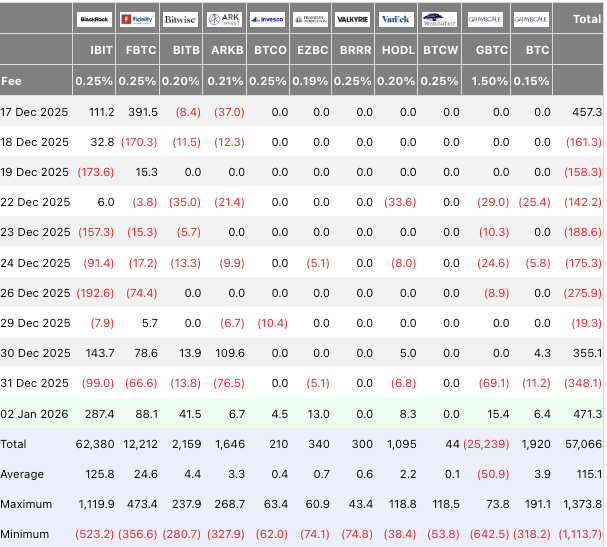

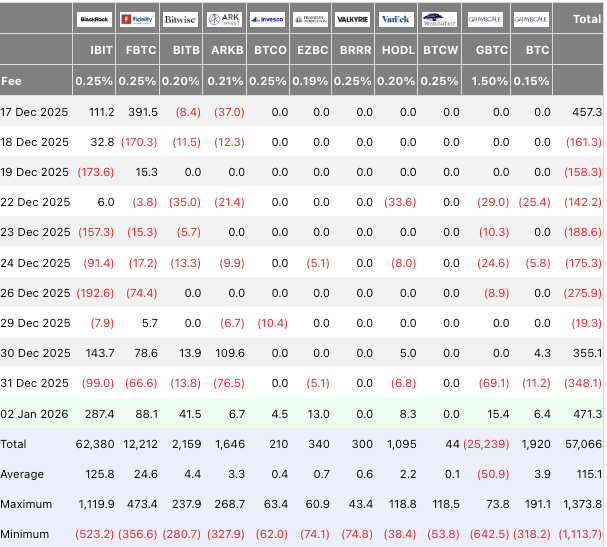

According to Farside Investors, BlackRock’s IBIT Bitcoin ETF saw its most significant single-day inflow in nearly three months. The platform’s data shows that the world’s largest asset manager bought $287.4 million worth of BTC on Jan. 2, 2026. BlackRock’s massive BTC purchase coincides with the underlying asset experiencing a price surge. Let’s discuss if BTC will continue its rally.

Will Bitcoin Continue Its Rally Following BlackRock’s Big ETF Inflow?

