The crypto market has been impacted by the geopolitical tensions going on between Ukraine and Russia. If not directly, at least indirectly. Bitcoin, along with most other coins has had a pretty rough week. Almost all the top 10 crypto assets had lost 10%-15% of their value over the past week.

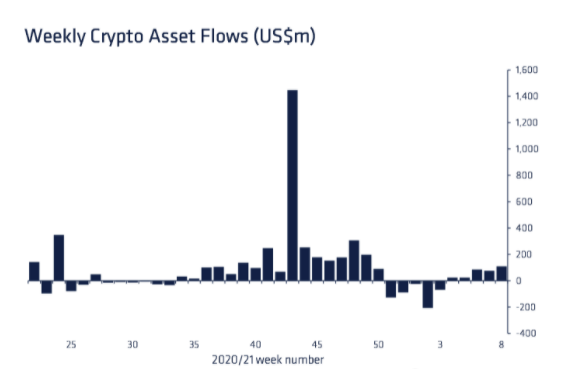

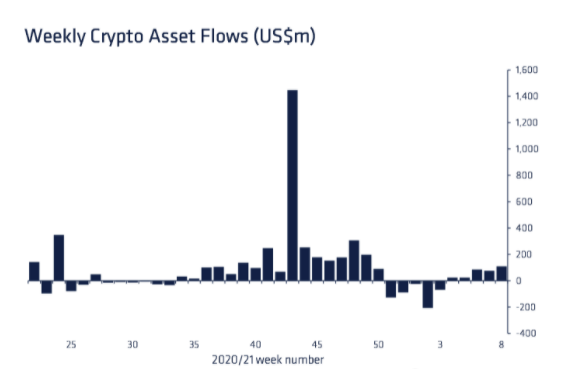

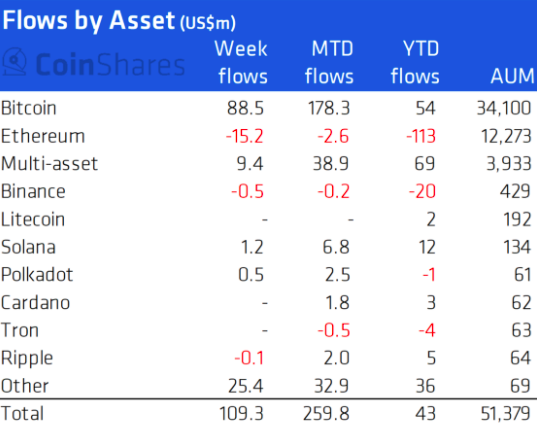

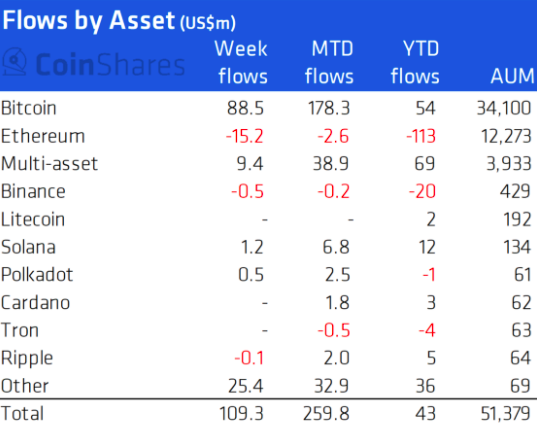

Amidst the unfavorable environment, digital asset investment products saw inflows worth $109 million last week. Post the back-to-back outflows noted in December and January, the latest data marks the fifth consecutive week of inflows. When broken geographically, both Europe and America had a say. Highlighting the same, CoinShares’ latest weekly report noted,

“While inflows were seen in both Europe and the Americas, it was predominantly the latter with inflows totalling US$101m.“

BTC, among other assets, saw the largest inflows totaling $89 million last week, the highest since December 2021. However, things did not look the same on the macro-frame. Per CoinShares,

“The [Bitcoin] inflows remain tepid, with the last 5 weeks of inflows totalling US$221m, representing 0.7% of total assets under management (AuM).“

Other altcoins like Solana and Polkadot witnessed minor inflows on their part, while Ethereum registered an outflow worth $15 million.

Not all sunshine and rainbows for Bitcoin though

Leaving aside the positive institutional flows, there’s a slight twist to the fairy-tale. And that has to do with the network activity and user interest.

