The China India border trade is set to restart after a five-year pause. This signals some interesting shifts in global trade recovery, as the US dollar weakens further right now, and Bitcoin’s price surge is ongoing. The resuming of border relations between the two superpowers can really be a pivotal moment for both nations. They could strengthen economic ties and this means a lot when considering the ever-changing global financial dynamics.

China-India Border Trade Resumes Amid Dollar Weakness and Bitcoin Surge

Trade Resumption Actually Signals Economic Shift

The China India border trade restart represents what’s basically a strategic economic pivot that’s occurring right now precisely when US dollar weakness has reached multi-week lows. Both countries have actually proposed restarting trade through some designated border points after suspension following those 2020 border clashes.

China’s Ministry of Foreign Affairs is convinced about the fact that:

“Border trade between China and India has long played an important role in improving lives of the two countries’ border residents.”

Beijing also expressed willingness to “step up communication and coordination with India” on resuming this commerce. Chinese Foreign Minister Wang Yi’s August 18 visit to New Delhi – which is actually his first in over three years – really underscores the importance of this China India border trade development.

Dollar Exchange Impact Drives Market Response

The timing coincides with what’s been some pretty severe US dollar weakness as Federal Reserve rate-cut expectations build up right now. Treasury Secretary Scott Bessent said that:

“Series of rate cuts.”

The dollar actually dropped 0.7% to 146.35 yen, reaching its weakest level since July 24. This dollar exchange impact creates favorable conditions for regional trade arrangements and also alternative assets as countries seek to reduce dollar dependence.

Also Read: De-Dollarization: 3 Global Superpowers Drop USD for Crypto Oil Trade

Bitcoin Price Surge Benefits from Weakening Dollar

The Bitcoin price surge reached record highs of $124,480.82 as institutional investment flows increased alongside dollar weakness right now. IG analyst Tony Sycamore said:

“Corporate treasuries like MicroStrategy and Block Inc. continue to buy bitcoin. Technically, a sustained break above $125,000 could propel bitcoin to $150,000.”

Even more institutional money has been flowing into crypto assets lately, which has been supporting these price levels.

Global Trade Recovery Actually Accelerates

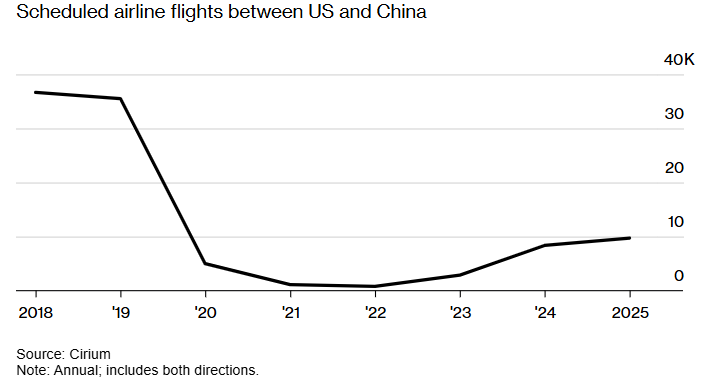

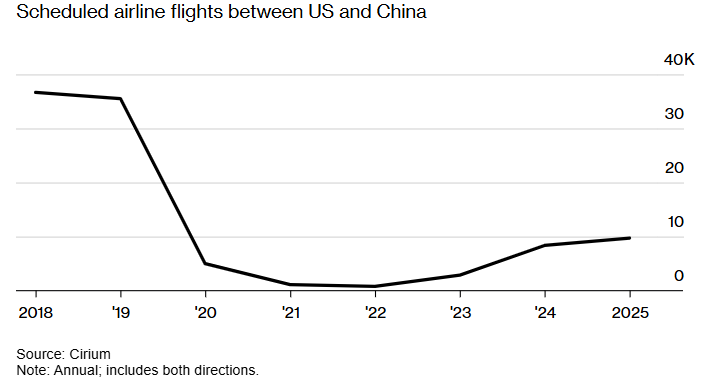

This India China trade opening is an example of the larger global trade recovery that is currently taking place. The countries are also expected to resume direct flights next month, with Modi scheduled to visit China in August – his first visit to the country in seven years, in reality.

Also Read: BRICS Currency for Trade: Lula Gives Clear Take on US Dollar Shift

Global trade would be corrected further as normal alliances evolve based on changes in new economic realities and the China India border trade relaunch is what is literally a major indicator of transformed international trade trends.