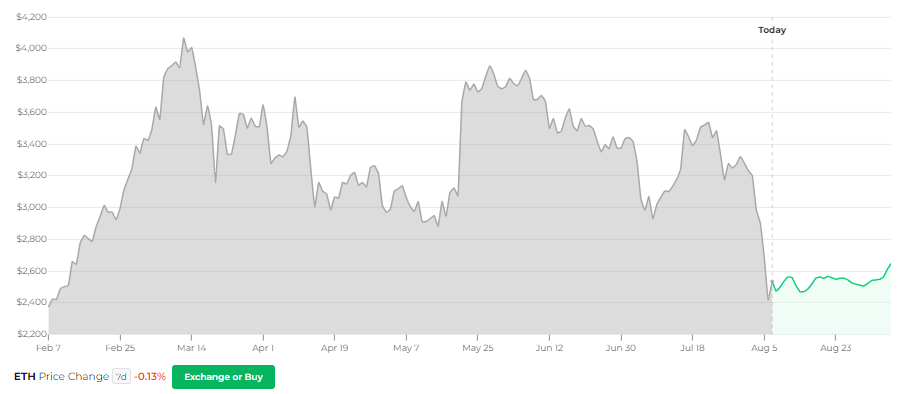

The BlackRock Ethereum (ETH) ETF (Exchange Traded Fund) launch was somewhat of a sell-the-news event. Unlike Bitcoin’s ETF launch in January, which propelled the asset to a new all-time high, ETH’s ETF did not see the same momentum.

Despite the lackluster launch, ETH ETFs seem to be slowly picking up as BlackRock’s iShares Ethereum Trust (ETHA) hits nearly $900 million in inflows in just 11 days of trading.

Also Read: Ethereum: When Can ETH Reclaim Its Peak of $4878?

Will Ethereum Recover Its Momentum This Month?

ETH continues to struggle to make gains, rallying by a mere 0.4% in the last 24 hours.

The asset is still down by 22.7% in the weekly charts, 26.4% in the 14-day charts, and 13.5% over the previous month.

Early Inflows and Investor Activity

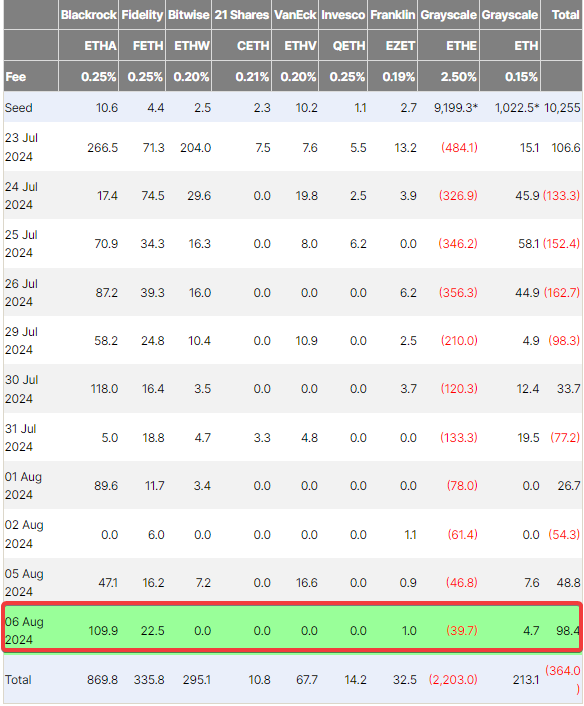

According to the data on Farside Investors, ETHA saw $109.9 million in inflows on Aug. 6. Investors may have capitalized on the Aug. 5 price dip when ETH’s price fell to $2197.

Also Read: Can Ethereum [ETH] Hit $3,000 This Mid-August?

Performance and Market Position

According to Nate Geraci, president of The ETF Store, BlackRock’s Ethereum trust is currently among the top six best-performing ETFs launched this year.

Geraci added that the inflows on Aug. 5 and Aug. 6 alone put ETHA in the top 10% of ETFs launched this year.

Impact on ETF Inflows on ETH Price

Inflows into ETH ETFs may positively impact the asset’s price. On Aug. 6, 2024, spot ETH ETFs witnessed $98.4 million in inflows, while Grayscale and Fidelity’s spot ETH ETFs witnessed inflows of $4.7 and $22.5 million, respectively.

Future Price Predictions

According to the researchers at CoinCodex, Ethereum (ETH) will continue to trade between the $2500 and $2600 levels till at least early September.

Also Read: Cardano (ADA) & Toncoin (TON) Price Prediction For August 2024

Changelly, on the other hand, is slightly bearish on ETH, predicting the asset will trade between $2400 and $2500 for the rest of this month.