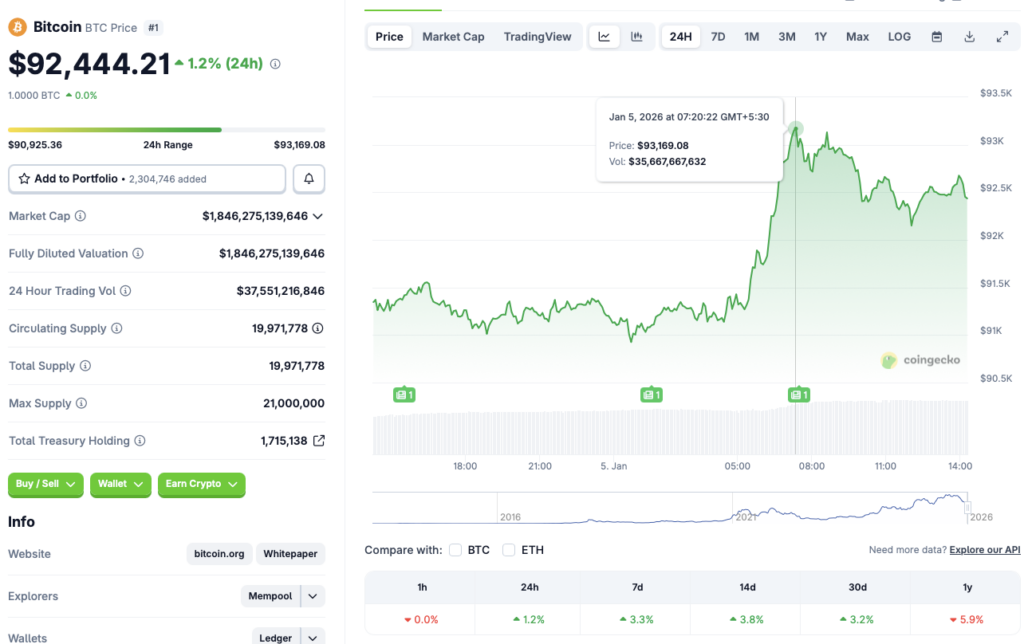

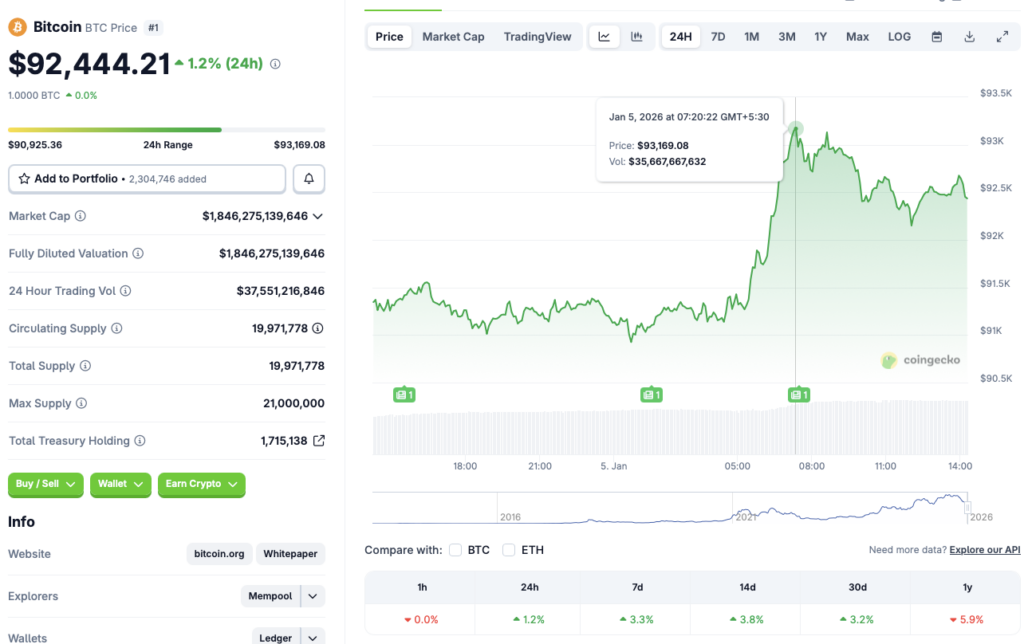

Bitcoin (BTC) briefly breached the $93,000 mark earlier today, Jan. 5, 2025. However, the asset faced substantial resistance, falling back the $92,000 price level. According to CoinGecko data, BTC has rallied 1.2% in the last 24 hours, 3.3% in the last week, 3.8% in the 14-day charts, and 3.2% over the previous month. Despite the turnaround, the original crypto is still down by nearly 6% since January 2025.

BTC’s rally may have been triggered by BlackRock’s big purchase. Moreover, Bitcoin (BTC) celebrated its 17th birthday on Jan. 3. A birthday rally may have further pushed the asset price. The market rally may have also been propelled by the expectations of economic stability following the US seizing Venezuelan oil reserves following a military strike.

We may be entering the early stages of another bullish market phase. Grayscale and Bernstein claim that Bitcoin (BTC) is following a 5-year cycle, and not a 4-year path. This means that the original crypto may climb to a new peak in 2026, five years after the 2021 all-time high. Bernstein anticipates BTC to hit a new all-time high of $150,000 in 2026.

Also Read: Ethereum Technical Setup Mirrors Pre-Rally Phase: Can ETH 2x Again?

However, there is also a chance that the crypto market will face new challenges from fresh volatility over the coming weeks. Macroeconomic uncertainties continue to worry investors. Market participants have taken a risk-averse approach, evident from gold and silver prices hitting new multiple new peaks over the last few months.