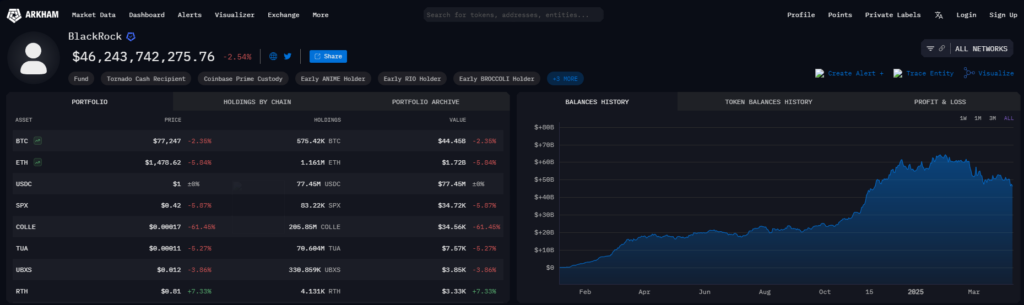

Blackrock crypto custody is now entering a new phase as the world’s largest asset manager has recently partnered with Anchorage Digital. This collaboration, which was actually announced on April 8, aims to address the rising demand for digital asset custody from both retail and also institutional investors. Right now, BlackRock manages over $47 billion in crypto holdings, including Bitcoin and Ether, and this move definitely strengthens institutional crypto adoption as well as secure cryptocurrency storage options in the current market.

Also Read: Chainlink (LINK) Vs. TRON (TRX): Which Is Better For This Dip?

Navigating Digital Asset Security: How BlackRock’s New Custody Solution Works

Anchorage Digital, which happens to be the only federally chartered crypto bank in the US at the time of writing, will provide BlackRock with various comprehensive digital asset custody services. Beyond just the basic custody options, Anchorage also offers additional staking and settlement services, which essentially enhances BlackRock’s overall crypto operations in many ways.

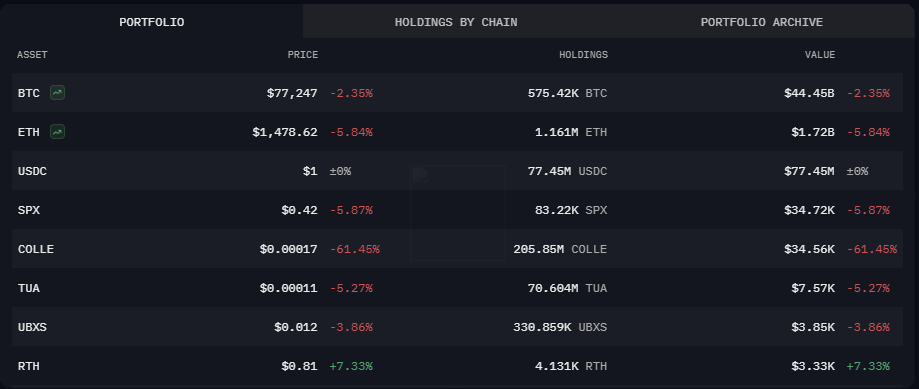

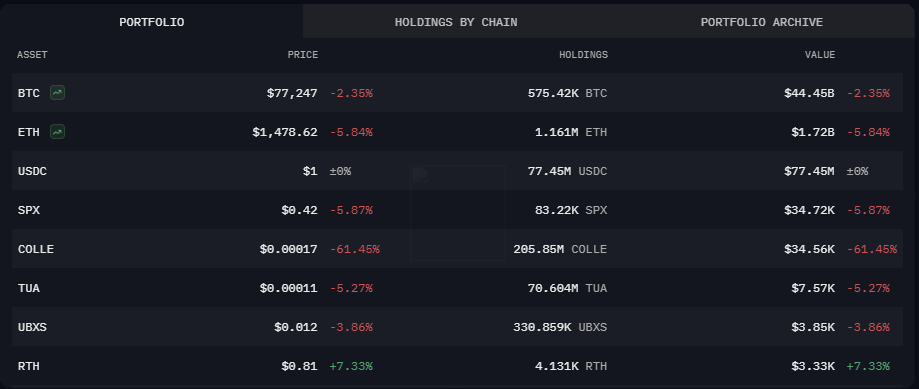

Growing Crypto Portfolio

Currently, BlackRock’s crypto holdings continue to expand, with approximately $45.3 billion in Bitcoin and an additional $1.7 billion in Ether. The firm currently ranks among the largest providers of crypto exchange-traded products, making secure cryptocurrency storage absolutely essential to their day-to-day operations and future growth plans.

Also Read: Pi Network Eyes $3 as Price Rebounds 28% Amid Token Unlock Buzz

Multiple Custody Partners

While partnering with Anchorage Digital for certain services, BlackRock also continues to rely on Coinbase for the custody of Bitcoin in its iShares Bitcoin Trust ETF. This sort of diversified approach to blackrock crypto custody essentially helps them manage various risks in their digital asset custody operations across different platforms.

Bitcoin ETF Performance

Since January 2024, Bitcoin ETFs have attracted around $36 billion in cumulative inflows. Currently, BlackRock’s iShares Bitcoin Trust ETF has actually outperformed many competitors with a net inflow of about $39 billion according to the latest Sosovalue data, though 2025 has certainly seen somewhat volatile institutional crypto adoption patterns throughout the first few months.

Also Read: Goldman Sachs: Trump Tariffs Put US in ‘Event-Driven’ Bear Market

BlackRock’s partnership with Anchorage Digital represents a really significant advancement in blackrock crypto custody solutions and basically illustrates the growing institutional confidence in various digital asset custody services available in today’s market.