Alt heading: Bitcoin and Ethereum Miners Get some Relief; But Will it Help?

The current crypto winter is the coldest yet. Crypto prices have plummeted by more than 50% this year. Moreover, Bitcoin (BTC), the original cryptocurrency, had its worst performing quarter in Q2 of 2022. Ethereum, too, has fallen victim to the cold. The second largest crypto by market cap has not been able to touch the $1.3K mark, a level many have their eyes on.

Additionally, miners have suffered as a consequence. As the cost of electricity went up and the value of Bitcoin went the other way around, many miners began selling their assets at discounted prices. Crypto mining company stocks also worsened as the cold got too much to bear.

However, new data reveals that the cost of producing Bitcoin has decreased.

Bitcoin miners get some relief, but what’s the downside?

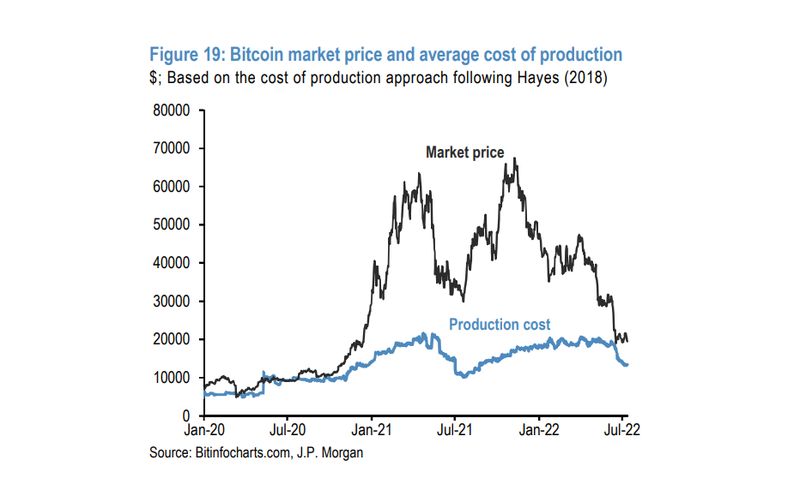

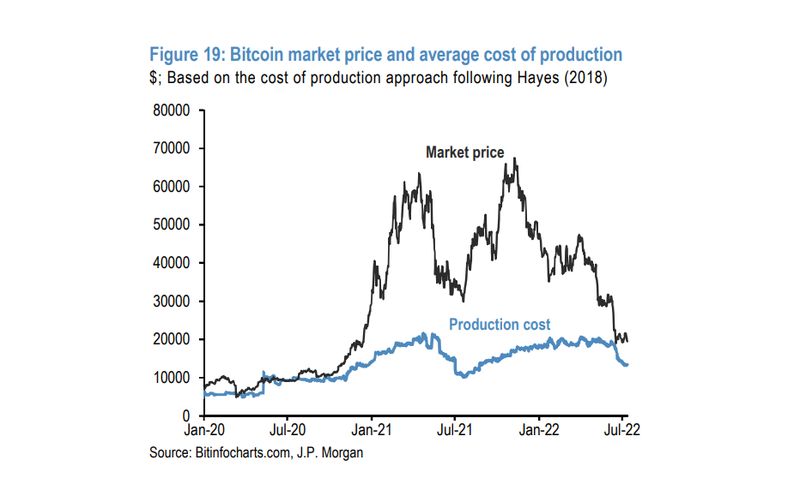

According to JP Morgan Chase & Co., the cost of producing one bitcoin has decreased from roughly $24,000 at the beginning of June to about $13,000. According to the Cambridge Bitcoin Electricity Consumption Index, the cost drop is due to a decline in electricity use. Miners are trying their best to preserve profitability and switching to more energy-efficient rigs. The study does not think the price drop is due to efficient miners leaving the industry. Nonetheless, they believe this development could be a barrier to BTC’s price moving upward.

The strategists behind the study wrote,

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward.”

In a bear market, some players think that the production cost represents the lowest limit of the Bitcoin price range.

How are Ethereum miners faring?

