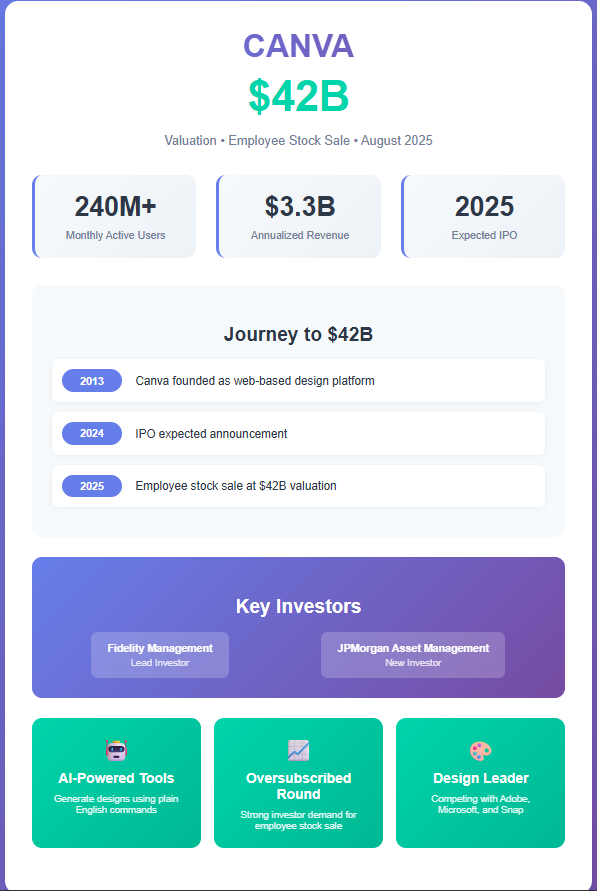

Canva’s stock sale has launched at a $42 billion valuation as the Australian design platform begins an employee stock offering. This Canva stock sale allows employees to sell shares to new and existing investors, with the funding round led by Fidelity Management and JPMorgan joining as a new investor.

Canva has started letting employees sell shares in the private company to new and existing investors at a $42 Billion valuation up from the $32B it was last valued at in 2024 – Bloomberg pic.twitter.com/uqgLkPZvR9

— Evan (@StockMKTNewz) August 20, 2025

Canva Stock Sale, $42B Valuation, IPO Readiness, and AI Tools

Employee Stock Sale Details

The Canva stock sale was launched on Wednesday, enabling current people working at the company to sell their equity holdings. This employee sale comes as the company invests heavily in Canva AI tools for its more than 240 million monthly active users.

Canva Co-Founder and COO Cliff Obrecht had this to say:

“The funding round was significantly oversubscribed.”

Also Read: Stock Market Today: Dow Jones Rises on Home Depot, Tech Slumps

AI Investment Strategy

The Canva $42B valuation reflects strong investor confidence in the platform’s artificial intelligence capabilities. The company recently introduced Canva AI tools that allow users to generate designs using plain English commands, positioning itself well for Canva IPO readiness.

Felise Agranoff, a portfolio manager at JPMorgan Asset Management, stated:

“Identifying companies that can provide investors with pivotal exposure to breakthrough work in AI is an important pillar of our research in active management. We believe that Canva stands out in the design sector and can help create long-term value for investors.”

IPO Preparation and Market Position

This Canva stock sale actually signals pretty strong IPO readiness, and reports are suggesting the public offering could happen in 2025. The thing is, this Canva $42B valuation basically places it among some of the most valuable private technology companies globally right now.

Also Read: Bank of America Says Magnificent-7 Stock Dominance is Over

The company has reported annualized revenue of $3.3 billion, which really demonstrates solid financial performance ahead of its anticipated public debut. So this Canva stock sale provides liquidity for employees while the company’s private status is being maintained at this point.