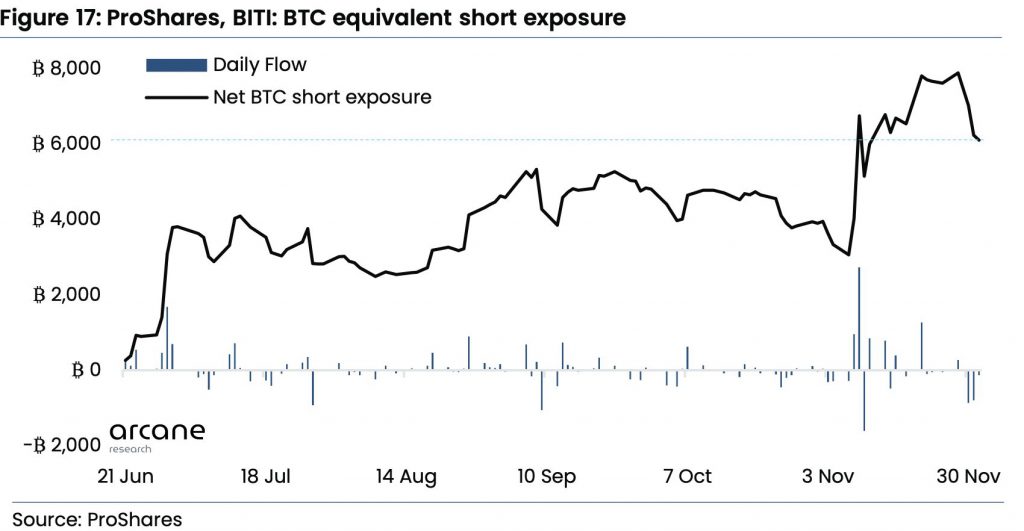

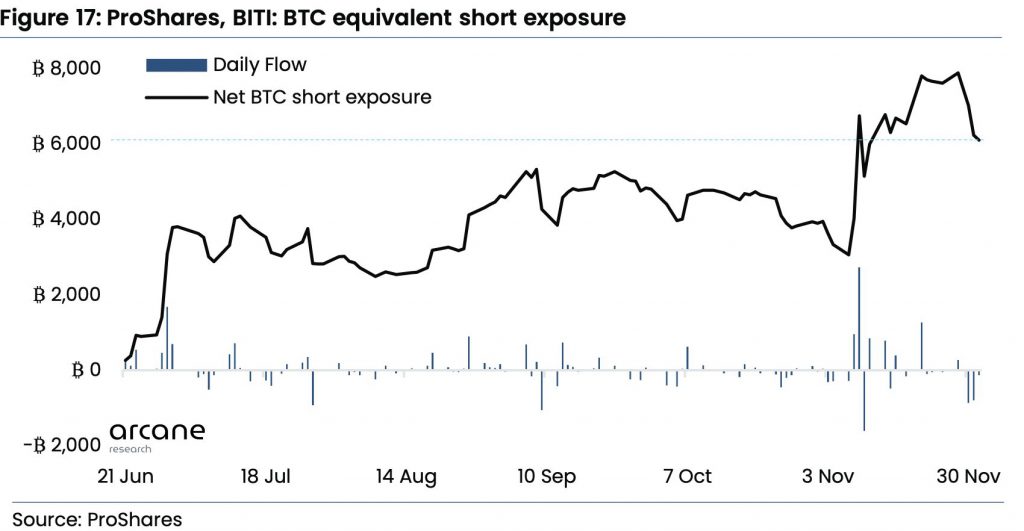

According to a new report by Arcane Research, short Bitcoin ETF’s AUM (asset under management continues to remain high. In November, the short ETF BITI offered by ProShares saw enormous inflows. Its short exposure increased to new all-time highs on November 9 following a daily inflow of 2,730 BTC.

The following days saw more significant inflows, with the ETF’s short exposure to BTC climaxing on November 28 at 7,890 BTC. The ETF has since seen significant outflows, but the AUM is still high because the short exposure is at 6,230 BTC, significantly higher than this summer’s heights.

