According to an X post by Cointelegraph, BlackRock’s spot Ethereum ETF purchased 78,920 ETH on Sept. 15, worth $363.2 million. BlackRock’s big purchase came amid a market-wide dip. The world’s largest asset manager may have taken the opportunity to increase their holdings significantly. Let’s discuss if you should buy the dip too, or wait for prices to dip further.

Will Rally Ethereum After BlackRock’s Big Purchase?

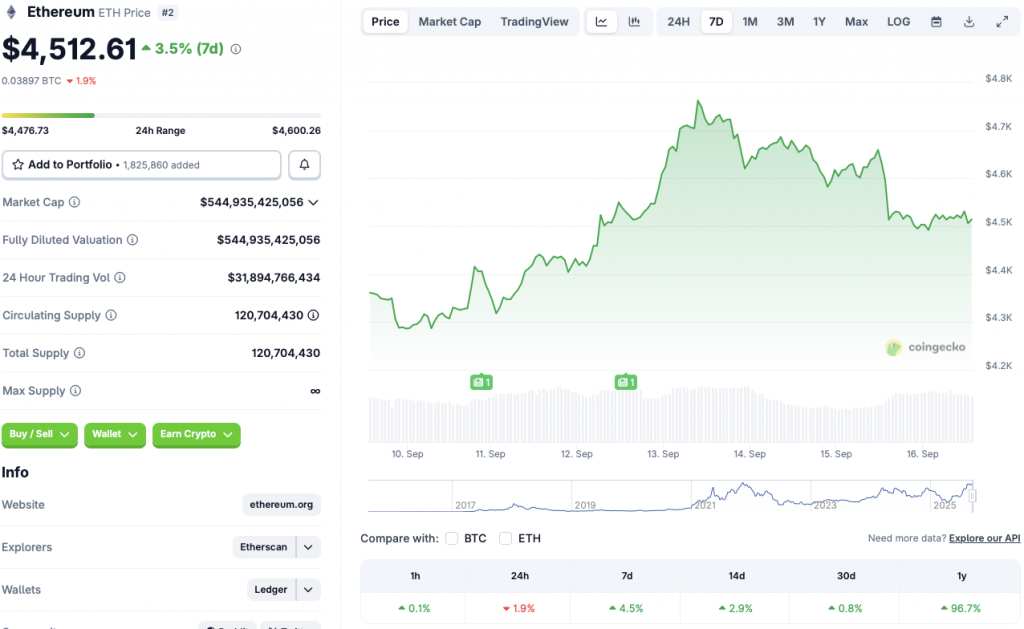

Ethereum (ETH) faced a steep price dip on Sept. 15, falling from $4659.53 to $4513.89. BlackRock’s purchase coincides with the price dip, which could mean that the financial institution bought the dip. Buying the dip is a popular strategy among many retail and institutional investors. According to CoinGecko, ETH’s price currently seems to be consolidating around the $4512 level. The asset could bounce back up from its current price level if market conditions improve.

Ethereum’s (ETH) price dip may have been triggered by investors taking caution before the Federal Reserve’s 2-day meeting from Sept. 16-17. Market participants are likely looking for clues on the Federal Reserve’s monetary policy stance. There is a high chance that the Federal Reserve will announce a 25 basis point interest rate cut later this month. A rate cut could lead to Ethereum (ETH) and the larger crypto market rebounding from the downward trajectory.

Also Read: Bitcoin, Ethereum, BNB Aiming New All-Time Highs By 2025 End

While the chances of an interest rate cut are high, rising inflation has caused some worry among investors. Inflation in the US rose to 2.9% in August, which could cause the Federal Reserve to keep interest rates unchanged. If the Fed keeps interest rates the same, Ethereum (ETH) and the larger crypto market could continue consolidating or face another correction.

Other macroeconomic developments, such as trade wars and tariffs, could also present challenges and bring forth fresh volatility.