Galaxy Digital, a cryptocurrency fund, has expressed an optimistic outlook. The strong demand for a Bitcoin ETF is evident from recent market reactions. The mere rumor of an ETF launch last week caused a rapid 10% surge in Bitcoin prices within hours. Similarly, the revelation of the ticker for BlackRock’s proposed Bitcoin ETF triggered a 12% increase in a single day.

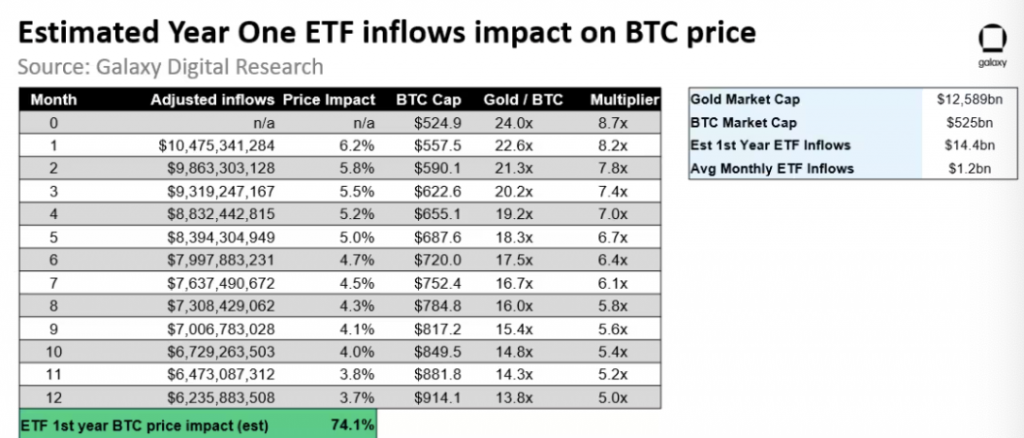

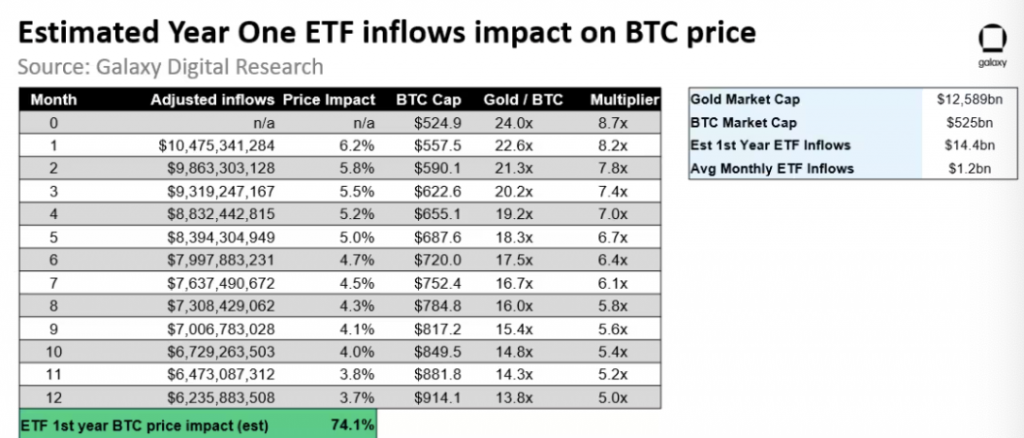

According to the research, the projected inflows from these ETFs could lead to a substantial 74% surge in Bitcoin’s price. This is during the initial year, taking into consideration the liquidity and price impact resulting from substantial investments.

The research report, coupled with an Oct. 24 blog post by Galaxy Digital’s research associate Charles Yu, arrived at the 74% figure by assessing the potential price impact of fund inflows into Bitcoin ETFs, drawing on gold ETFs as a benchmark.

Yu’s analysis suggests that Bitcoin’s price could experience a 6.2% increase in the first month. This would be following the ETF’s launch, gradually stabilizing to a 3.7% monthly increase by the end of the first year. With a 74.1% increase in Bitcoin’s current price, this could propel it to reach $59,200.

Markus Thielen, the head of research at digital asset financial services firm Matrixport, echoed similar sentiments in a previous post. He estimates that if BlackRock’s proposal for a spot Bitcoin ETF gains approval, Bitcoin’s price could surge to a range between $42,000 and $56,000.

While Yu acknowledges that any delay or rejection of spot Bitcoin ETFs could impact these forecasts, he asserts that the estimates remain conservative and do not account for potential “second-order effects” stemming from the approval of spot Bitcoin ETFs.

