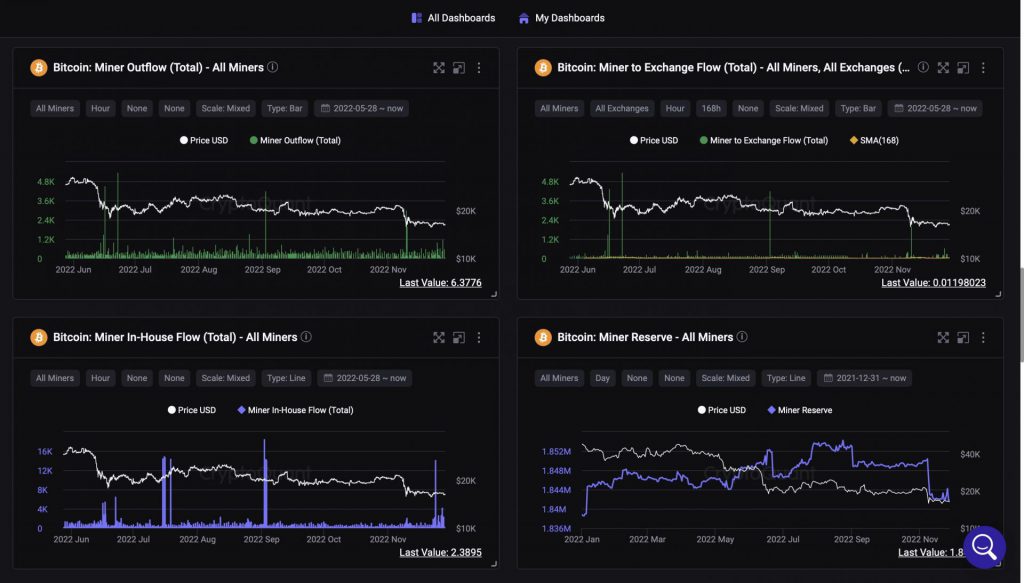

The latest data from CryptoQuant pointed towards depleting miner reserves. The same was supplemented with spikes in the miner wallet outflows and exchange inflows. For context, on November 5, the USD value of the aggregate miner reserve stood at a local high of $39.4. However now, the same has already dropped to $30.2 billion.

Pointing toward the sell pressure, CryptoQuant’s Senior Analyst—Julio Moreno, tweeted on Tuesday,

“Here comes the sell pressure. Sharp increase in miner bitcoin flows to exchanges after the last price drop.“

The state of the miner net position change reaffirmed that Bitcoin miners have been selling “relatively aggressively” of late. This metric has been hovering around low levels not seen in months.

Contextualizing the impact of the same, Pseudonymous On-Chain and Cycle Analyst—Root—tweeted:

Alongside, the founder of Capriole Investments—Charles Edwards—said recently that if the price of the asset doesn’t improve, “a lot of” miners could go out of business.

“It’s a Bitcoin miner bloodbath. Most aggressive miner selling in almost 7 years now. Up 400% in just 3 weeks! If price doesn’t go up soon, we are going to see a lot of Bitcoin miners out of business.“

Further opining on why the mine-and-HODL strategy was not viable, he said,

“What we are seeing is not sustainable. Mine-and-hodl is not a viable strategy as a Bitcoin miner. Miners are paying the consequences of the “never selling” arrogance widespread just 6 months ago. You need to manage (trade) your Bitcoin position constantly in this market.“

At press time, the market’s largest crypto asset was trading at $16.4k, down by 0.2% on the hourly.