The ongoing bear market has been detrimental to the crypto community. While Bitcoin [BTC] has struggled to make it past $20K, weak hands were bidding adieu to the market. A few others, however, hold on to their holdings, hoping that the world’s largest crypto has reached a bottom. There have been many predictions about BTC’s bottom over the last couple of weeks. While some say it’s $13K, a few others think Bitcoin would sink to a low of $10K. For some, $20K is the ultimate bottom. Analytics platform, Glassnode, however, believes that Bitcoin’s bottom was not yet in.

The bear market prompts many things, one of which is wealth redistribution. In a recent report, Glassnode pointed out how Bitcoin wealth was moving from weak hands onto strong hands. This was part of the capitulation that was taking place. It should also be noted that the current capitulation was from retail investors and miners. Thanks to this, Bitcoin’s bottom might be closer than expected.

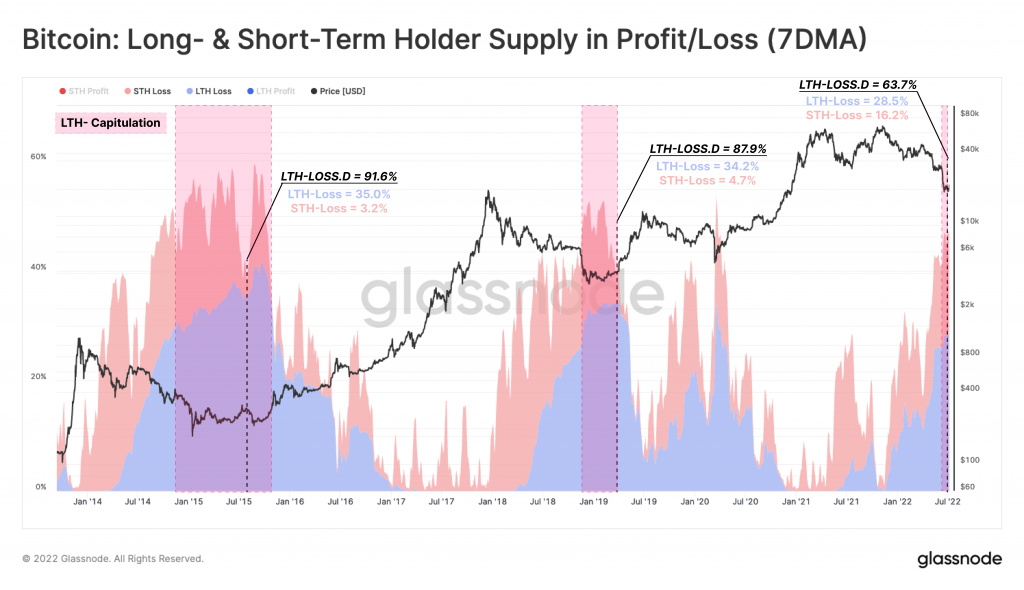

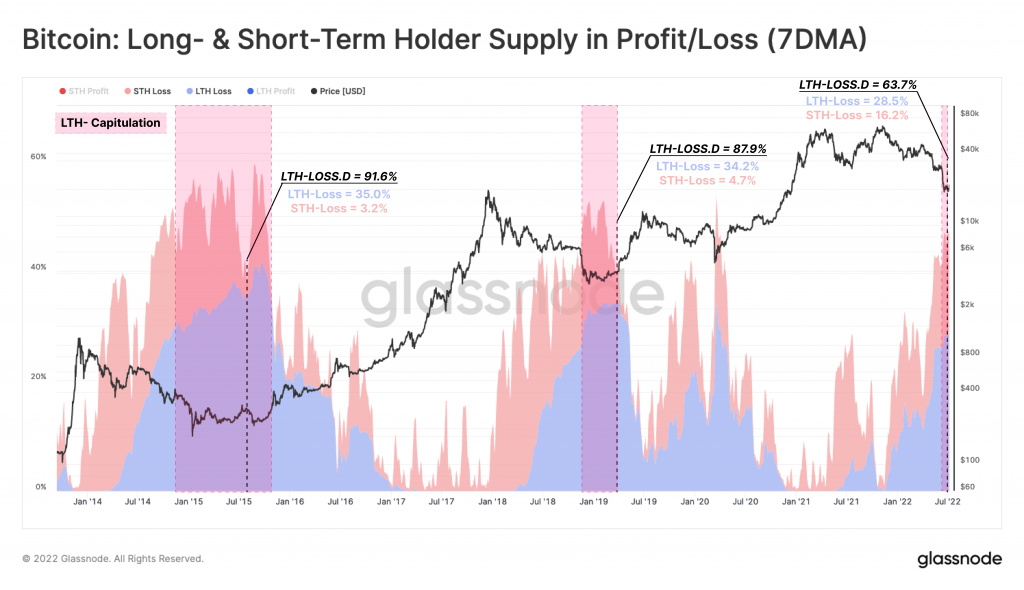

However, for Bitcoin to form a bottom, the importance of long-term holders carrying on a large proportion of the unrealized loss was highlighted. For any bear market to steer towards an “ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and with the highest conviction.”

As seen in the above chart, long-term holders [LTH] during previous bear cycles were at a loss of 34 percent. The supply held by short-term holders [STH] was only 3-4 percent. However, STHs have a whopping 16.2 percent of the supply in a loss.

This means that “freshly redistributed coins must now go through the process of maturation in the hands of higher conviction holders.“

Bitcoin bottom and miners

Just like long-term holders, miners have a significant role in aiding Bitcoin is testing its bottom. Miners often come up during the late stages of the bear market and induce selling pressure. Since May, miners have reportedly sold off 7,900 BTC. However, spending has been diminished to 1,350 BTC every month.

As mentioned earlier, miner capitulation has played a significant role in the 2018 bear market. However, Bitcoin took over four months to attain a bottom back then, and now, miners have sold their assets for just about two months.

“Miners currently hold approximately 66.9k BTC in aggregate in their treasuries, and thus the next quarter is likely to remain at risk of further distribution unless coin prices recover meaningfully.”

Additionally, Glassnode concluded by saying that Bitcoin could be inching close to its bottom considering capitulation. But, investors would have to deal with “a combination of both time pain (duration), and perhaps further downside risk to fully test investor resolve, and enable the market to establish a resilient bottom.” It should be noted that at press time, Bitcoin had once again dropped below $20K.