Despite minor pullbacks noted here and there, Bitcoin has been able to cling on to $30k over the past few days. With the volatility in the market reducing, BTC’s price has been consolidating around the said threshold. After noting a mere 2.4% fluctuation over the past week, the king coin was seen trading at $30.18k at press time.

What’s keeping Bitcoin afloat?

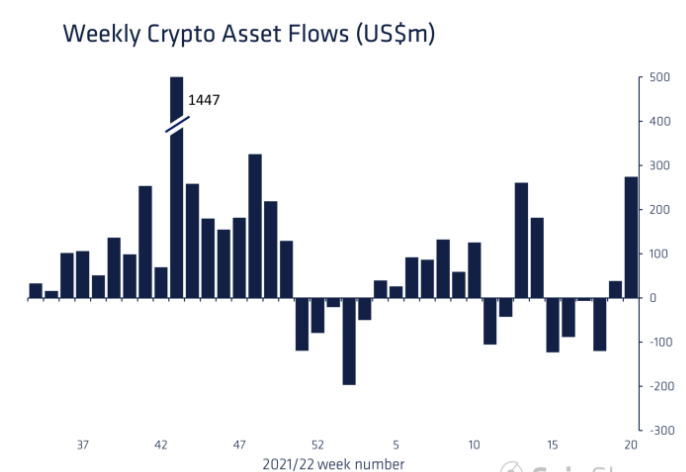

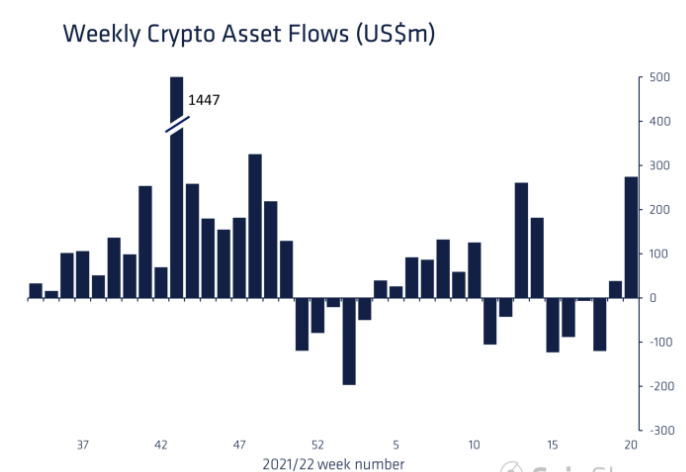

Getting straight away to the point, institutions. Consider this – Throughout most of April, digital asset investment products noted outflows, and in most instances were led by Bitcoin. The flows managed to step into the positive territory during the beginning of May.

The inflow same trend was honored to even last week. Interestingly, the numbers were at a multi-week high in the said period. Per data from Coinshares’ latest weekly report, digital asset investment products noted a net flow summing up to $274 million last week.

Outlining what the same essentially conveys, the report noted,

“A strong signal that investors saw the recent UST stable coin de-peg and its associated broad sell-off as a buying opportunity.”

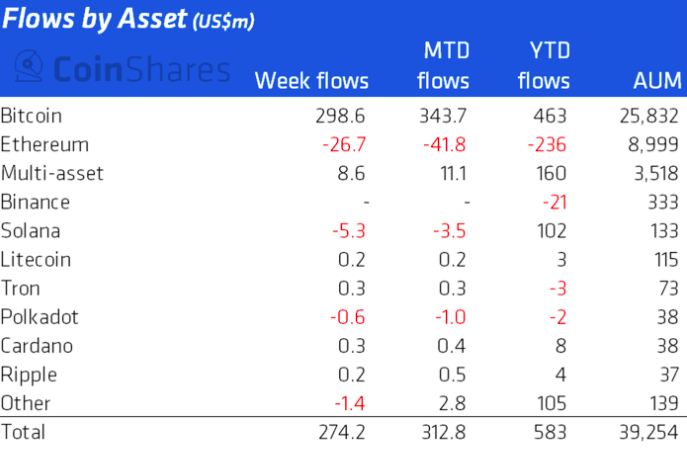

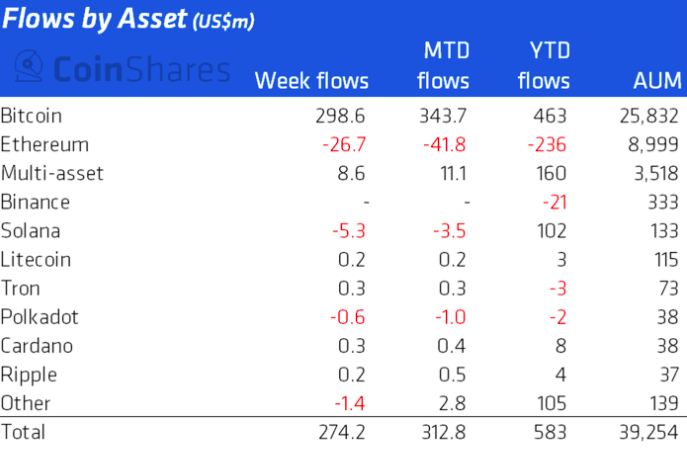

Bitcoin alone noted an inflow of $299 million, indicating that institutional investors were busy diverting funds toward this coin and accumulating it. Perhaps, this investor class flocked to Bitcoin during the FUD period because of the asset’s relative safety and haven nature.

Investors, nonetheless, stayed away from alts. Litecoin, Tron, Cardano, and XRP noted comparatively minor inflows, while the negative numbers registered by Solana and Ethereum managed to pull down the aggregate figure.

Are weak hands capitulating alongside?

It is sort of traditional for strong hands to buy coins during periods of instability. Now, just like how every coin has two sides, even this one has. Accumulating by strong hands and abandoning by weak hands usually go hand-in-hand.

Per Santiment, Bitcoin’s idle addresses have become more active over the past week. In fact, during the capitulation dip noted last Thursday and Friday, the same peaked at local highs, indicating an increase in the age consumed.

Outlining the thumb rule and implication of such a spike, Santiment noted,

“Generally, when Age Consumed spikes arise during price drops, it’s related to weak hands exiting positions.”

Now, even though the filtration is good from a fundamental perspective, HODLers exiting positions could put immediate pressure on Bitcoin’s price. As a result, the asset might react to the same and we might witness a pullback below $30k over the next few days.