Bitcoin’s price has swung up and down quite a few times over the past week. On Wednesday, BTC briefly rose up to $41.7k, but was quick to meltdown and return back to the $39k range. On Thursday, it managed to reattain $41k, and in fact, opened around the same price even on Friday. On 19th March, it registered a rise to $42,400 for the 1st time since 3rd March.

From a technical perspective, Bitcoin has to overcome two resistance barriers to commence its full-fledged bull run. The first level is around $45k and the other is around $52k. The said price marks have acted like roadblocks and have denied the king-coin an entry into the “elite bullish suite” in the recent past. Thus only if BTC successfully breaks above them, it would be in a position to shrug off its bearishness.

Having said that it doesn’t mean that BTC’s price movement would only be onwards and upwards after it breaks above $52k. Profit-taking, retracements, and pullbacks would occur, but Bitcoin would be in a much better position to bounce back.

Double-checking the price levels

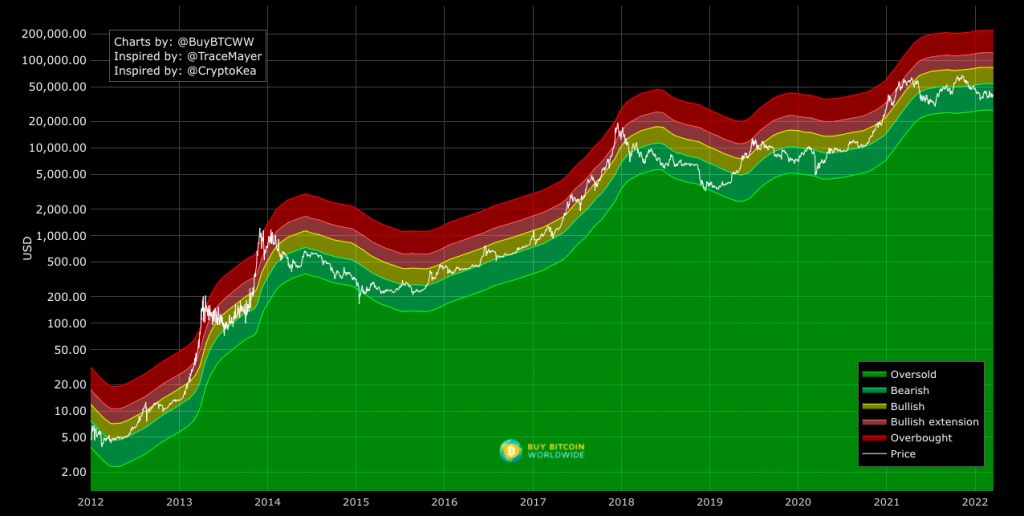

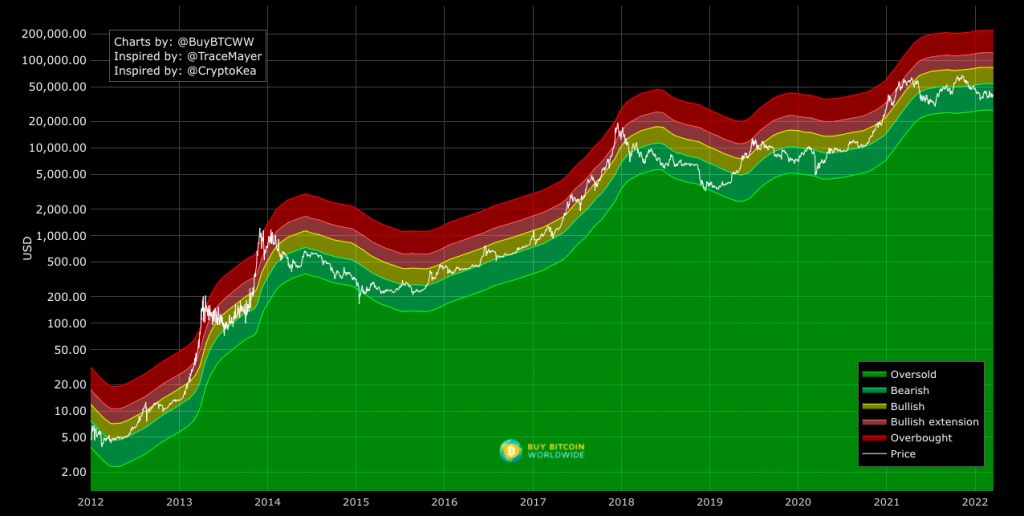

To cross confirm the targets, let’s peek into the Mayer Multiple readings. This metric was created to compare and analyze Bitcoin’s price w.r.t. its past movements. Whenever Bitcoin has rallied, this metric’s reading has mostly reflected readings above 1.5. However now, it stands midway at 0.86, indicating that Bitcoin has not even started gearing up for the next bull run.

Also, Bitcoin’s price continues to hover in the ‘bearish’ band [light green] on the chart. For it to step into the bullish band [yellow], it would have to cross $53,522.52—which is fairly close to its $52k technical test level.

Also, as far as past precedents are concerned, Bitcoin has always made it to the bullish zone after spending time in the bearish arena. However, the amount of time it has taken to do so has varied.

Keeping the state of the market in mind, it doesn’t look like the sentiment would flip right away. If BTC gets a weekly close below $35k, then the whole bullish thesis would get fractured. It would continue its correction phase for a few weeks before commencing its next leg up.

Even though at this stage it is not a matter of the question of if, when Bitcoin spreads its wings and takes off, market participants need to remain patient and wait for the coin to attain one of the said levels before judging the trend.