For the first time since July last year, Bitcoin dropped below $30k. During the late hours of Monday, it stooped down to $29.7k. The dip was, however, quite brief. The weekly support of around $30k came into play, and Bitcoin was back up to $32.2k on Tuesday at press time.

What instigated the dip?

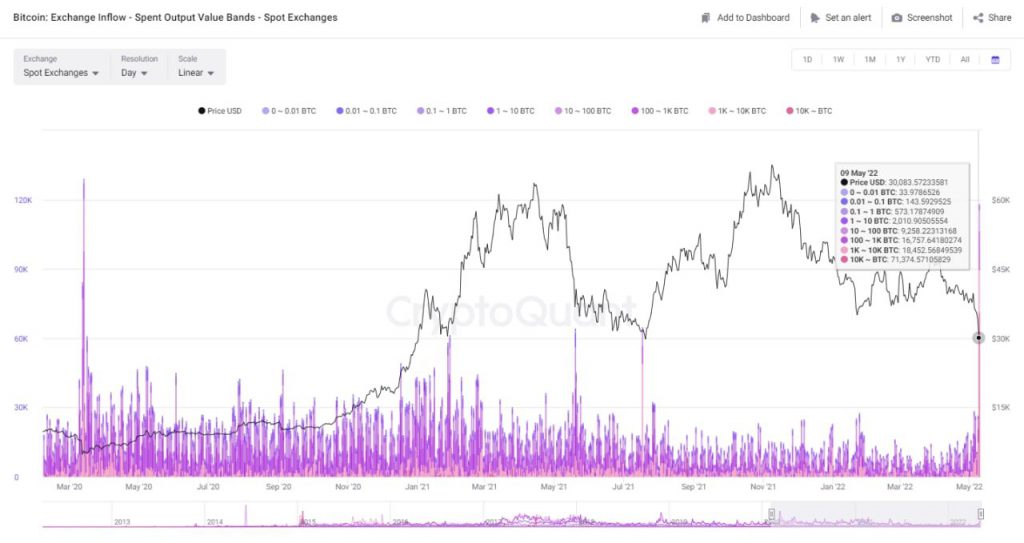

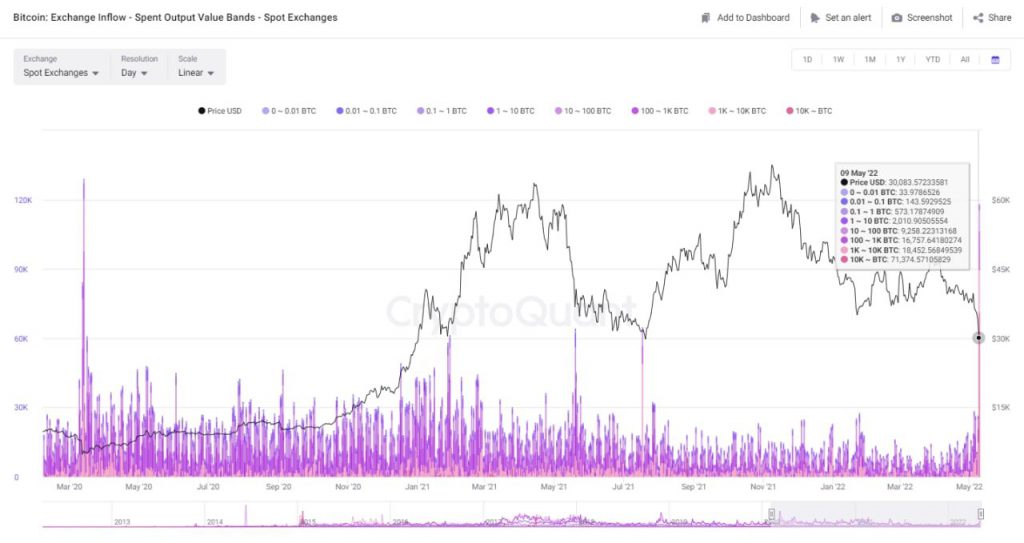

Market participants have been selling at quite a rampant pace of late. Yesterday alone, close to 40.6k BTC, worth $1.3 billion at press time, were sent to exchanges. Per Santiment, such a hefty inflow was noted back in December 2019, making the current one the largest in over 29 months.