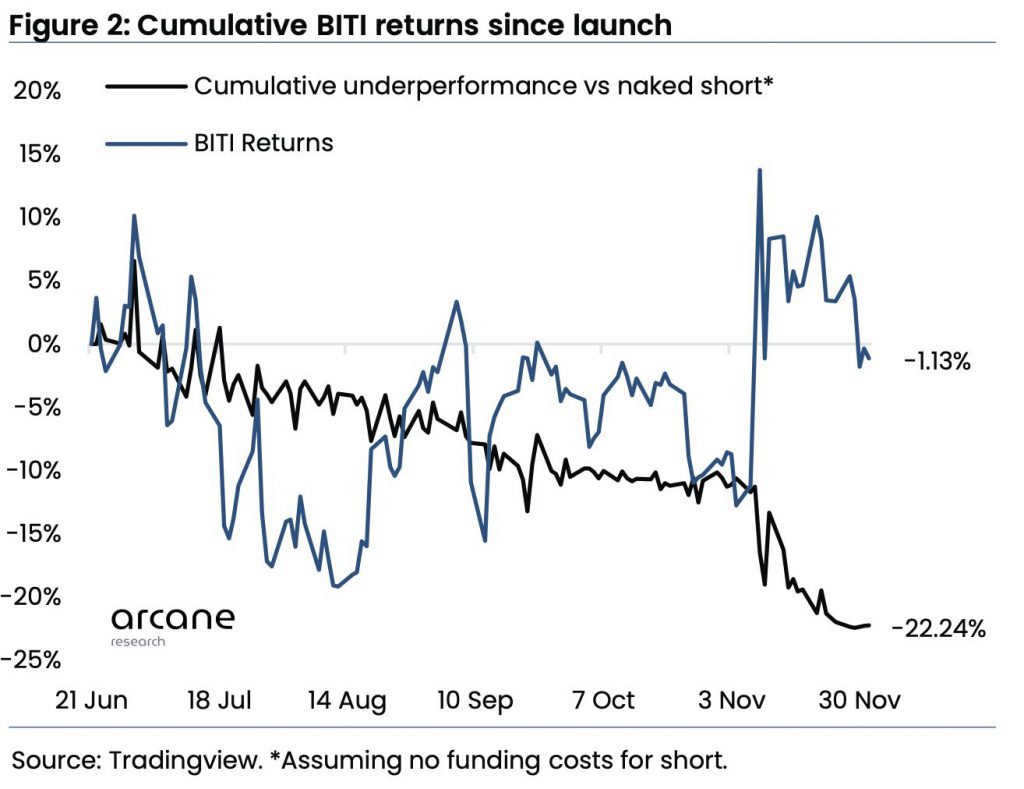

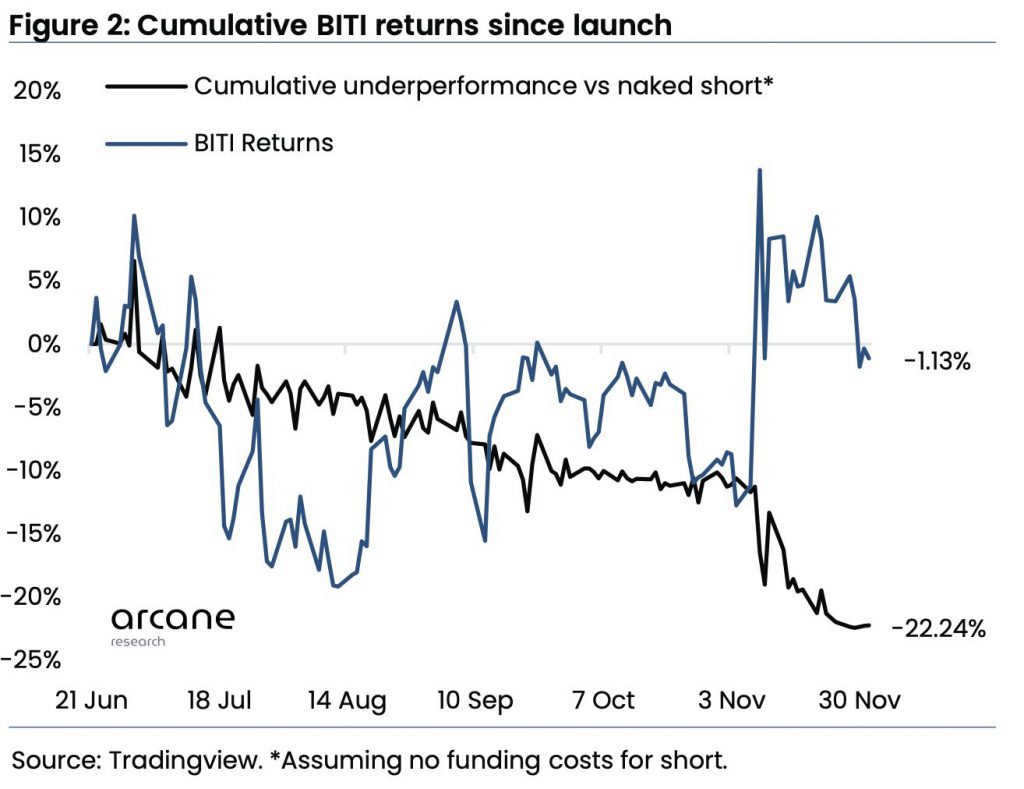

Despite Bitcoin’s drop outperforming a naked BTC short by 22.24%, BITI has produced negative returns since its introduction in June due to the ETF’s structure.

Bitcoin short ETF now seeing outflows?

The Arcane study noted that, recently, inflows have changed to outflows. A total of 860 BTC worth of outflows were recorded on November 30 for BITI. Similar outflows of 760 BTC occurred on December 1. A stabilized BTC price could be the reason for the withdrawals. Furthermore, Arcane highlights that most inflows since November 9 have been at a loss due to Bitcoin bottoming.

Inflows into the short ETF typically happen during the height of market fears. Arcane noted the trend of BITI’s AUM peaks occurring close to BTC bottom depths. This may imply that counter-trading extreme BITI flows is a potentially profitable trading tactic.

Bitcoin (BTC) has decreased by 21% from $20,700 to $17,200 since the beginning of BITI. A trader who bought BITI on launch day and held it for a long time would have slightly negative returns of -1.13%, outperforming a naked BTC short by 22%. Arcane noted that the everyday expenses associated with BITI and its structure are a significant BITI concern.

At press time, BTC was trading at $16,810.16, down by 1.2% in the last 24 hours.