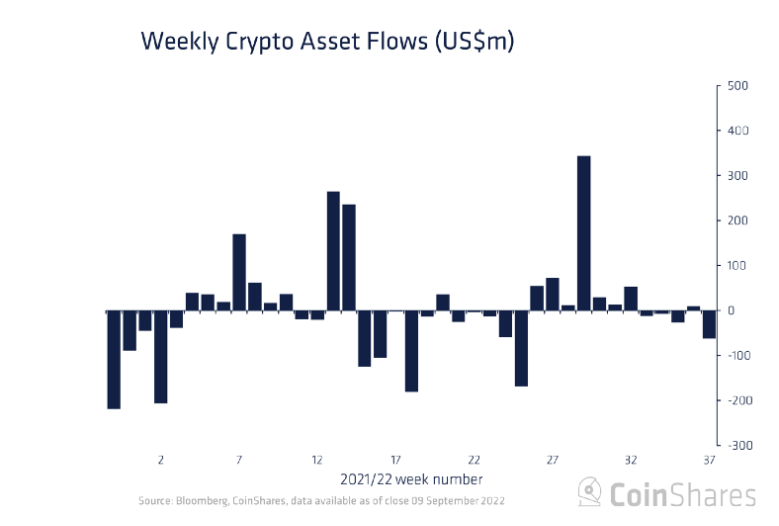

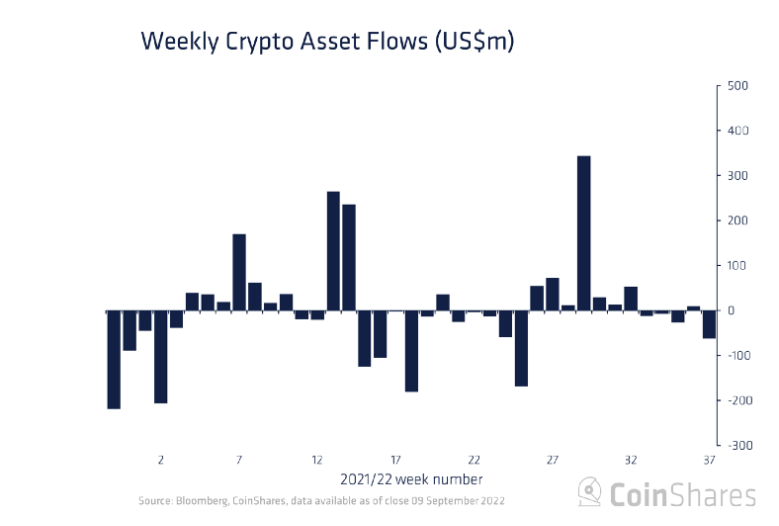

Last week, digital asset investment products registered outflows summing up to $63 million. While Ethereum noted the largest negative flows, Bitcoin stood next. For inverse products i.e. the ones providing short exposure, the trend was the other way around. Chalking out the same, CoinShares’ latest weekly report noted,

“Bitcoin saw a 5th consecutive week of outflows totaling US$13m, while short-bitcoin investment products saw inflows totaling US$11m highlighting continued negative sentiment.”

The same report also highlighted that institutions mostly registered negative flows in the week that ended on 9 September. 3iQ noted the largest outflows but it was followed by ProShares—whose digital asset outflow number stood at $10.2 million.

Even though the net number remains to be negative, a trend flip was noted at the end of last week.

ProShares’ Bitcoin exposure increases

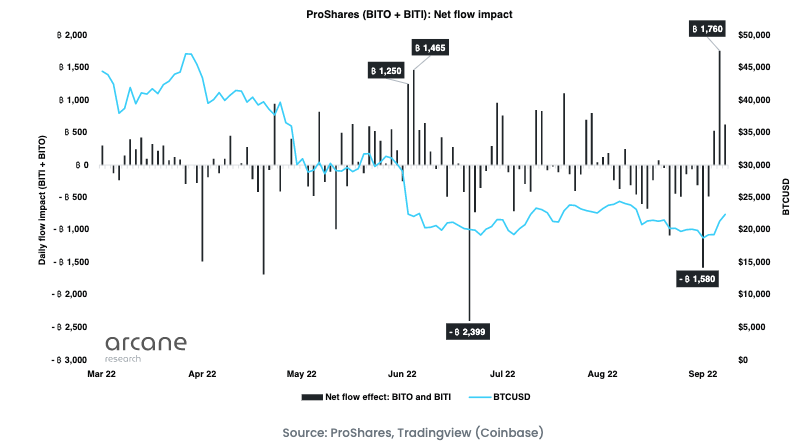

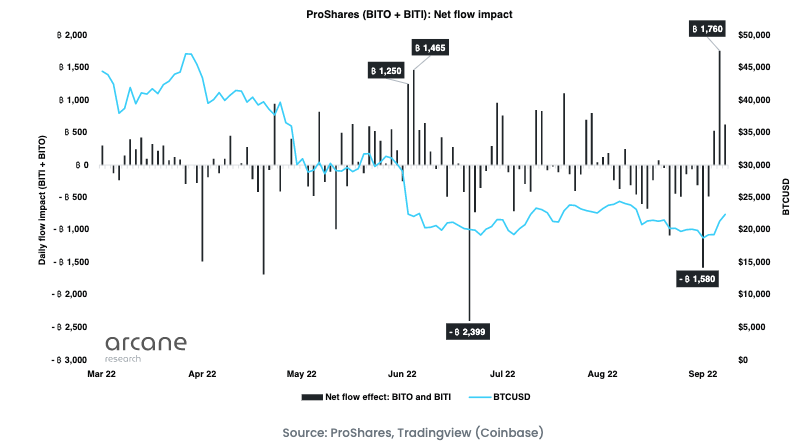

A report from Arcane Research released yesterday highlighted that Thursday and Friday of last week showed “promising signs” in ETFs, after a month of near-constant net negative flows to ProShares BTC ETFs. Per the report,

“In the last three trading days, BITO has experienced consecutive inflows, equivalent to a growth in BTC exposure of 1650 BTC.“

ProShares Bitcoin Strategy ETF [BITO], as such, is a Bitcoin-linked ETF that seeks to provide capital appreciation to investors primarily via managed exposure to Bitcoin futures contracts.

BITI—the short ETF—saw substantial outflows on the other hand on Friday. The same amounted to 1,060 BTC. Chalking out what this possibly means in terms of trader sentiment, Arcane Research’s report noted,

“This is the largest BTC equivalent outflow from BITI since launch, and it suggests reduced conviction from traders betting on a further downfall.”

The Friday outflow from BITI and inflow to BITO—in conjunction—contributed to a net positive directional impact equivalent to 1,760 BTC in the ProShares ETFs. And per Arcane Research, the Friday flows mark the strongest day in terms of ProShares’ flows since last year’s 21 October.

In fact, the outflows continued even on Monday for BITI and the number stood at 425 BTC.

Word of caution

Well, the of-late data—in isolation—does typify a growing bullish sentiment in ETFs. However, it should be noted that BITI’s BTC equivalent exposure sits on par with June and July highs. And BITO’s BTC exposure has declined to a three-month low.

Price-wise, Bitcoin CME futures noted a 9.8% fall yesterday, and as a result, BITO and BITI noted a fall and rise of the same magnitude.