Bitcoin (BTC) has experienced a remarkable surge, surpassing the $73,636 mark with a 2.5% increase within a mere 24-hour period. This sudden rise marks a sharp turnaround from the losses incurred earlier this week, initiated by a significant $360 million liquidation event. The upward momentum was fueled by an impressive influx of investments into exchange-traded funds (ETFs), setting new records in terms of both dollar value and Bitcoin volume.

Record Inflows into Bitcoin ETFs

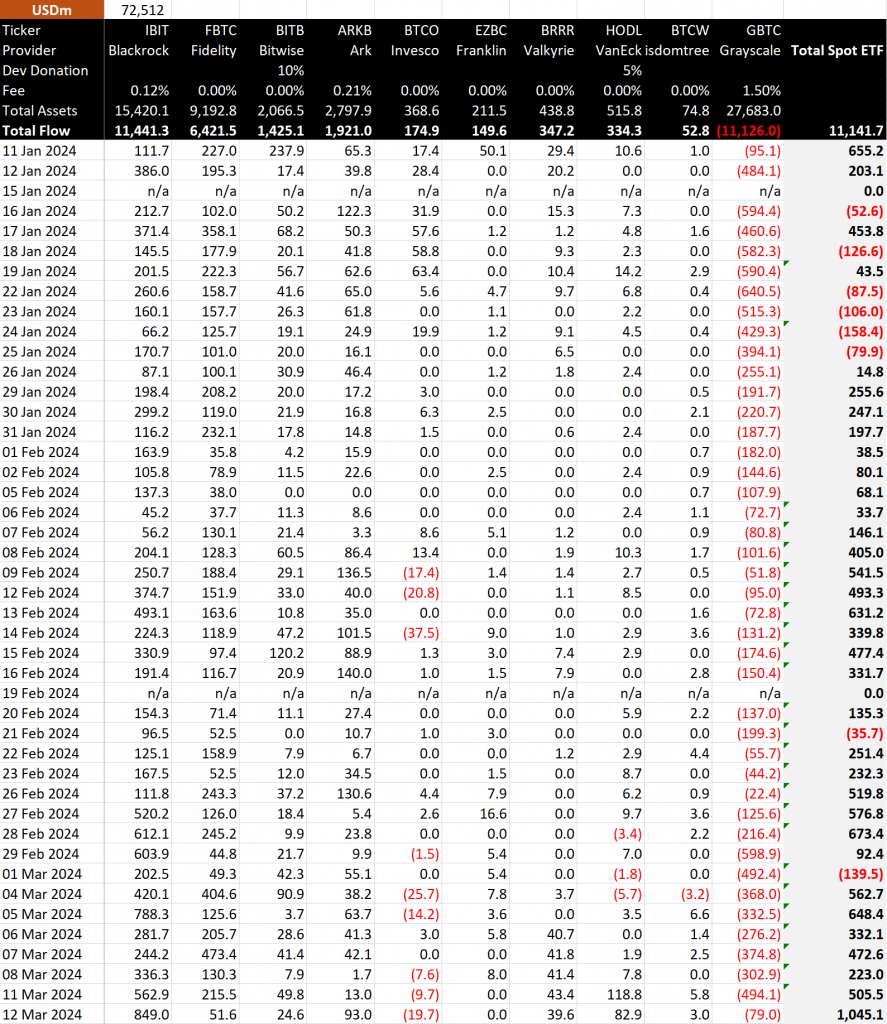

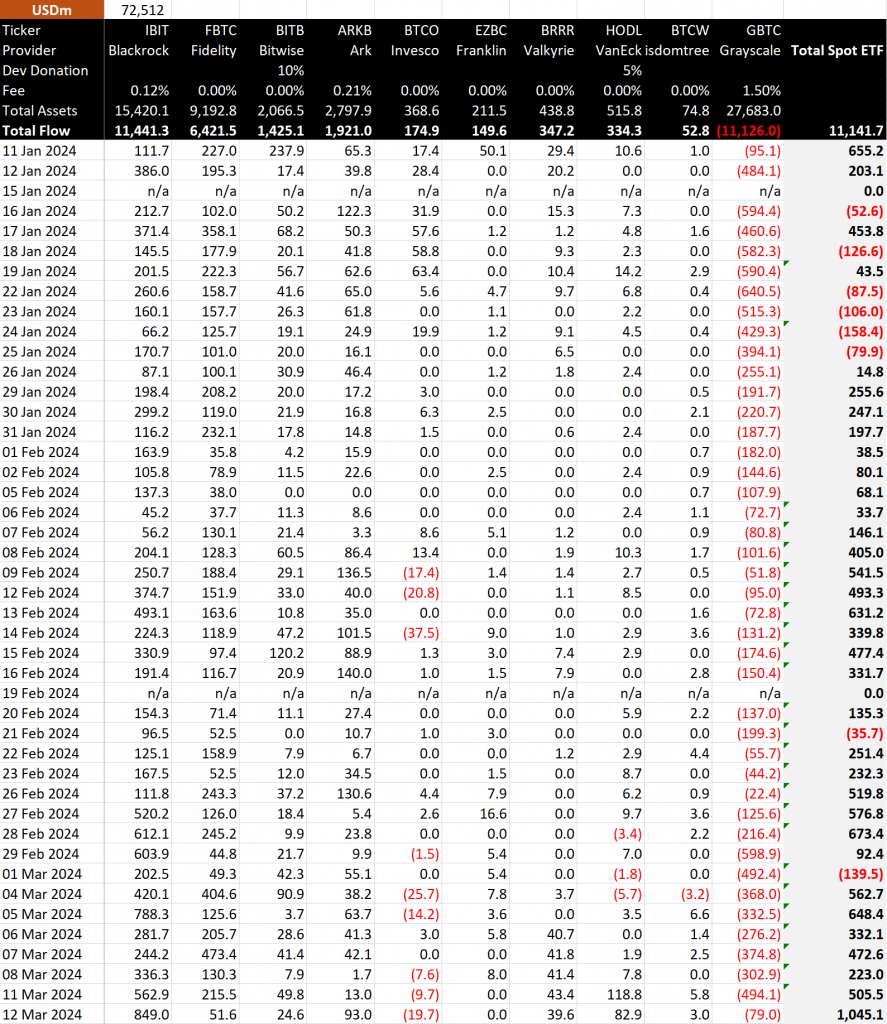

Data meticulously monitored and reported by BitMEX Research highlights a notable surge in spot Bitcoin ETFs, drawing a net inflow of 14,706 BTC, valued at over $1 billion, on Tuesday alone. This surge not only surpassed previous records but also eclipsed the inflows observed in February, which amounted to $673 million. The substantial increase in ETF investments underscores a renewed interest and confidence in Bitcoin among institutional and retail investors alike.

Also Read: Dubai Police Partners With Cardano Foundation to Prevent Crime

The Rise of the ‘Smart Whale’

Amidst the flurry of activity, attention has turned to a savvy investor affectionately known as the ‘smart whale,’ whose strategic maneuvers have captivated the crypto community. This individual reportedly amassed significant gains, totaling around $217 million, through astute trading decisions involving Bitcoin. Holding 4.3K BTC, valued at an impressive $313 million, this whale epitomizes the potential for substantial returns in the volatile yet lucrative markets.

