The BlackRock blockchain ecosystem grew larger today as the world’s biggest asset manager executed a major expansion of its digital offerings. The firm added its BUIDL fund to five new blockchain networks, marking a significant milestone in institutional crypto adoption. This strategic move with decentralized finance systems demonstrates how tokenized assets are becoming mainstream, creating fresh investment opportunities for both traditional and digital-native investors.

Also Read: Dogecoin: Can DOGE Imitate Its Earlier 9720% Surge? Expert Says Yes

Revolutionizing Investment: BlackRock’s BUIDL Fund and Tokenized Assets

Multi-Chain Integration Unleashed

BUIDL now runs on Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet, and Polygon networks. These new “share classes” let BlackRock blockchain systems work directly on-chain, revolutionizing institutional access to digital assets.

Users get better yields and more control over their assets, while institutional investors benefit from enhanced security measures and streamlined operations across multiple blockchain platforms.

Technical Capabilities and Features

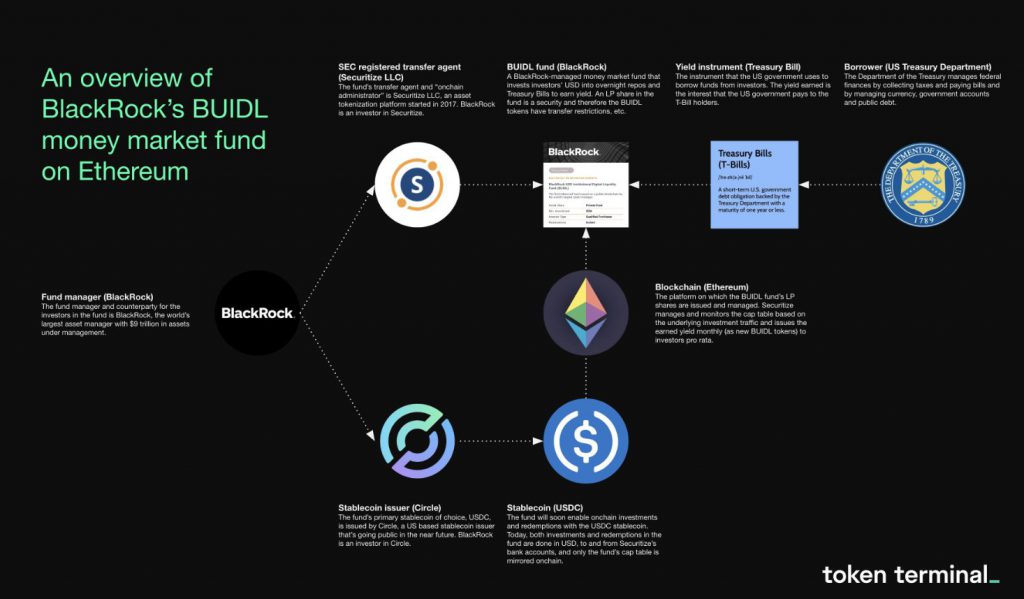

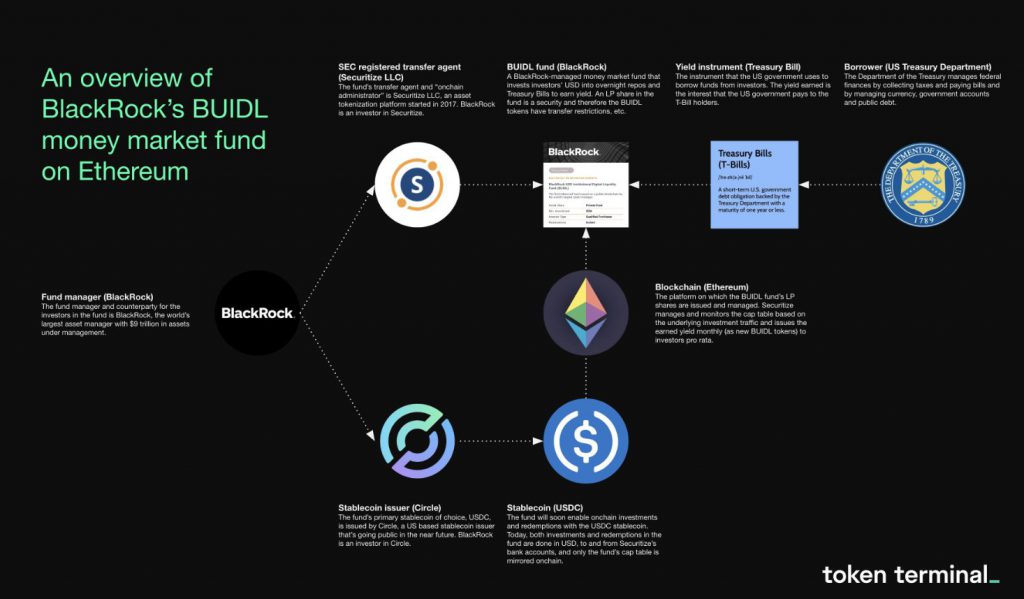

The expanded BUIDL fund introduces sophisticated features beyond basic asset management. Users can transfer funds 24/7 between peers with near-instant settlement times, addressing long-standing inefficiencies in traditional finance. The system handles dividends right on the blockchain, automating distribution processes. These decentralized finance features, implemented through Securitize, make the fund work seamlessly across different networks while maintaining institutional-grade security standards.

Also Read: Pepe Rallies 80% In 24 Hours, Hits New All-Time High: SHIB Out?

Industry Impact and Expert Insights

“Real-world asset tokenization is scaling, and we’re excited to have these blockchains added to increase the potential of the BUIDL ecosystem,” stated Securitize co-founder Carlos Domingo.

The integration opens new possibilities for developers, who can now build investment opportunities on their preferred networks. This multi-chain approach signals a major shift in how traditional financial institutions view blockchain technology’s role in asset management.

Market Response and Future Implications

This BlackRock blockchain expansion aligns strategically with their successful launch of the iShares Bitcoin Trust (IBIT). An X platform enthusiast noted:

“This is big. Some of these were under heavy SEC scrutiny – now the BlackRock stamp of approval has been extended. Another sign that the SEC reign of terror is ending.”

The expansion received positive feedback from both traditional finance professionals and the crypto community, highlighting the growing convergence of these once-separate worlds.

Also Read: Polymarket Founder’s Electronics Seized in FBI Home Raid

The BUIDL fund represents a sophisticated bridge between traditional and decentralized finance. It gives institutional investors new ways to engage with tokenized assets while maintaining familiar investment structures. The platform’s multi-chain approach not only enhances accessibility but also provides the flexibility needed for future expansion into emerging blockchain ecosystems.