According to a 13F filing shared by Bloomberg ETF analyst Eric Balchunas, Harvard University’s largest position is BlackRock’s IBIT Bitcoin ETF. The world-renowned university holds about $442.88 million worth of IBIT shares. According to Balchunas, Harvard University’s endowment gives substantial validation to the IBIT ETF. The university is currently among the top 16 IBIT holders globally.

BlackRock ETF Offloads Bitcoin Amid Crash

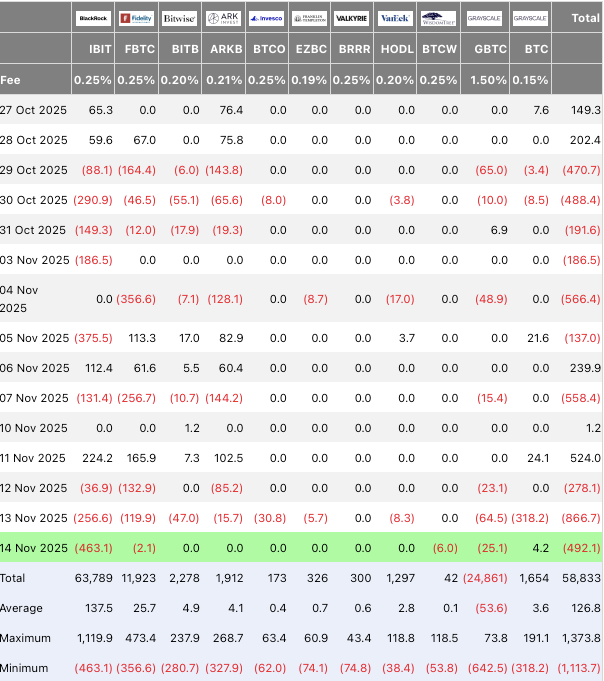

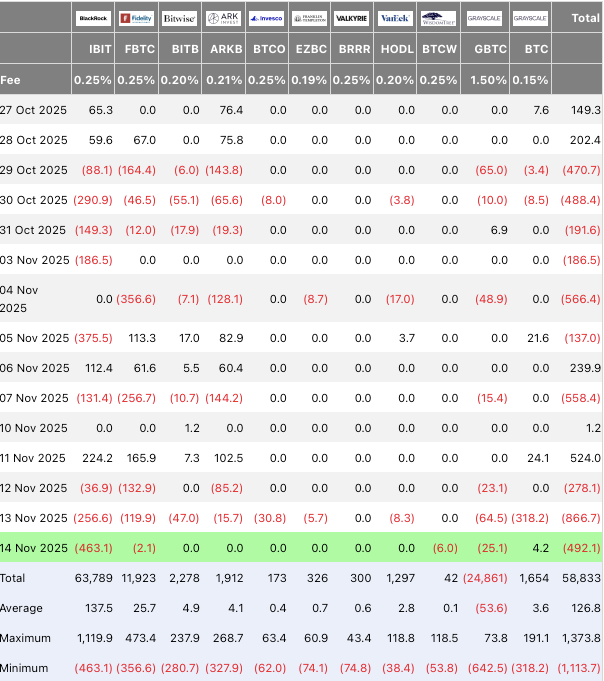

ETF outflows have played a major role in the ongoing market correction. According to Farside Investors, financial institutions offloaded $278.1 million worth of Bitcoin on Nov. 12, $866.7 million on Nov.13, and $492.1 million on Nov. 14.

ETFs have played a substantial role in the current market cycle. Bitcoin (BTC) has hit multiple all-time highs after the US SEC approved 11 spot ETFs in 2024. Ethereum (ETH) also hit a new all-time high earlier this year, thanks to increased ETF inflows. With ETF inflows plummeting, BTC and ETH have lost substantial footing.

Bitcoin (BTC) and the larger crypto market are facing one of the most significant crashes in recent memory. The original crypto has fallen below the $96,000 mark, a price level last traded at in May 2025.

Also Read: Saylor’s Total BTC Spend: Is Today’s Bitcoin Volatility a Warning?

The crash may be due to the dwindling chances of another interest rate cut from the Federal Reserve. Fed Chair Jerome Powell warned about slow economic growth and rising inflation during his October speech. Powell’s speech may have led to investors moving away from risky assets, such as cryptocurrencies.

Will BTC Recover Soon?

The crypto market is currently facing substantial volatility. Bitcoin (BTC), being the market leader, is setting the tone for most other assets. With no interest rate cut in sight, the crypto market may consolidate around current levels.

However, macroeconomic trends could further influence the crypto market. Slow economic growth could lead to investors moving further away from Bitcoin (BTC) and other cryptocurrencies.