The Bitcoin reserve stablecoin bill, unveiled today by White House Crypto Czar David Sacks, represents a transformative approach to U.S. cryptocurrency regulation. The comprehensive legislation tackles cryptocurrency market volatility through enhanced stablecoin regulation while establishing a groundbreaking Bitcoin reserve system to strengthen digital asset markets.

Also Read: De-Dollarization: Will Trump’s “100% Tariffs” Save The US Dollar?

How David Sacks’ Bitcoin Reserve Stablecoin Bill Tackles Market Volatility & Security Risks

Strategic Bitcoin Reserve Implementation

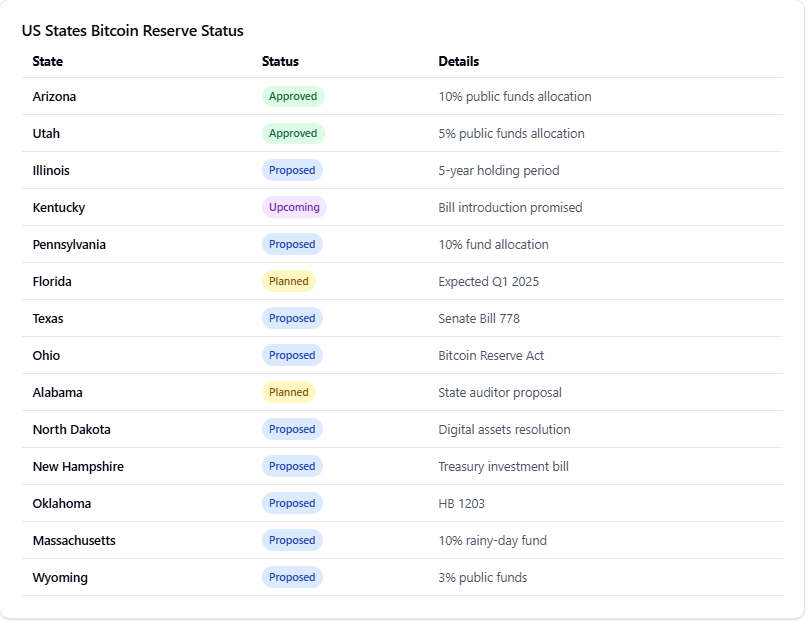

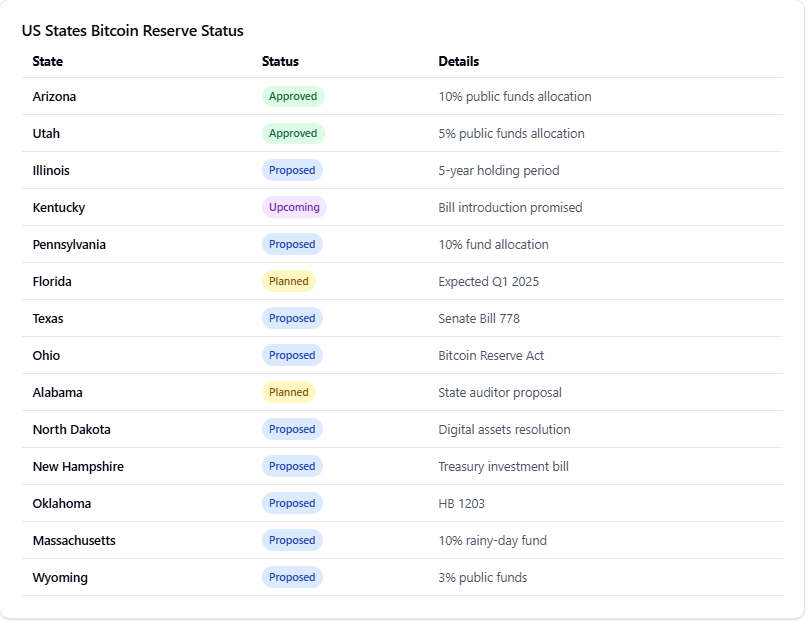

The Bitcoin reserve stablecoin bill, launching with some serious momentum, has authorized fifteen states to make Bitcoin a strategic reserve asset. Multiple federal regulators have designed the initiative to tackle numerous cryptocurrency security risks, while building several crucial foundations for digital asset markets. The newly formed Digital Assets Working Group will take charge of coordinating with various state agencies to ensure smooth adoption across the board.

Stablecoin Integration with FIT21

French Hill, House Financial Services Committee Chairman, stated:

“In the 119th Congress, we have a bicameral project for both a stablecoins bill and a regulatory framework that will bring clarity to digital assets in the United States.”

The integration of stablecoins into the FIT21 structure marks a decisive shift in cryptocurrency market volatility management.

Also Read: Cardano Founder Hints at Major Crypto Developments: February Could Get Wild

Banking Reform and NFT Classification

The Bitcoin reserve stablecoin bill addresses anti-crypto banking restrictions and introduces new classifications for NFTs and specific meme coins. David Sacks had this to say:

“The SEC wouldn’t tell founders what the rules were, and then would prosecute them. Many told me personally that they were debanked just for starting a crypto company.”

Economic Impact and Treasury Demand

The stablecoin regulation component presents significant opportunities for market stability. Sacks stated:

“Stablecoins could potentially generate trillions of dollars worth of demand for US treasuries, which could lower long-term interest rates.”

Also Read: Ripple: XRP On Track To Deliver Major Q1 Gains: Here’s How

Bipartisan Support and Implementation Timeline

Key Senate Committee leaders, including Bill Hagerty and Tim Scott, support the cryptocurrency security risks measures outlined in the legislation. Various state authorities are partnering with the Digital Assets Working Group to roll out several phases of the Bitcoin reserve initiative, marking a major shift toward clear regulations in numerous areas of the U.S. cryptocurrency market.