The cryptocurrency industry has been on a roller coaster ride. The Bitcoin [BTC]-led market was recovering after a major dip. Bitcoin, at press time, was trading at $66,995 following a 4.30% surge over the last 24 hours. Currently, the asset is trading 9% below its all-time high of $73,750. But how long will the king coin remain below the $70,000 zone? VanEck believes that the cryptocurrency could be seeing a notable uptrend.

Prominent asset manager VanEck has been making headlines lately for its spot Bitcoin and Ether ETFs. More recently, VanEck suggested that it could reach a high of $2.9 million by the year 2050. But the firm notes that this could be possible when Bitcoin turns out to be a vital part of the international monetary system over the next couple of years. This comes in the face of geopolitical issues that do not seem to simmer down. Matthew Sigel, head of digital asset research at VanEck, added,

“As we look at the world right now, we see enormous economic imbalances, rising distrust in existing institutions and continued deglobalization. We think many of these distortions stem from … a massive misallocation of capital since the global financial crisis as G7 governments have abused the printing press, spending borrowed money on impossible goals. Bitcoin … is the ultimate hedge against this rising fiscal recklessness.”

Also Read: JPMorgan Says Bitcoin & Crypto Market Will Rebound in August

Bitcoin’s Market Capitalization to Surge Following Adoption

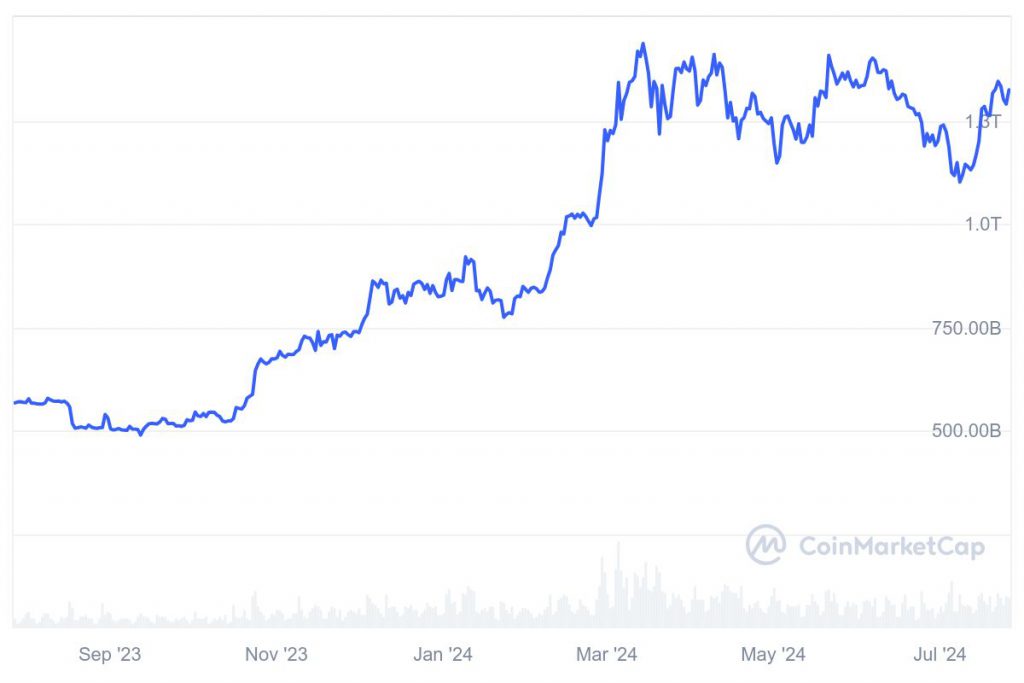

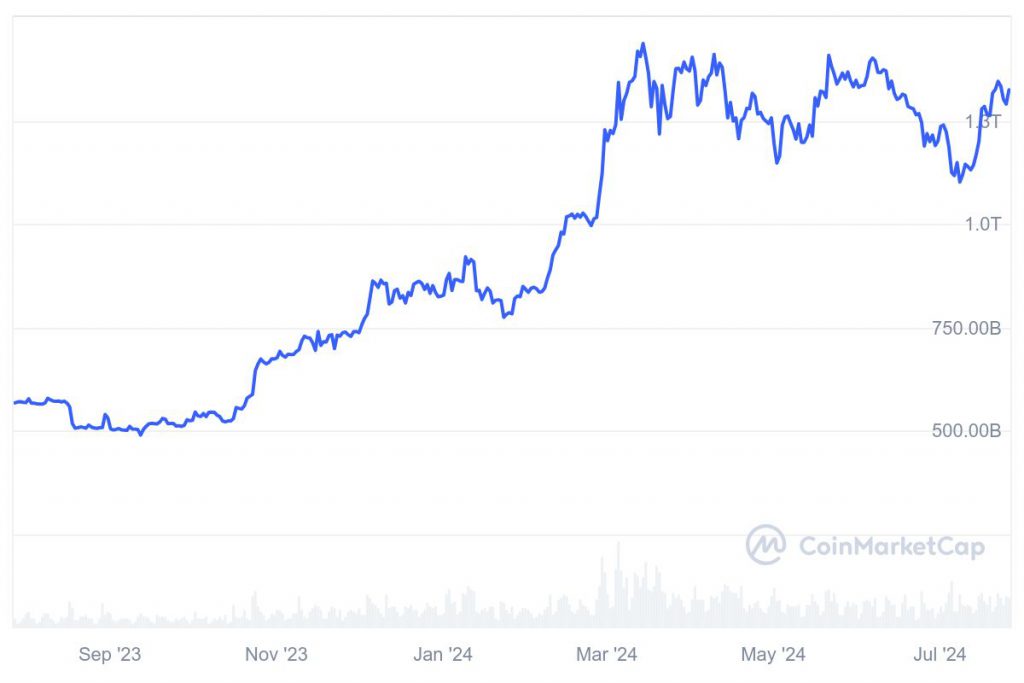

The king coin’s market cap currently stands at $1.32 trillion. But VanEck predicts that BTC’s market value will rise to a high of $61 trillion by 2050. Along with its role as a hedge, BTC is expected to record this surge because of its growing global usage. VanEck’s analysts suggested that 10% of international trade and 5% of local trade are expected to be settled with Bitcoin. This would eventually push central banks to hold 2.5% of their assets in Bitcoin.

Also Read: Bitcoin and Ethereum: August Price Predictions Analysis