The Bitcoin mining industry has time and again received backlash for being power intensive. Despite the efficient evolution of the Bitcoin mining industry, governments across the world have been taking measures to conserve power. In Q4 2022, New York officially became the first US state to issue a moratorium on fossil-fuel-powered crypto mining.

Later, a Canadian province did something similar, but for a different reason. The Manitoba province put forth an 18-month moratorium on new crypto mining in light of the possibility of new crypto projects overpowering the local grid. More recently, British Columbia, another Canadian province, hit a pause on electrical connections for crypto mining. The said measure was taken to preserve the province’s supply of clean electricity and to cater to its climate action and economic goals.

Read More: Canada’s British Columbia Halts Crypto Mining Energy Requests For 18 Months

Was The Bitcoin Mining Industry Demanding in 2022?

A recent Twitter thread by Digiconomist pointed out that the Bitcoin mining industry consumed an aggregate of 161 TWh of electricity last year. Notably, the power consumption was higher than in countries like Sweden.

Additionally, the network consumed 1,738 kWh of electrical energy on average for every transaction processed on the blockchain. Digiconomist highlighted that the same amount of electricity could power an average US household for two months.

Also Read: Jack Dorsey’s Block Leads $2M Fund for African Bitcoin Mining Company

Despite using more power, the number of transactions executed on the network last year was less than in 2021. In fact, as reported earlier, Bitcoin’s on-chain transaction count was less than Ethereum’s in 2022. Explicitly, Ethereum registered a total of 408.5 million transactions, while Bitcoin noted only 93.1 million.

Further putting things into perspective, the thread noted,

“… the worldwide volume of non-cash transactions is growing past 1 trillion. BTC’s share is down to just 0.009%, while Bitcoin’s share of global electricity consumption is up to 0.64%..”

On top of all that, miners also continue to be responsible for 411 grams of electronic waste per Bitcoin transaction on average. That amounts to throwing away an iPad every time one sends money via the Bitcoin network.

Additionally, the carbon footprint of a single Bitcoin transaction last year was 969 kilograms of CO2. The same was apparently equal to per passenger carbon footprint of a one-way flight from New York to Sydney or the total footprint of around two million credit card transactions.

State of Bitcoin Miners

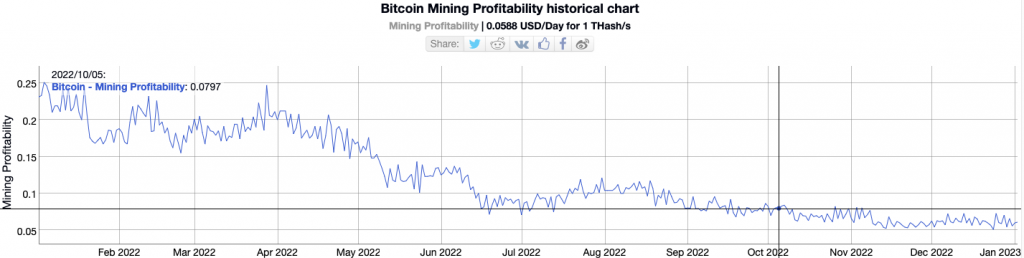

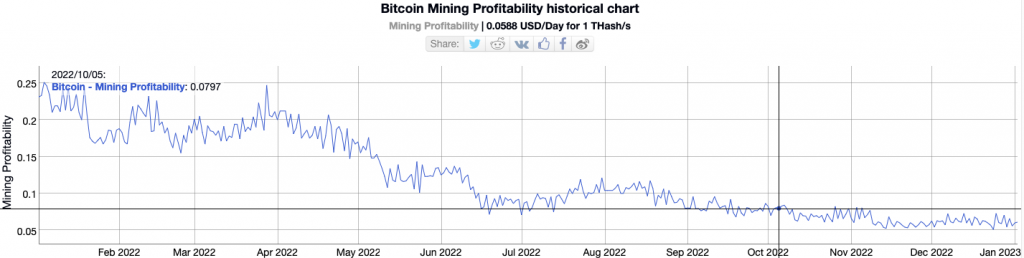

Yet, Bitcoin miners continue to be in a distressed state. This time last year, BTC’s mining profitability was fairly high. As illustrated below, the number kept falling going forward.

Currently, it is hovering around its lows. At press time, the Bitcoin mining profitability stood at $0.0588 per day for 1 THash/s.

The lagging price of BTC has reduced profitability and made it difficult for miners to cater to their inevitable operational expenses. As a result, prominent names like Core Scientific have succumbed and filed for bankruptcy. To add more to the woes, public Bitcoin mining companies collectively owe more than $4 billion in debt.

Read More: Bitcoin Mining Companies Together Owe $4B In Debt