Also Read: Bitcoin ETF Approval to Bring Increased Institutional Investment

Bitcoin Spot ETFs to see increased inflows

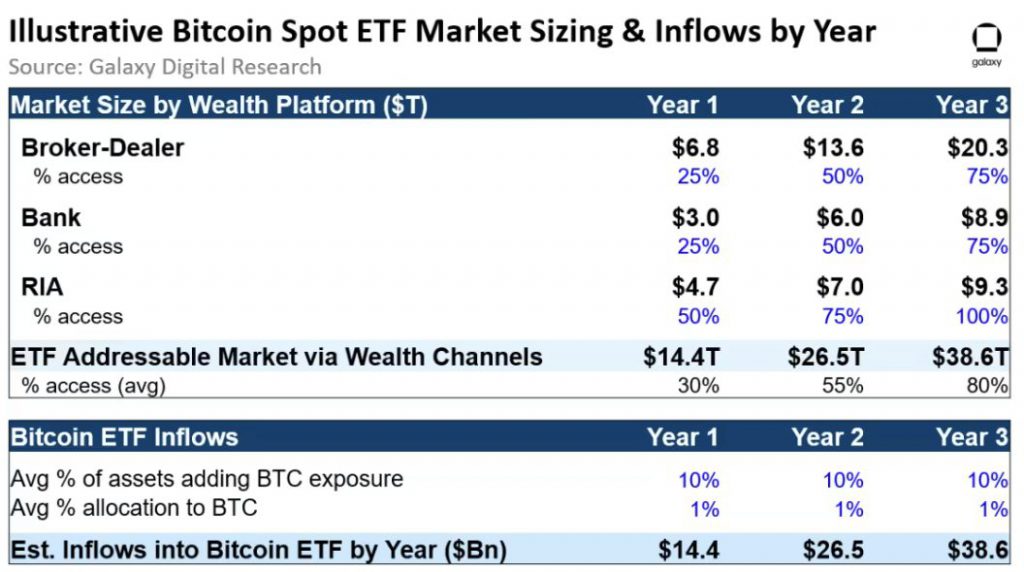

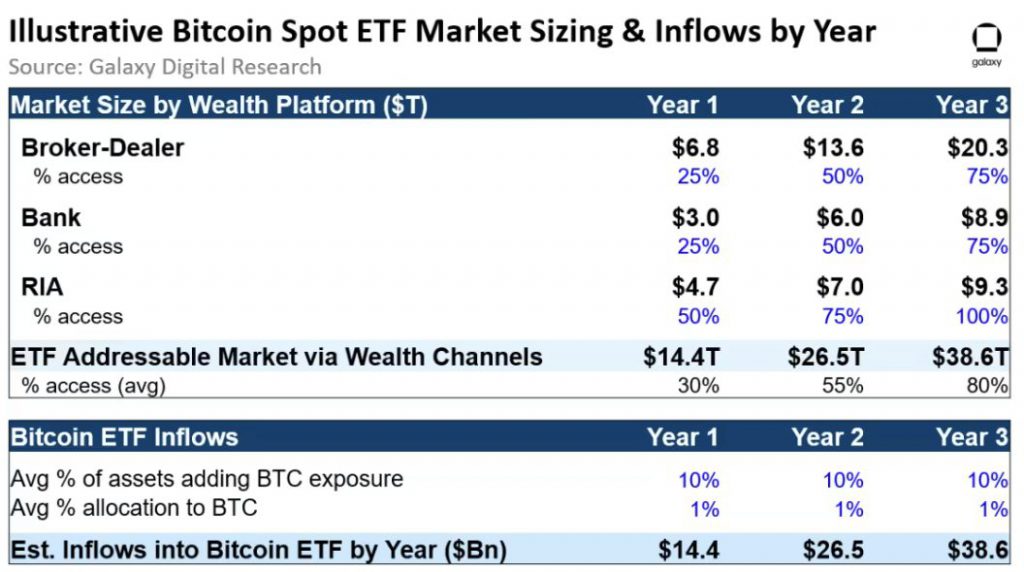

It suggests that the introduction of spot BTC ETFs could attract a substantial $14.4 billion in inflows within their inaugural year. In a recent research report, the company expounded on how ETFs could potentially become a more appealing investment option. This is for investors when compared to current offerings such as trusts and futures, which collectively hold a value exceeding $21 billion.

The anticipated influx of funds into spot Bitcoin ETFs is projected to be substantial. Galaxy Digital estimates that this figure could swell to $27 billion by the second year. This is followed by an impressive $39 billion by the third year after their launch. The report places considerable emphasis on the significant potential of these ETFs. However, the focus remains on the U.S. wealth management industry as a key target market.

Galaxy Digital underscores that the U.S. wealth management industry presents the most readily accessible and direct avenue for Bitcoin ETFs. The report underscores the significance of this by pointing out that as of October 2023, broker-dealers oversee a substantial $27 trillion in assets. Simultaneously, banks manage an impressive $11 trillion, while Registered Investment Advisors [RIAs] have a substantial $9 trillion under their purview. This cumulative figure amounts to an impressive $48.3 trillion.

Also Read: CFTC Commissioner Says Market is Ready For Spot Bitcoin ETFs