Towards the latter half of March as Bitcoin bulls started showing some fighting spirit, the asset’s price managed to break past a couple of barriers on its path and breach the psychological $48k mark. During the said period, institutional flows for BTC and other cryptos remained positive.

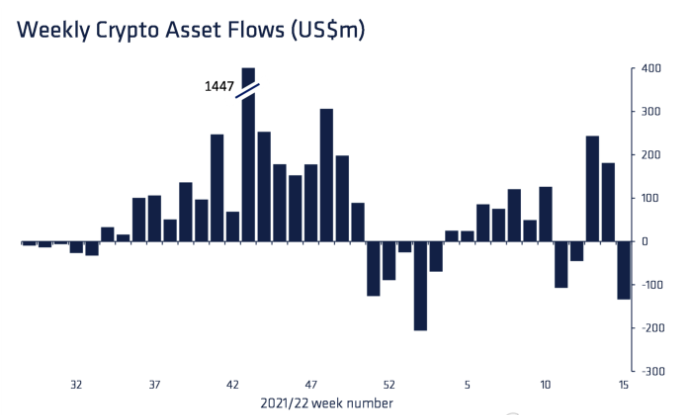

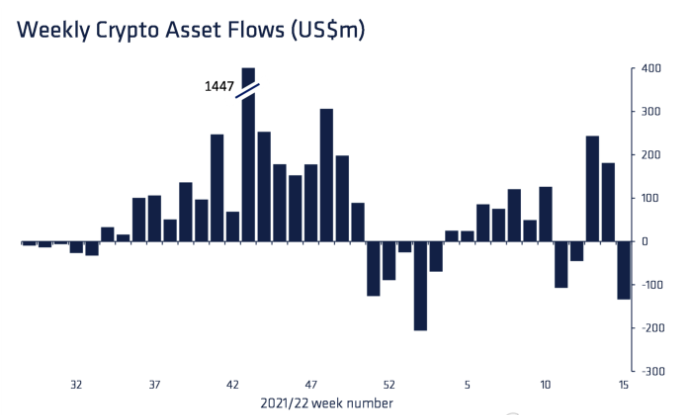

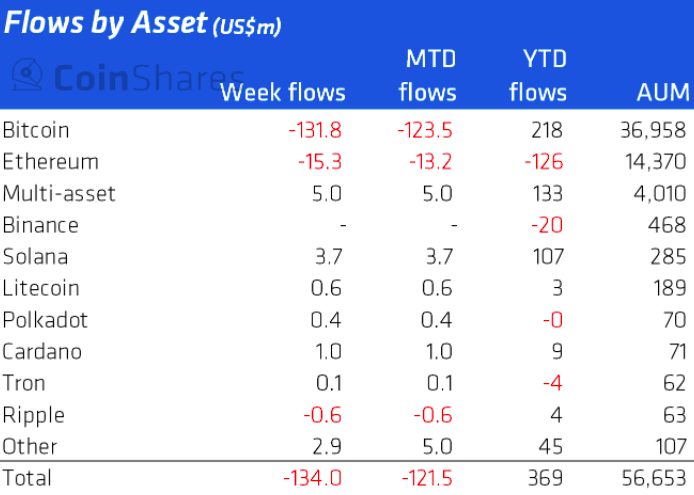

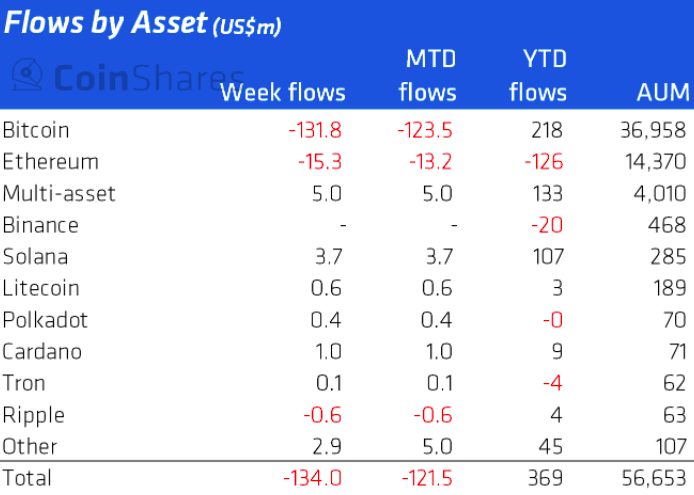

However, over the past week, as the price landscape started becoming unstable, the flows re-entered the negative territory. As per CoinShares’ latest weekly report, digital asset investment products saw outflows totaling $134m last week, marking the second-largest weekly outflow this year.

As such, the outflows were broad-based across providers in both Europe (39%) and America (61%). Speculating the reason for such a reaction, CoinShares noted,

“We believe price appreciation the previous week may have prompted investors to take profits last week.”

