With Bitcoin standing at the door of $42k, market participants from the crypto space stand divided at this stage. One set of them believes that the king-coin might re-visit lows before bouncing back to the terrains of $50k, while the other set thinks that BTC is already en-route to creating higher highs.

Over the short term, Bitcoin’s movements have been quite lethargic. After climbing up by merely 0.7% and 1.9% on the daily and weekly timeframe, BTC was priced at $41.8 at press time.

Endure pain to reap gain(s) – Bitcoin’s mantra?

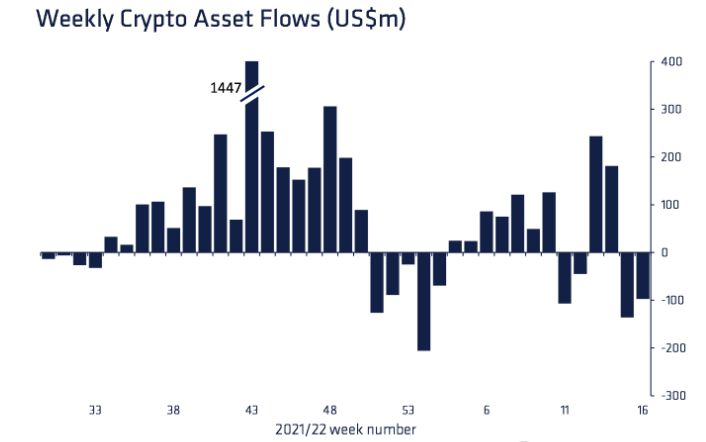

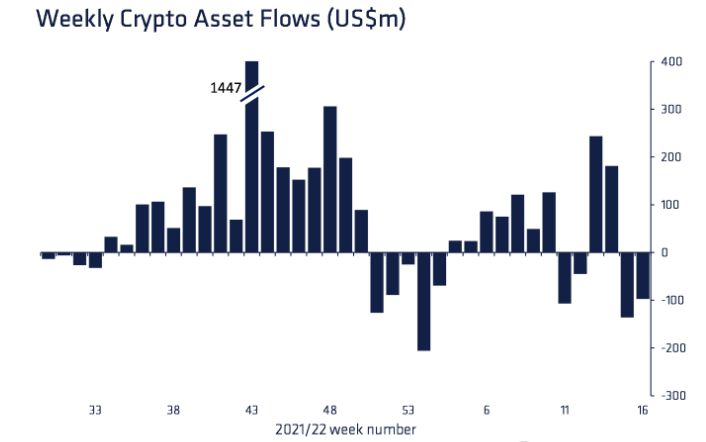

Institutional flows concerning crypto continue to remain negative at this point. Over the past week, digital asset investment products saw outflows totaling $97 million, of which $73 million accounted only for Bitcoin. CoinShares attributed the same to be a result of the “recent profit-taking.”

So, at this stage, is the pain set to increase even more, or is the market ready to rip off its bandage and start fetching gains? Well, having a look at what Bitcoin investors are upto would give us a clearer picture of the direction in which the market is heading towards. To analyze the same, we’ll look into both the strata of HODLers—short term and long term.

HODLer barometer suggests…

Investors, at this stage, continue to see a value between $35k and $42k. In the said region, accumulation trends remain to be quite constructive. However, they lack the momentum to aid Bitcoin to break higher.