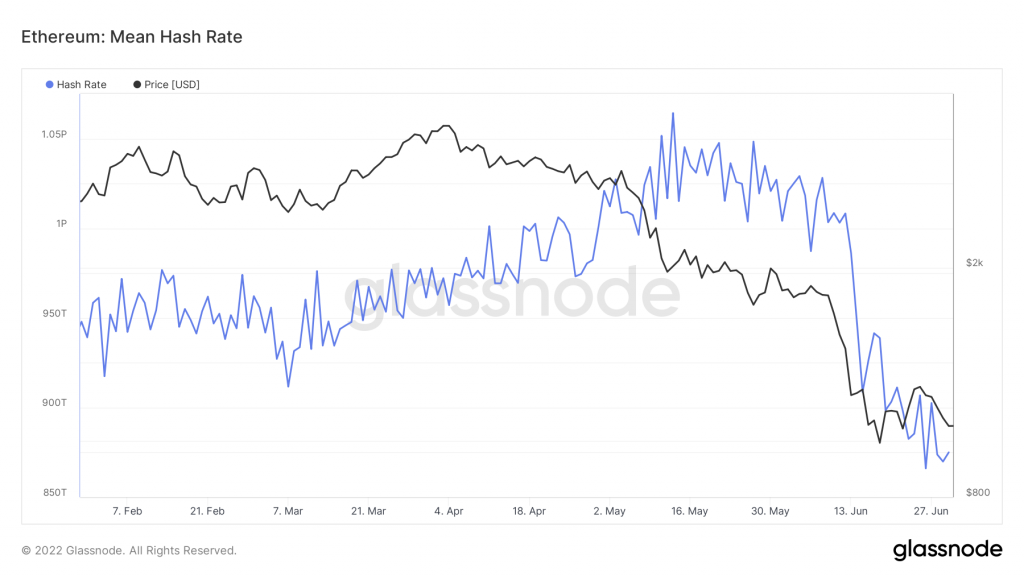

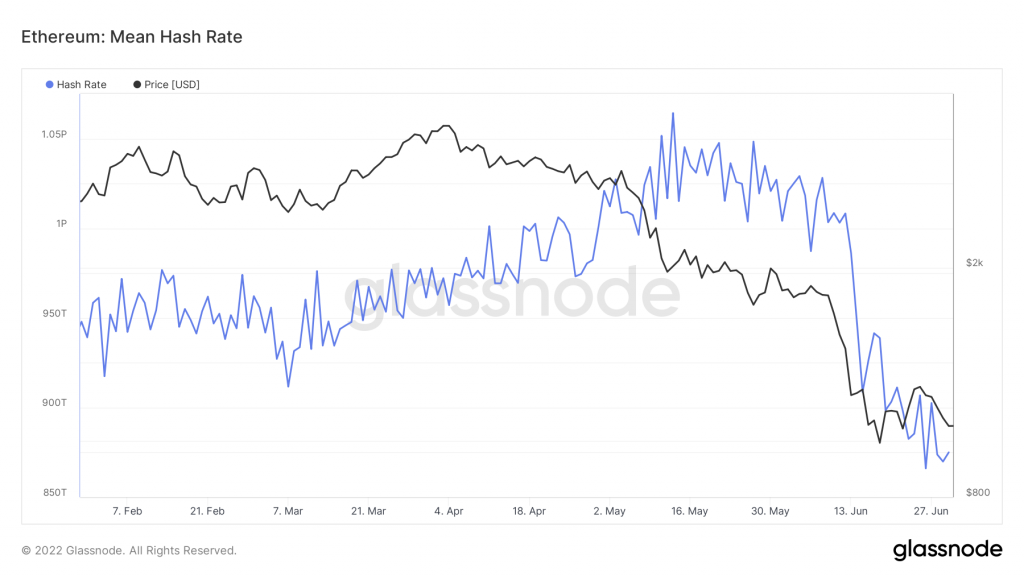

In June, Ethereum miner revenue dropped to $498 million, which was alarming. The drop in revenue is attributed to Ethereum moving to a Proof-of-Stake (PoS) consensus method. PoS will make mining obsolete, and many miners fear being out of business once “the merge” is underway.

As profitability went down, ETH miners pulled out of the system, leading to a drop in hash rate.

At block 15,050,000, the Ethereum network received a planned update to modify the Difficulty Bomb’s settings. On June 30, the Gray Glacier upgrade went online, delaying the Difficulty Bomb by around 100 days. A rapid spike in mining difficulty is referred to as Ethereum’s “difficulty bomb.” This is done to dissuade miners from using the proof-of-work algorithm after switching to proof-of-stake.

The 100-day delay does provide some relief to ETH miners, but it is only a temporary motion.

At press time, Bitcoin was trading at $20,552.75, up by 2.1% in the last 24 hours. At the same time, Ethereum was trading at $1,194.63, up by 7.8% in the previous 24 hours.