The ‘smart whale’ made headlines by depositing 100 BTC, equivalent to $7.22 million, into the renowned exchange Binance just three hours ago, evidently capitalizing on the recent price surge to secure profits. This move further underscores the agile and opportunistic nature of traders within the crypto space, adept at leveraging favorable market conditions for maximum gains.

A Closer Look at Trading Strategy

Examining the timeline of their trades provides valuable insights into their strategic approach. The ‘smart whale’ began accumulating Bitcoin on Aug. 24, 2023, steadily building a significant position in the leading asset. Notably, they executed a well-timed withdrawal of 8.5K BTC, valued at an impressive $279 million, from Binance at an average price of $32,854.

Despite facing a liquidation event and subsequent losses, the ‘smart whale’ reentered the market by depositing 4.3K BTC, amounting to $183 million, into Binance at an average price of $43,534. This calculated move not only reaffirmed their bullish outlook on Bitcoin but also positioned them for further gains as the asset’s value continued to rise.

With their current holdings valued at $313 million, the ‘smart whale’ has amassed a total profit of approximately $217 million. Such impressive returns underscore the immense potential for wealth generation within the dynamic and rapidly evolving landscape of cryptocurrencies.

Also Read: Bitcoin Hits New High of $73,000: Why is BTC Rising Today?