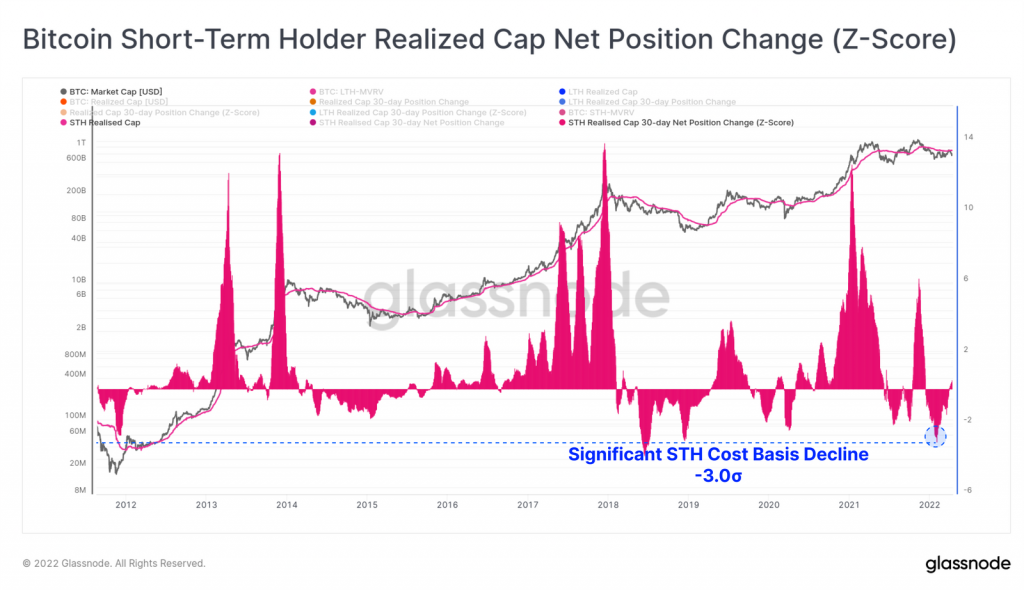

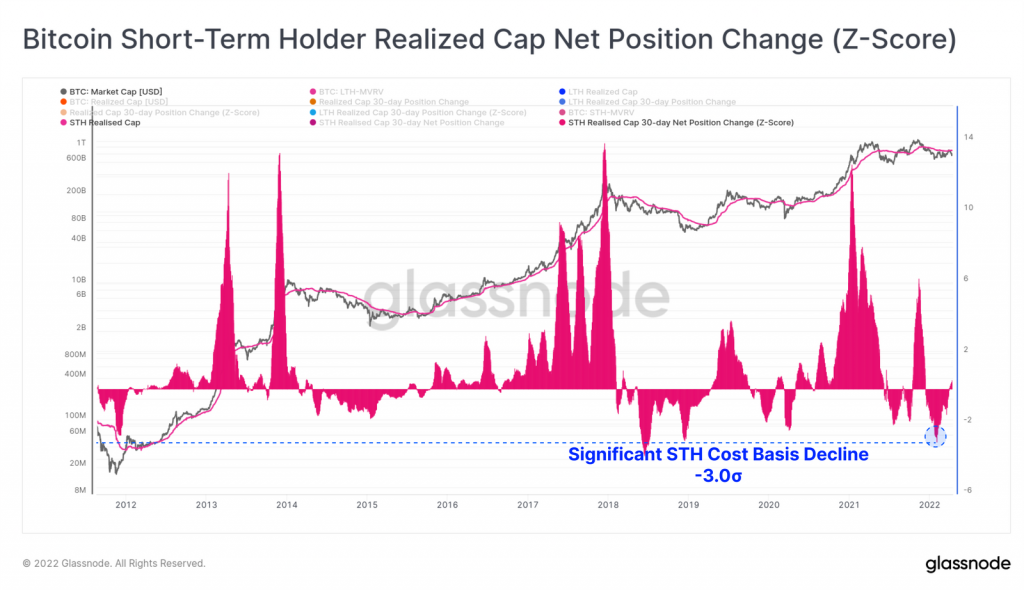

Now, if we look at the rate of decline of the short-term HODLer realized cap, we can see that it has fallen by another historical margin. Notably, the magnitude of STH realized losses has been at a similar magnitude only twice in the past, both occurring in the worst phases of the 2018 bear market. The current one, as such, is twice as severe as what was noted during the July 2021 bottom at $29k.