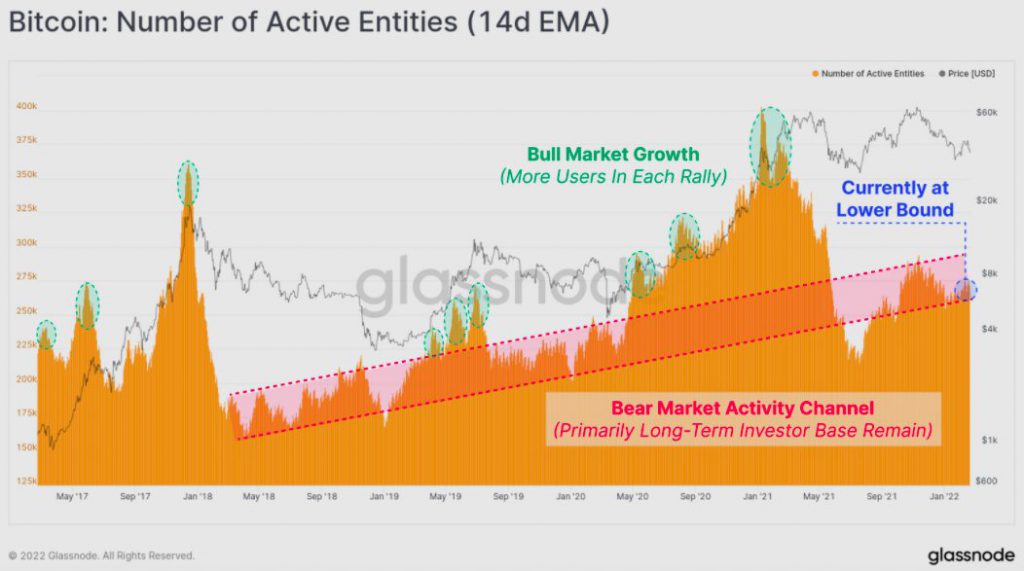

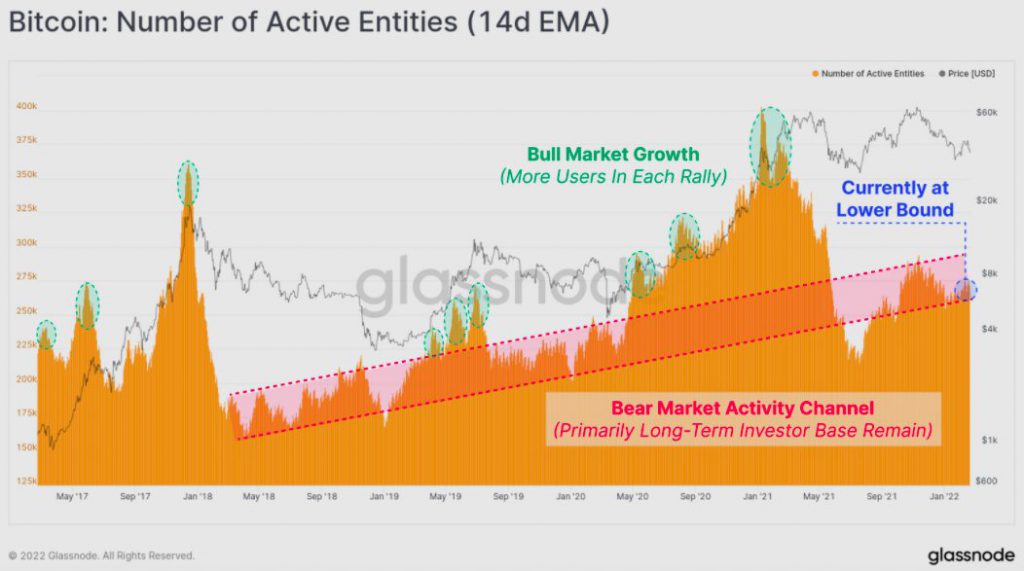

The chart attached below presents the number of active entities using the Bitcoin network. Bull markets are usually characterized by periods of growing demand from users, typically with an increasing number of active entities during each subsequent bullish impulse. On the other hand, bear markets are marked by periods of relatively low network activity, and diminished interest.

On the macro-frame, things do look intact for Bitcoin. Highlighting the same, Glassnode’s weekly newsletter noted,

“The lower-bound of this channel has historically increased in near-linear fashion, suggesting that the pool dependable Bitcoin users (the HODLers) is still growing over the long-term.“

Last week, however, the degree of on-chain activity was seen languishing around the lower bound of the bear market channel, indicating diminished interest and demand for the asset over the short term.