In a recent interview with Citi, BlackRock CEO Larry Fink further reiterated his belief in Bitcoin (BTC) and blockchain technology. Fink stated that there is a lot of “legitimacy” around BTC and the blockchain technology around the asset. The chief of the world’s largest asset manager, however, does not believe BTC is a currency, instead comparing it to “digital gold.”

BlackRock’s Long-Term Outlook On Bitcoin

In the interview with Citi, Fink said that most of “BlackRock’s business is based on long-termism.” This statement suggests that BlackRock is quite bullish on BTC’s long-term prospects.

Fink also said that Bitcoin (BTC) is a currency of fear. He stated that people buy BTC because they are fearful of their country’s security and the debasement of their currency.

Will The Asset Climb To a New Peak Soon?

Bitcoin (BTC) has hit multiple all-time highs over the last year. BTC’s climb to new highs could be attributed to high ETF inflows. BlackRock’s Bitcoin ETF, IBIT, is among the most popular BTC ETFs in the market. Crypto-based ETF inflows are expected to continue growing over the coming years.

Also Read: BlackRock ETF Flips Coinbase as Top BTC Holder With 781K Bitcoin

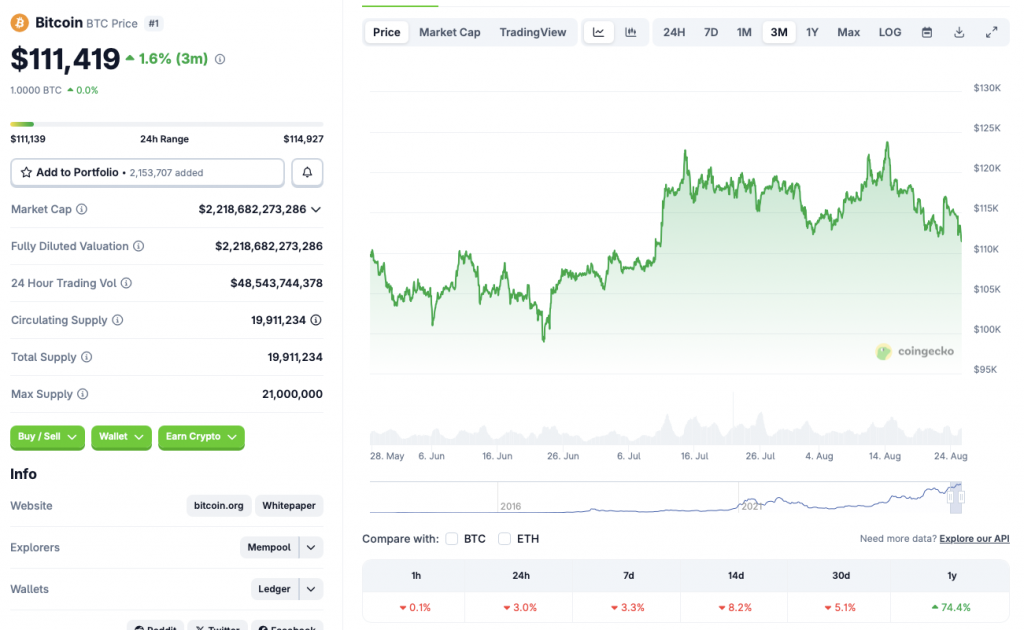

Bitcoin (BTC) hit its most recent peak of $124,128 on Aug. 14. The asset’s price has fallen by more than 10% since its all-time high. BTC’s price has fallen to the $111,000 level, facing substantial liquidations. According to CoinGecko’s BTC data, the asset is down 3% in the last 24 hours, 3.3% in the weekly charts, 8.2% in the 14-day charts, and 5.1% over the previous month.

BTC’s price dip may continue over the coming weeks, given that September has historically been a bearish month for the asset. However, there is a chance that the Federal Reserve will cut interest rates next month. A rate cut could lead to a surge in risky investments. BTC could pick up steam under such circumstances.