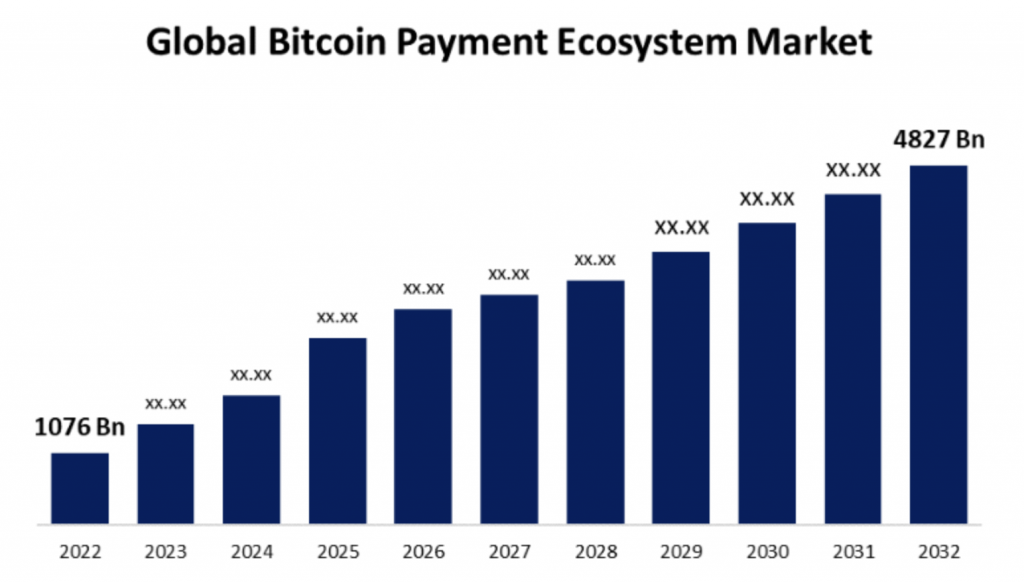

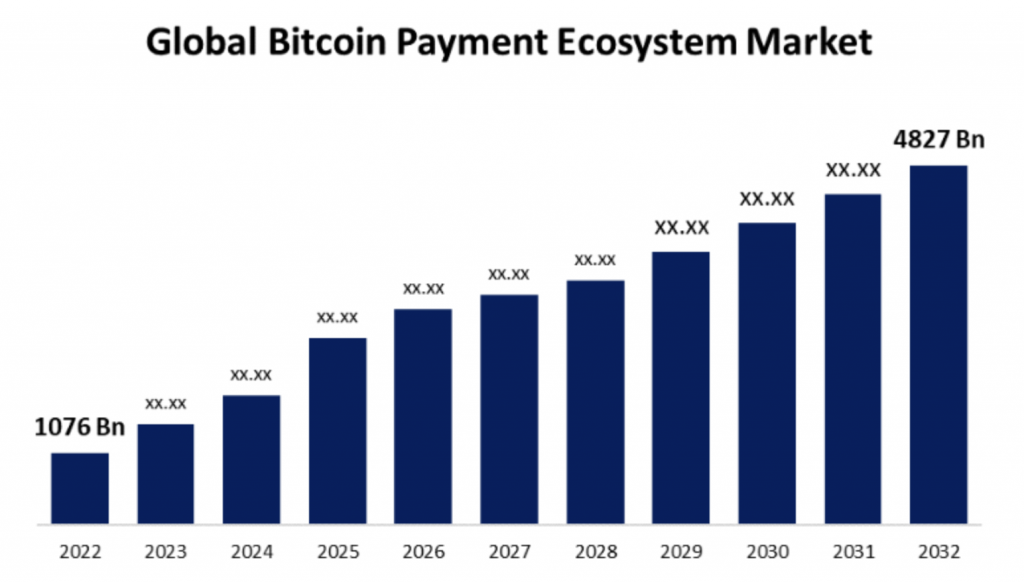

According to a recent report, the Bitcoin (BTC) payment ecosystem market may rise from $1.076 trillion in 2022 to $4.82 trillion by 2032. The rise translates to a Compound Annual Growth Rate (CAGR) of 16.19% for the period.

Also Read: Grayscale Bitcoin Fund Could Suffer Further Selloff: JPMorgan

According to the report, factors influencing Bitcoin’s (BTC) payment ecosystem growth are growing exchange markets, non-compliance, and increasing flexibility of commercial transactions in e-commerce. Moreover, the report notes that government regulations could further help boost BTC’s payment ecosystem.

However, the report highlights that BTC’s volatility could impede the payment market’s growth. Moreover, the original cryptocurrency faced a significant correction over the previous week after the US SEC’s (Securities and Exchange Commission) historic approval of 11 spot BTC ETFs (Exchange Traded Funds).

Bitcoin’s price to fall to $20,000?

According to a recent report by Deutsche Bank, one-third of all respondents in a poll said that BTC’s price could fall to $20,000 by January 2025. If BTC drops to $20,000, it would translate to a nearly 50% dip from current levels.

Bitcoin (BTC) is currently down by 6.7% in the weekly charts and 7.7% over the previous month. However, the asset is up by over 72% since January 2023.

Also Read: Ripple: El Salvador Bitcoin Advisor Says XRP to Fall 98%, to $0.01

However, Changelly predicts an average price of $49,141 for BTC in January 2025. Moreover, the platform anticipates BTC to surpass its all-time high of $69,044, which it attained in November 2021, in July of next year.

Although Bitcoin (BTC) is undergoing a correction right now, the asset may pick up steam very soon. BTC will witness its next halving cycle in April this year, which many consider a bullish event. The original cryptocurrency may see a sharp reversal in trend very soon.