The last 34 days have been relatively quiet for Bitcoin. Since 1st December, the largest digital asset has strictly paraded between the range of $17360 and $16250. A minor breakout above $17360 was observed on 13th December. However, a quick correction followed on the 15th. Such price action would usually keep investors guessing, but according to data, there is contradictory behavior at press time.

Small Bitcoin Addresses Are Aggressively Accumulating?

According to Santiment Analytics, BTC addresses holding between 0.1 BTC to 100 BTC are currently on an aggressive accumulation cycle. Over the past 6 months, these addresses increased their overall BTC holding by 9%. However, the interesting derivative of this particular behavior is its prevalence since 2017. These addresses started their holding spree during the 2017 bull market.

A period of selling unraveled during the winter cycle but majorly these addresses have been on the front foot. In terms of consistency, they have only added more BTC over time, hence it leaves a positive attribute irrespective of the current bearish ordeal. However, the whales are beginning to shift the narrative.

Are Whales playing the Reverse Game?

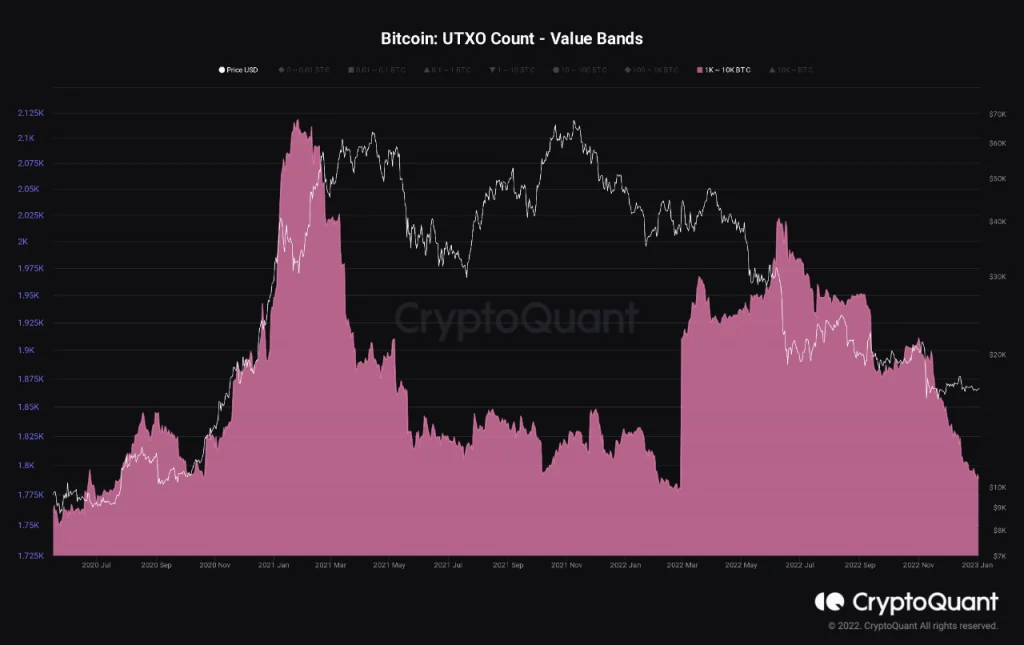

From a macro-standpoint, Bitcoin whales or addresses holding more than 1000 BTC led the bull run in 2020/2021. However, after peaking in terms of strength, whales started to register a decline in numbers. As illustrated in the chart, the UTXO Count Value Bands are strictly declining. For a brief period in March 2022, the number of whales dominated proceedings, but since then, whales have been put under tremendous stress.

There are infinite reasons for the present conundrum. However, a concrete bullish market phase is directly correlated with deep-pocket investors pushing its valuation. The initial push is dependent on Bitcoin Whales before the fishes flock in to extend the rally.

But Is it that Straight-Forward?

Yes, but every bull market since 2017 has been slightly different that the previous one. The idea of Bitcoin distribution and Institution Involvement is drastically different from cycle to cycle. The overall macroeconomic structure is wildly disruptive at press time, which puts further pressure on the asset class.

Lastly, controversies and fraudulent behavior of other assets haven’t been helpful. Just like every other time, the next Bitcoin bull run will be determined by a different set of conditions, and keeping track of fundamentals remains highly important.