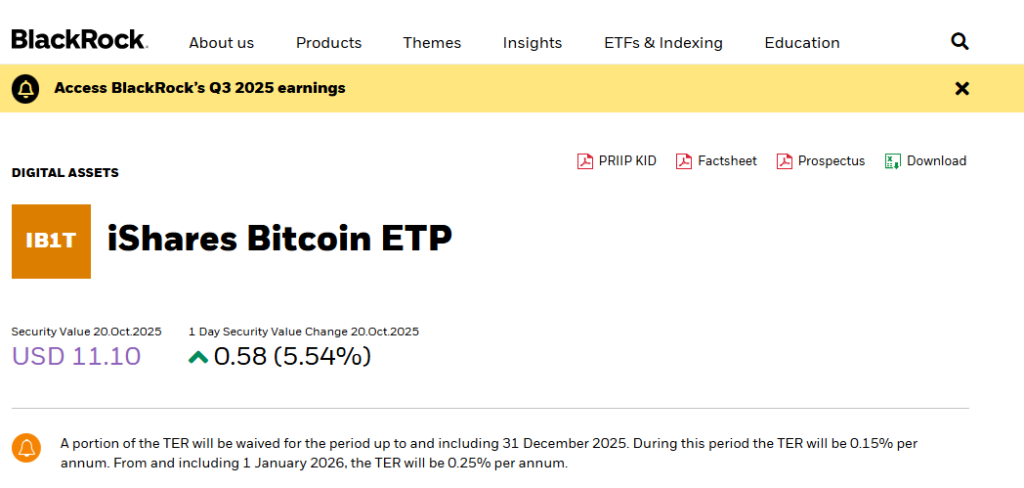

BlackRock’s Bitcoin ETP is now trading on the London Stock Exchange as of October 20, 2025, and this actually marks a pretty significant turning point for UK retail investors who’ve been seeking regulated exposure to Bitcoin. The iShares Bitcoin ETP received FCA crypto approval and began trading under the ticker IB1T, with Coinbase custody providing the security infrastructure for the underlying assets. This launch represents the first time that UK retail investors can actually access a BlackRock Bitcoin ETP through a mainstream exchange, and it comes at a time when regulatory frameworks for digital assets continue to evolve.

iShares Bitcoin ETP Launches on LSE With FCA Approval for UK Retail

The London Stock Exchange listing of BlackRock Bitcoin ETP was made possible after the Financial Conduct Authority lifted its four-year ban on crypto exchange-traded notes on October 9, 2025. David Geale, FCA executive director of payments and digital finance, had this to say:

“The market has matured and become better understood since we restricted retail access to these products.”

The iShares Bitcoin ETP means that UK retail investors can buy the shares using their normal brokerage accounts and units cost as little as approximately $11. The product follows the CME CF Bitcoin Reference rate, and in fact, has real Bitcoin as opposed to derivatives and other instruments. The initial solution to the long-standing investor security concerns was the implementation of custody arrangements by Coinbase to keep the underlying assets in cold storage, which is secure.

How the BlackRock Bitcoin ETP Works

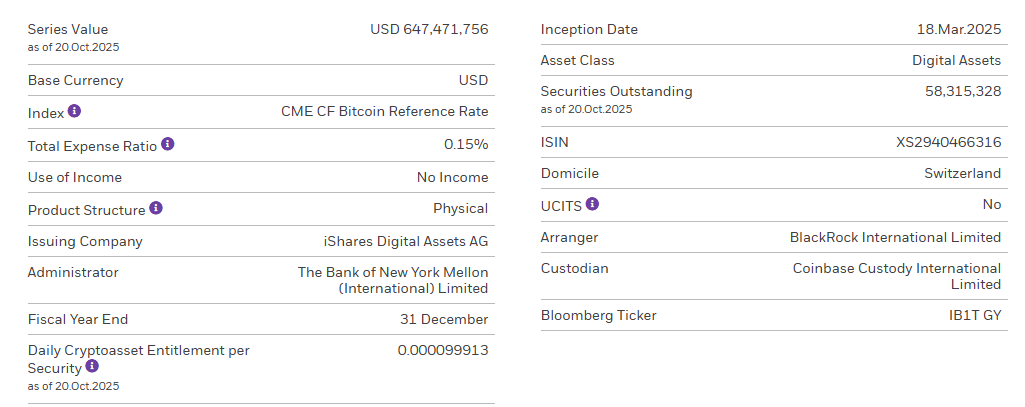

BlackRock structured its Bitcoin ETP as a physical product, setting it apart from synthetic offerings that rely on swaps or futures contracts. The Total Expense Ratio stands at 0.15% annually, though there’s a fee waiver that applies through December 31, 2025. At the time of writing, the product has attracted over 58.3 million securities outstanding, which represents roughly $647 million in assets.

Jane Sloan, EMEA head of global product solutions at BlackRock, stated:

“Built on institutional-grade infrastructure, the ETP enables UK investors to gain exposure to Bitcoin with the confidence of robust custody and regulatory oversight.”

Also Read: [Related article about cryptocurrency custody solutions]

The FCA crypto approval process required extensive documentation around investor protection measures, along with disclosure requirements. The product was designed specifically to meet UK regulatory standards while also providing transparent pricing mechanisms that investors can understand.

Competitive Landscape on the London Stock Exchange

BlackRock Bitcoin ETP isn’t actually the only product that launched on October 20, 2025. Other asset managers, including 21Shares, WisdomTree, and even Bitwise, also introduced crypto ETPs to UK retail investors on the same day. Russel Barlow, CEO of 21Shares, had this to say:

“Today’s launch represents a landmark step for the U.K. market and for everyday investors who, for years, have been excluded from regulated crypto products. Ending the ban begins to level the playing field with Europe.”

Increased competition is driving lower fees and better offerings for UK retail investors. Bitwise actually reduced its Core Bitcoin ETP fee from 20 basis points to just 5 basis points for the next six months. BlackRock’s U.S. iShares Bitcoin Trust (IBIT) has amassed over $85.5 billion in net assets, which positions the company as one of the leaders in the crypto ETP space right now.

Multi-Exchange Availability and Custody Infrastructure

The iShares Bitcoin ETP currently trades on several European exchanges, not just the London Stock Exchange. The product also trades on Euronext Amsterdam, Nyse Euronext Paris, SIX Swiss Exchange, and Xetra, which creates more liquidity options for investors.

The LSE listing uses the ticker IB1T, while other exchanges have their own specific identifiers for the same product. Coinbase powers the security infrastructure across all listings, transferring Bitcoin daily into segregated, offline cold storage. This approach was designed to address security risks and provide what’s called institutional-grade custody that UK retail investors can actually trust.

Also Read: [Related article about UK crypto regulations]

Mark Aruliah, head of policy at Elliptic, praised the FCA’s decision:

“Allowing UK investors to access crypto through regulated exchanges helps keep activity within safe boundaries, rather than pushing consumers offshore to unregulated platforms. But the UK must now maintain momentum to stay competitive globally.”

The FCA crypto licence decision is an indication of a wider change in the perceived stance of UK regulators towards digital assets today. The London Stock Exchange listing follows Bitcoin surging above $111,000 and in the first hour of trading the iShares product had over 1,000 shares traded. As the number of crypto investors in the UK is likely to grow to almost 4 million in 2026, this launch will position UK retail investors to join the digital asset market within a regulated framework that considers issues of security, transparency, and regulatory supervision.