Chalking out the implication of the same, Glassnode’s latest newsletter suggested,

“By this metric, a STH capitulation has already occurred…”

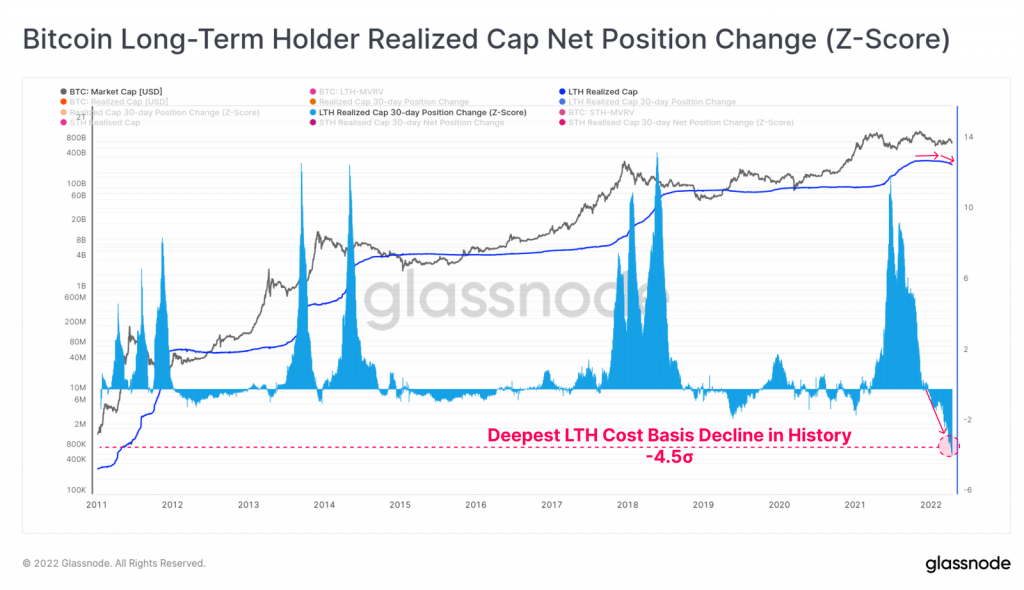

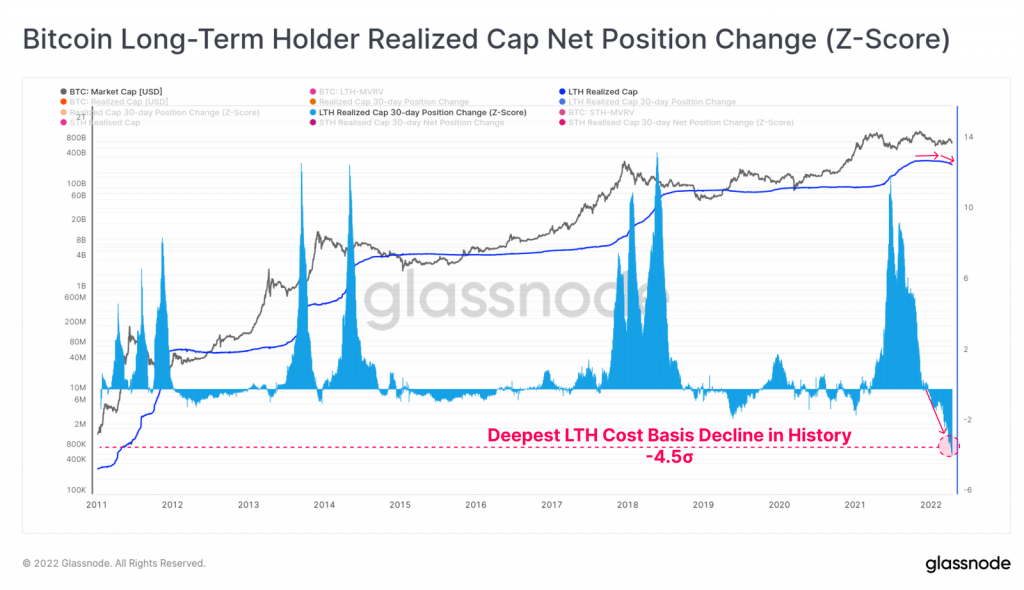

The dataset associated with long-term HODLers seemed to be “even more impressive,” per the data analytics and insights platform. As can be noted from the chart below, the degree by which the long-term HODLer realized price has declined is the deepest in history and is without an equal.

“… many LTHs who were caught by surprise by the current correction, have now capitulated out of the market…right into the hands of buyers who see value between $35k and $42k.”

Keeping the aforementioned data sets in mind, it can be inferred that a huge swathe of the market has already capitulated, and if demand in the $35k-$42k region becomes even more intense, then a bullish flip might just be around the corner for Bitcoin.