2022 will go down as one of the worst years for the cryptocurrency industry. With Bitcoin [BTC] witnessing a major plummet to mid $15K levels, the market experienced a significant correction phase. However, the narrative seems to be changing with BTC moving beyond $24,000 at press time, While many claims that the bull market has already started, a few others continue to put forth the bull trap speculation. But how long will the bear market last?

Historic data points out that the Bitcoin bull run has lasted for 2.5 years on average. Bear markets, on the other hand, have time and again existed for just 1 year following the bull market.

Market cycles usually consist of four phases. It starts off with accumulation, followed by markup, and then distribution. The last one is the markdown phase which usually is associated with the bear market. Therefore, when Bitcoin enters its accumulation phase once again, a bear cycle is usually inching toward its end.

Several analysts believe that Bitcoin is currently in its accumulation phase. This is mostly due to the fact that the king coin is being overbought.

As seen in the above chart, the Relative Strength Index [RSI] indicator revealed that NTC was being excessively purchased at the moment.

Here are other reasons why Bitcoin might have started its bull cycle

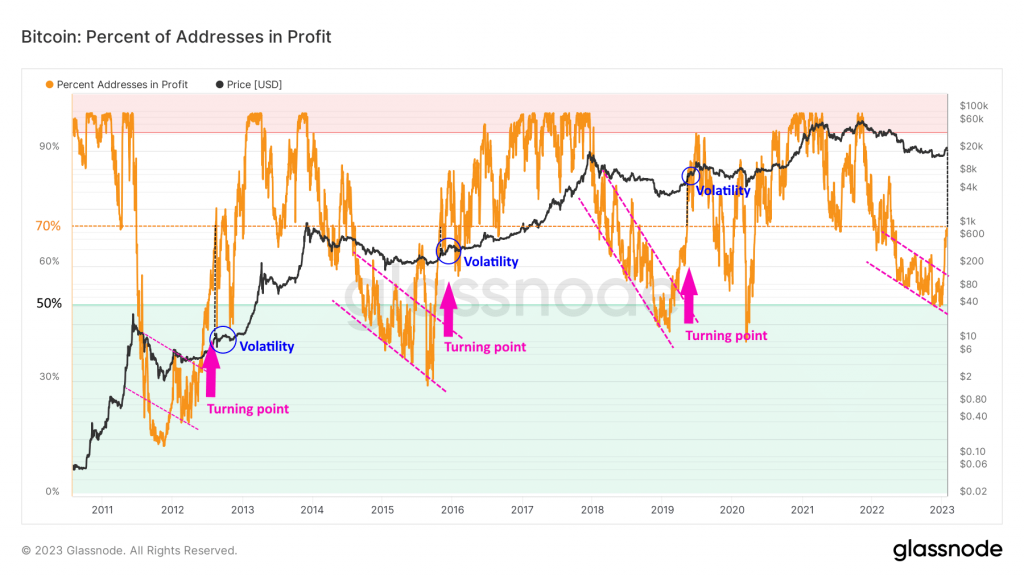

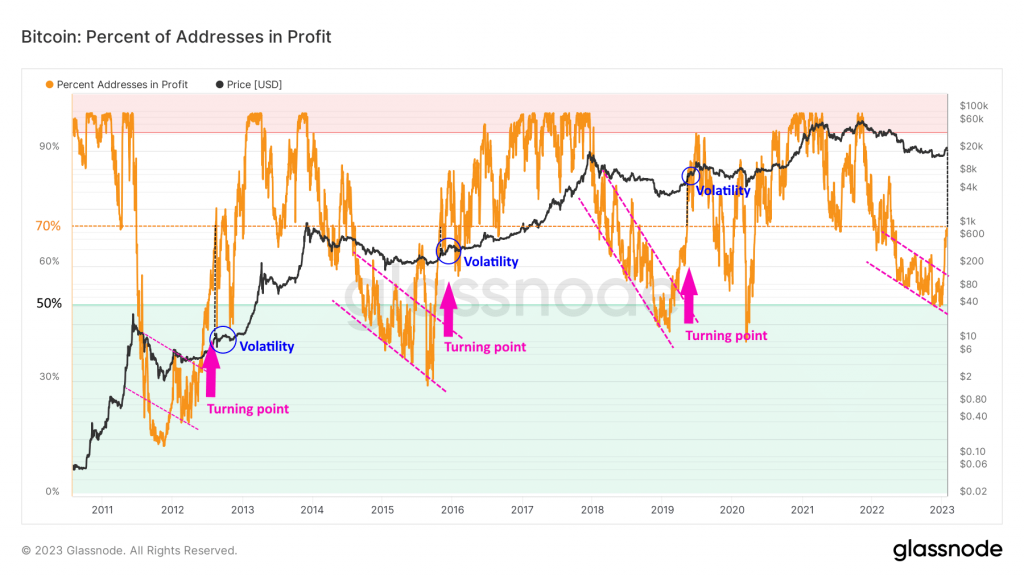

Founder of the Capriole Fund, Charles Edward took to Twitter to highlight how the bull market was here. This was related to the addresses that were currently at profit. He tweeted,

“We’re likely at start of a new cyclical Bitcoin bull market, inside the volatility circle. Percent addresses in profit has bounced significantly from 50-70%, a structure which usually sees profit taking, but also marks a regime change.”

At press time, Bitcoin was trading for $23,440.32 with a 1.49% daily drop.