So, who exactly is selling? Well, the answer to that is pretty straightforward. Per CryptoQuant, whales have been dumping their holdings. As far as spot exchange data is concerned, HODLers possessing >10k coins sold a cumulative 71k coins yesterday. On the other hand, participants with 100-10k coins cumulatively dumped approximately 35.1k coins.

The sell figures of HODLers with lesser coins from other cohorts were comparatively lesser, justifying the fact that large market participants have done the damage this time.

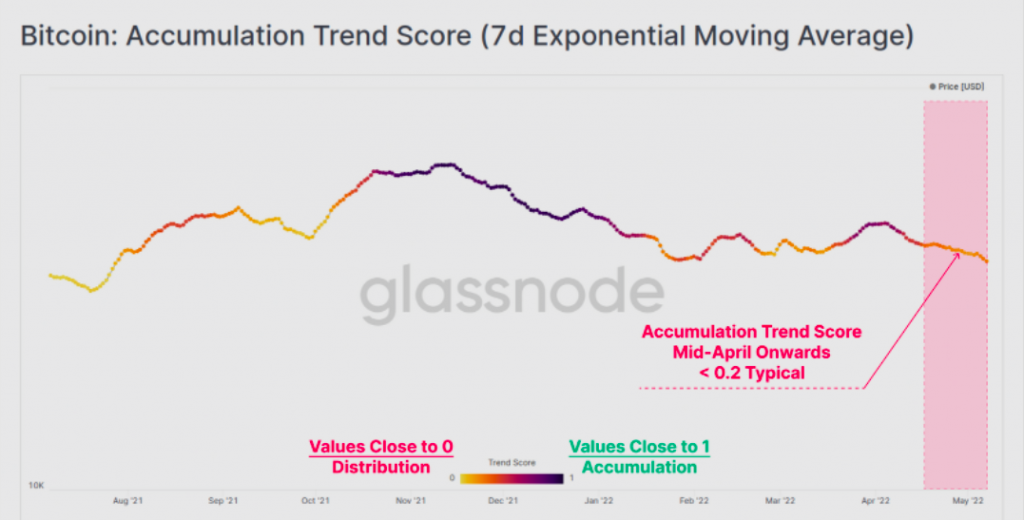

The accumulation trend that was in play until recently has also softened of late. The reading on the accumulation trend score indicator has been hovering below 0.2 since mid-April, supporting the same. Per Glassnode,

“This generally signals more distributive behaviour, and less accumulation has been in play, and is coincident with weaker market prices.”

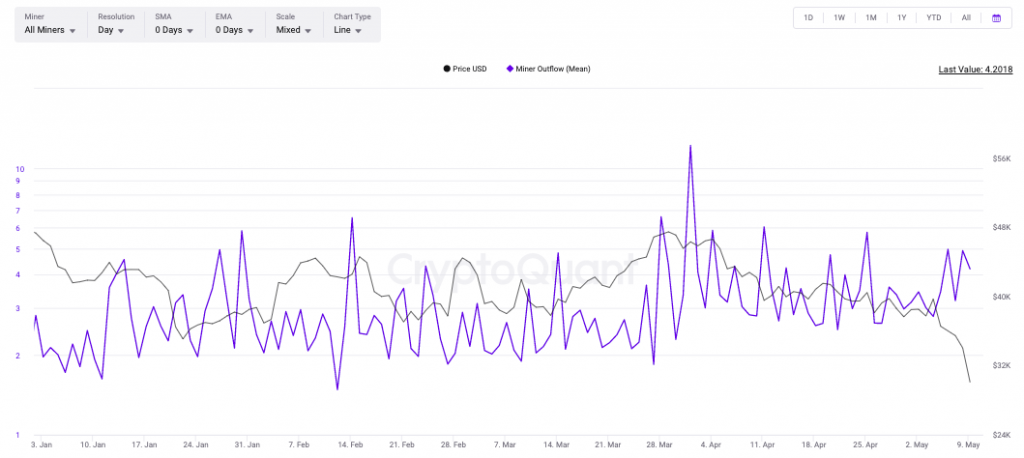

Are Bitcoin miners capitulating?

Miners are usually considered to be whales, given the size of their coins they HODL. So, are they among the whales who are selling? Probably not.

Per CryptoQuant’s data, miner outflows have not seen any abnormal spike on its chart. Over the past day, the said number has dipped, indicating that most miner HODLings are intact, irrespective of the price dump.