Bitcoin bears the brunt

Bitcoin, single-handedly, managed to push the flows down the cliff by registering outflows cumulatively worth $132 million.

Altcoins, barring Ethereum, and multi-asset investment product flows however remained positive, for they noted inflows totaling $6 million and $5 million respectively.

The wobbly macro landscape

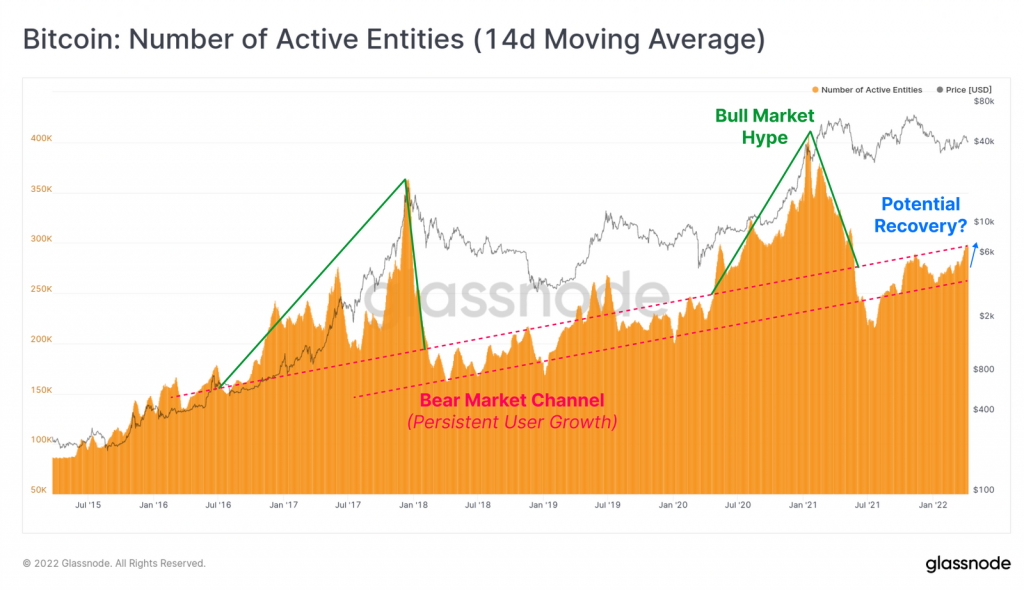

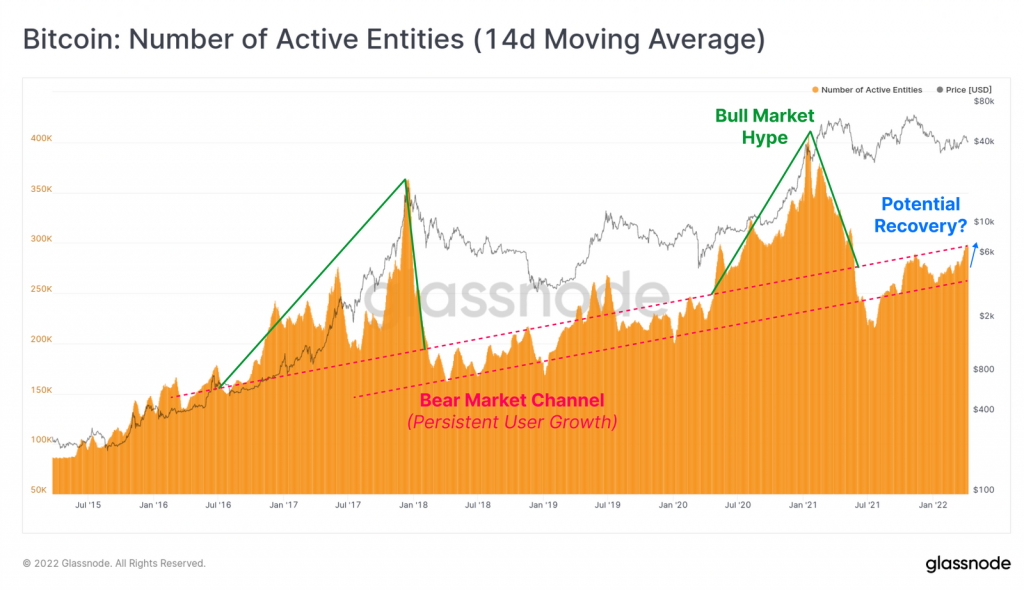

Bitcoin’s on-chain activity continues to lack momentum. The number of active entities, for starters, remains engulfed within its macro 6-year bear market channel.

However, the current active entity count of 296k/day is at the upper end of this channel, and only if sustained growth is witnessed, would the bleak picture become bright.

