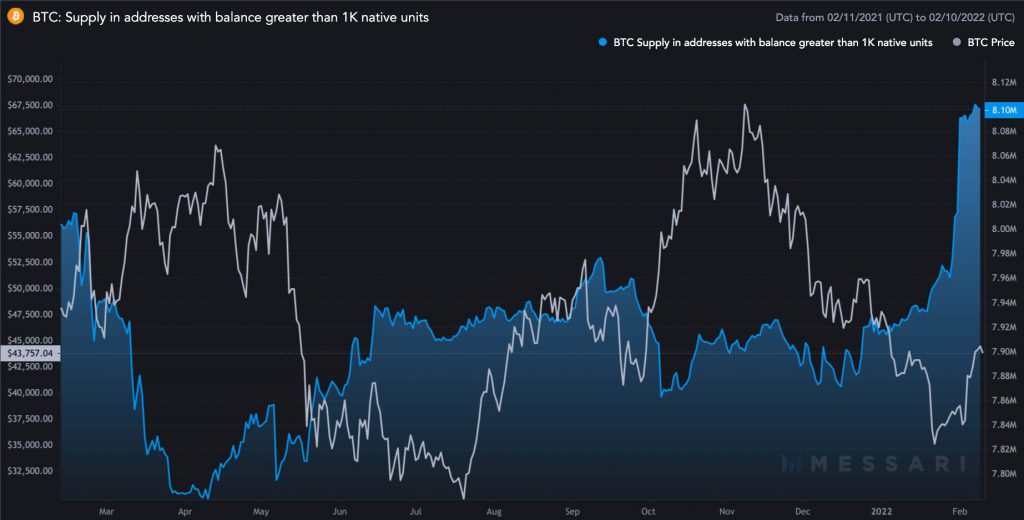

During the current market recovery, Bitcoin (BTC) addresses owning at least 1,000 BTC, known as whales, have begun to accumulate more tokens. According to Coin Metrics, the total supply in these addresses was 8.096 million BTC on Feb. 10, up from 7.95 million on January 24th, 2022.

Bitcoin’s rise in the last two weeks has boosted purchasing sentiment among the wealthiest crypto investors, with BTC rebounding from its 2022 bottom of $33,000 on January 24th to around $43,500 on February 11th.

Not just whales, Bitcoin fishes are also back to accumulating mode

During the recent Bitcoin price rise, little Bitcoin investors, or “fishes,” who have addresses with less than 1 BTC, have also joined the buying frenzy. Meanwhile, the data site Econometrics displays the Coin Metrics data as clusters, indicating a synchronized accumulating pattern among Bitcoin whales and fish.

The clusters were very similar to those seen in the days running up to BTC’s record high of $69,000 in November 2021.

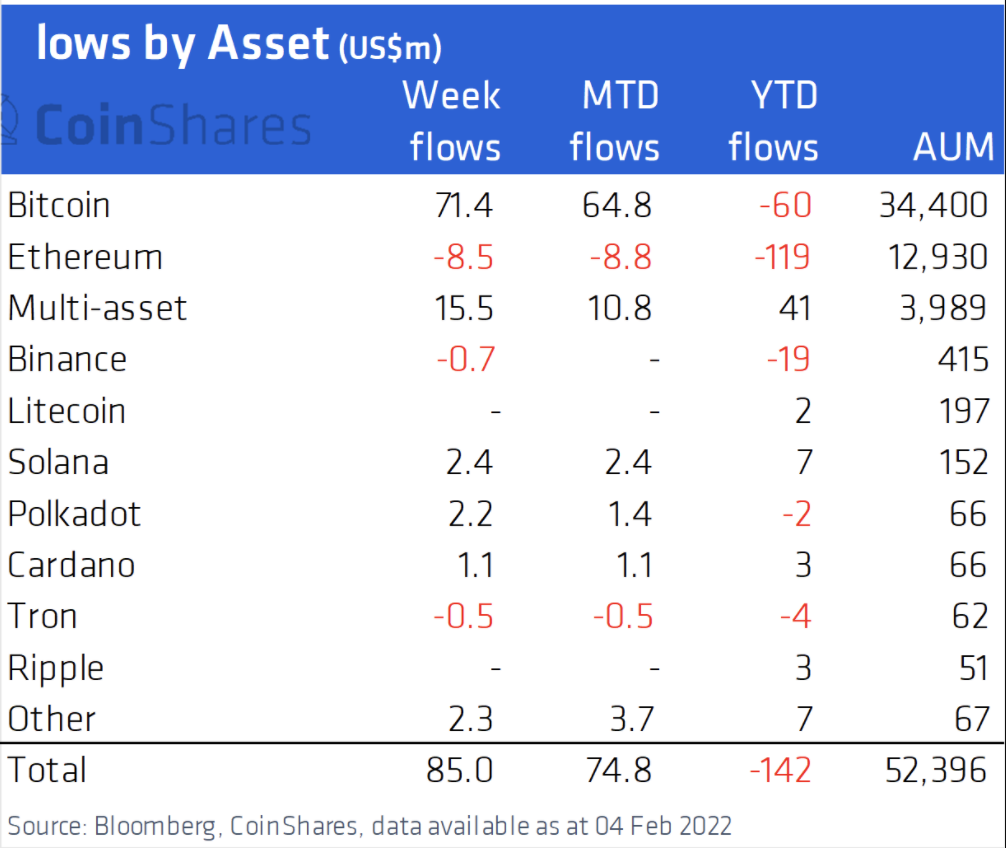

According to a report released this week by CoinShares, inflows into crypto funds increased last week. Notably, capital infusions into these funds have doubled to $85 billion, with $71 million coming into Bitcoin-focused investment products, implying that increasing institutional interest is also helping to boost BTC’s price recovery.

Nick, an analyst at Ecoinometrics, claimed that Bitcoin’s valuation had capacity to rise in the next months, citing a “aggregated risk score” generated from four parameters: risk of an overextended market, risk of low demand and strong supply, risk of holders taking profits, and risk of rising selling pressure.

“Right now, it’s only warming up,” said the Ecoinometrics expert, adding that “in theory, there’s no obstacle to the price rising much higher except for the lack of momentum.”

Meanwhile, on-chain data tracking platform Whalemap forecasted a price range of $46,200–$49,000 as Bitcoin’s “current resistance zone,” citing heavier trading activity in the past. Similarly, the $41,400–$42,400 area is currently working as support, according to the business.

Well, going by the data, it would appear we are on track to get back and beyond where we were in 2021. There is a lot of positive patterns, and ideally, we should see the markets get back on its feet entirely.