Bitwise Asset Management, which handles $15 billion worth of funds, prides itself on being the second institutional client to be allowed to launch an XRP ETF by the US Securities and Exchange Commission (SEC) in November 2025. The first was Canary Capital in mid-November, which saw $58 million in trading volume on the first day.

It’s been more than two months since the Bitwise XRP ETF went live for trading. Institutional clients made a beeline for investing in the newly-launched asset. The SEC approval was touted to be a game-changer for XRP that could drive its price up. However, that was not the case as the leading altcoin is heading south in 2026.

Also Read: XRP Price Stabilizes With Hammer Candle: Perfect Time To Buy XRP Dip?

Has Bitwise XRP ETF Generated Profits or Given Losses?

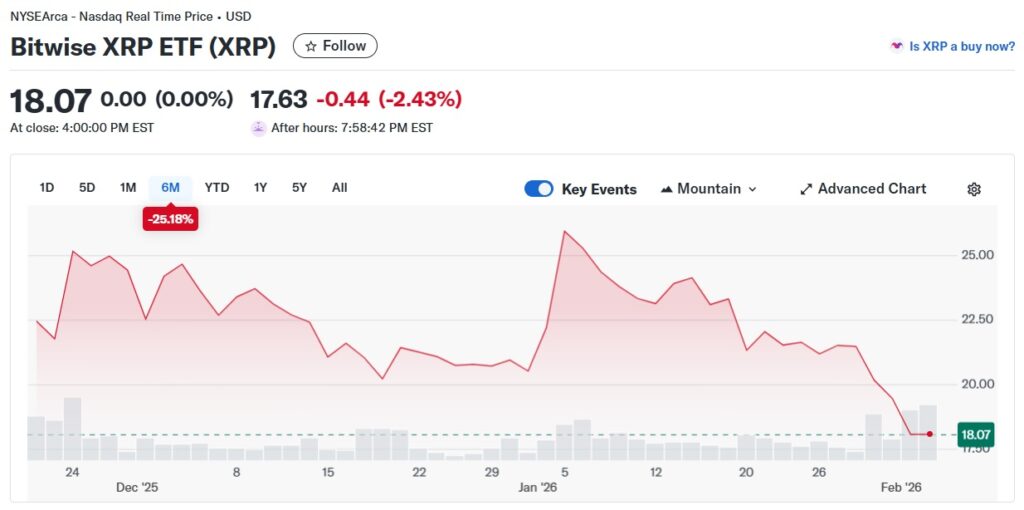

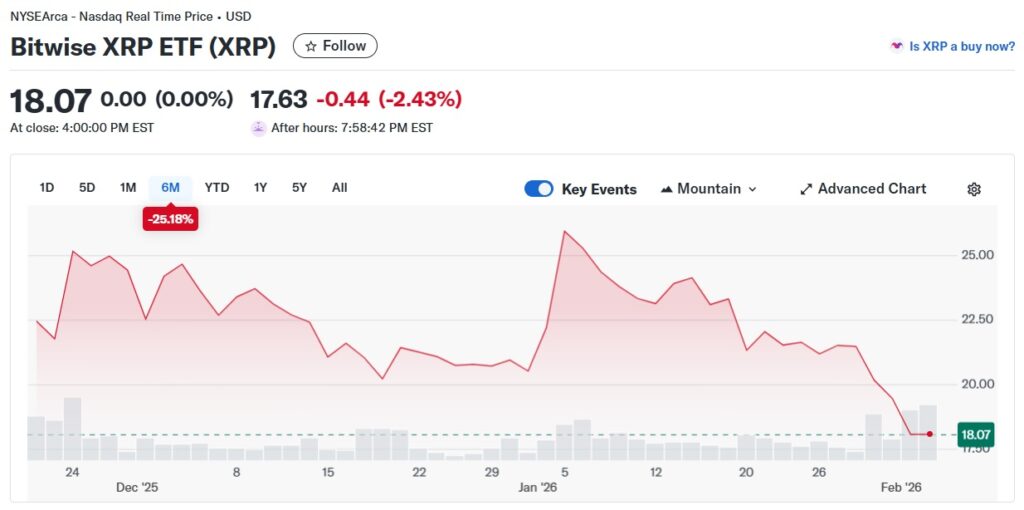

The Bitwise XRP ETF was launched for a price of $24.15 and reached a high of $26.88. However, things went down for the ETF from 2026 as the altcoin went bearish. The uncertainty in the market led to the downfall, with trade being affected due to growing tariffs. The broader markets remain on a slippery slope with a slump around the corner.

Bitwise XRP ETF is now trading at the $18.07 level on Wednesday and had fallen to a low of $17.63. Therefore, the ETF has delivered losses to clients in 2026 with barely any profits. The index is already under pressure as BlackRock briefly encountered losses in its Bitcoin ETF funds. The price decline in BTC rocked the sector as BTC fell below the $75,000 range.

Analysts have also projected the Bitwise XRP ETF as a high-risk asset suitable for those with financial tolerance. An investment in this ETF is not the same as holding the actual XRP token. There is heightened volatility as large funds are moved in and out of the asset. Investors must be careful before deciding to go all-in on the asset.