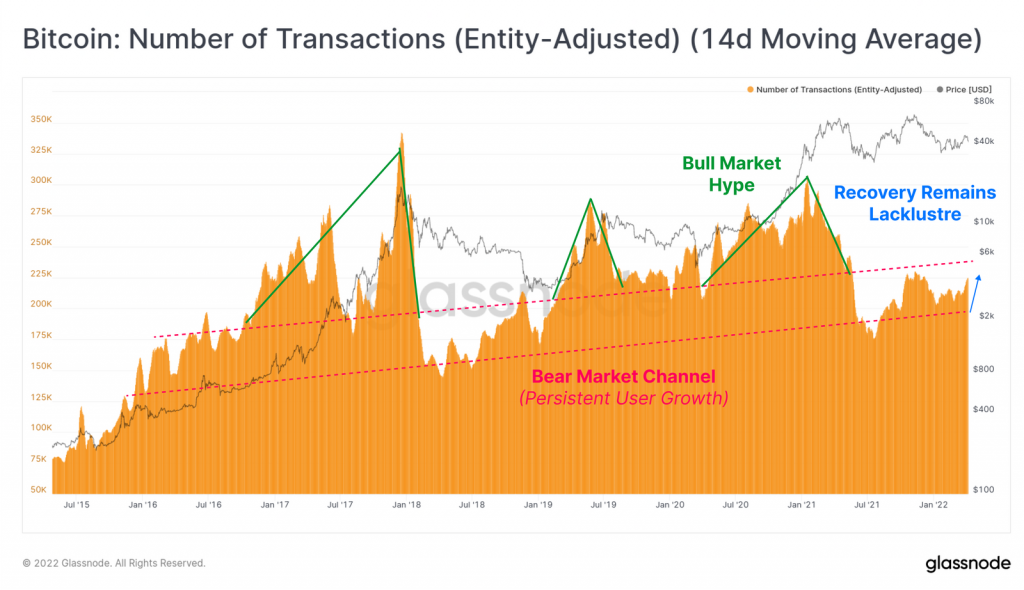

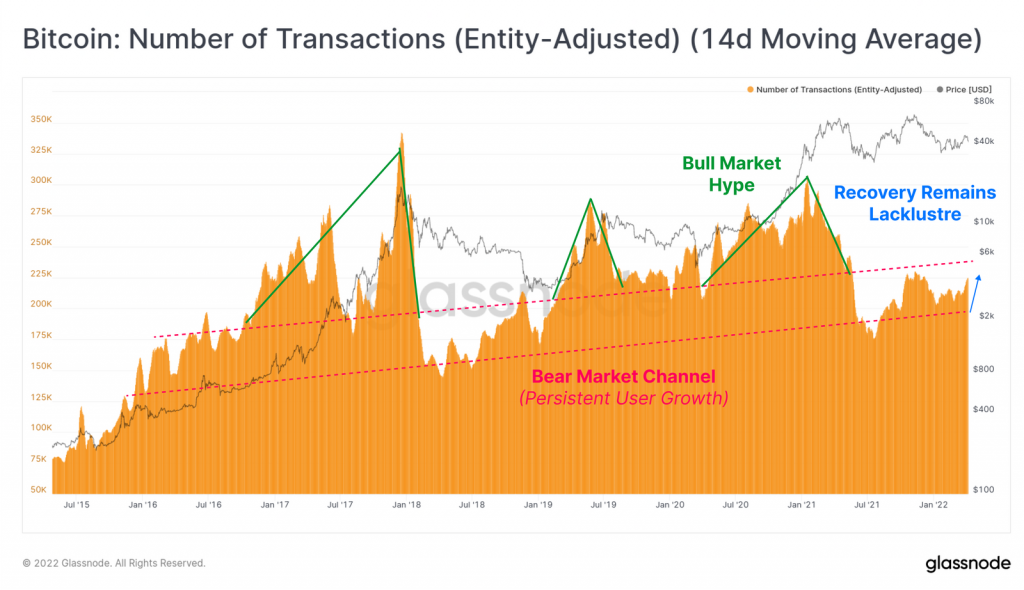

Transaction counts also remain to lack vitality. They’re currently at around 225k txns/ day, quite similar in magnitude to what was registered back during the 2019 bear market.

Pointing out a contrasting trend, Glassnode highlighted,

“What is quite interesting to see is that over the longer-term macro time-scale, both of these on-chain activity metrics continue to climb, even during bear market trends. This signals a persistent growth in the HODLer user-base.”

With both positives and negatives, Bitcoin’s macro landscape remains to be wobbly. Even though the user base has consistently grown, late movements do not assure an immediate recovery.

Thus, only when the said numbers improve, alongside the institutional interest, would Bitcoin be able to enter into another macro-bull cycle.