For the first time since 16 March, Bitcoin’s price dumped below $40k on Monday. The freefall was bound to happen, for BTC let go of its crucial $42k support level.

At press time, however, things seemed to look slightly improved. On the 30-minute chart, BTC had already registered a streak of 8 green candles and had glided up by 2.16% over the past four hours. In fact, the RSI too had crossed the mid-mark and was hovering above 50 at the time of press, indicating the gradual change in sentiment.

Does Bitcoin have ‘options’ w.r.t. where to head next?

Well, during such periods of volatility, traders with low-risk appetites usually stay out of the market to reduce the risk they’re being exposed to. On the contrary, during decisive trend periods, trader participation usually escalates.

Of late, a similar phenomenon has been noted.

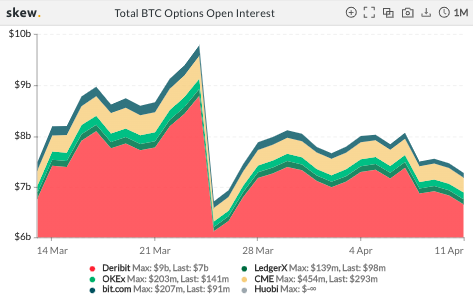

Bitcoin’s Open Interest [options] had started rising at the end of March, after registering a substantial dip. As the market consolidated during the first week of April, the OI remained flat. Nonetheless, over the past 48-50 hours it has dipped substantially, indicating a low speculative interest at the moment.

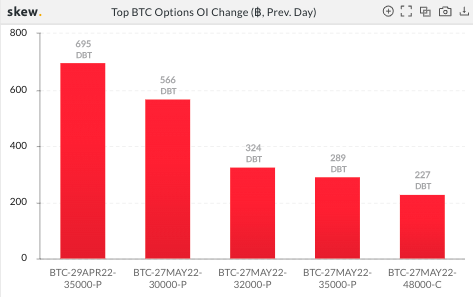

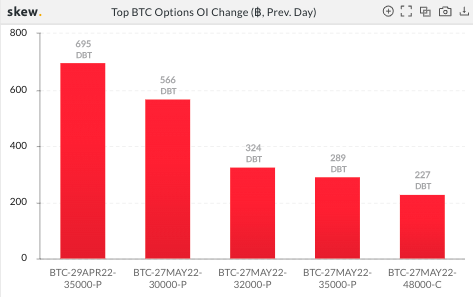

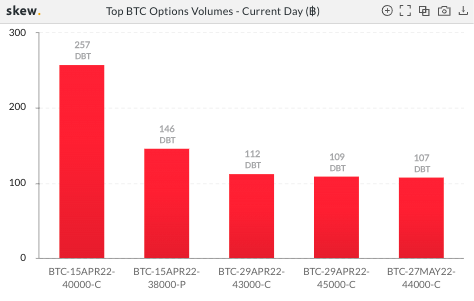

However, the sentiment has started to flip already. Irrespective of the expiry date and the strike price, most traders purchased put [sell] contracts yesterday [chart above]. While today, calls [buy contracts] have already started overshadowing puts [chart below].

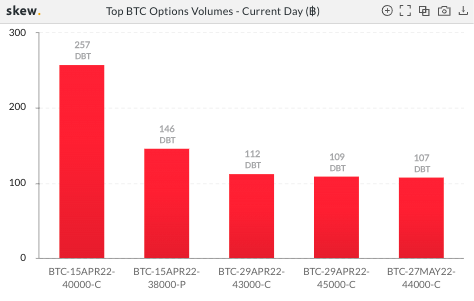

Having a closer look at today’s state of affairs would essentially highlight that the market is not completely devoid of bearish traders. For Friday’s upcoming expiry, 146 contracts with a strike price of $38k had been purchased. However, the number of calls for $40k on the same day stood much higher at 257.

Well, the intense degree of bearishness might have partially fizzled out over the past few hours, but it shouldn’t be forgotten that “extreme fear” still lingers in the minds of market participants.

Despite the prevalent optimism, the bull v. bear battle can take a turn in any direction hereon. Thus, it’d be best to exercise caution and wait for a directional bias to take concrete shape before stepping into the market.