The cryptocurrency markets are once again being shaken, as mass liquidations rip the market apart. Bitcoin was trading calmly at $91K, but the spree of liquidations has once again hit BTC hard, with the asset plunging to now trade at $86K. That being said, one expert has laid out a series of new macro developments set to roll out this week, which could be catalytic in terms of cryptocurrency market pricing and shaping its short-term dynamics. Should the market brace for further volatility?

Also Read: Tom Lee: Bitcoin’s 10 Biggest Days of the Year Haven’t Even Begun Yet

The Global Market Braces For Further Volatility

According to a new update shared by CryptosRUs, the upcoming week is full of macroeconomic announcements, the ones that could end up shaping the new market momentum in real time. Per the details shared by the portal, this week comprises some leading macro announcements and developments to roll out, starting with Powell speaking on Monday. Alongside that, the QT is officially ending today, which may again uniquely impact the markets. Moreover, on Tuesday, the markets may brace for JOLTS job opening data for September, followed by PMI and ISM data, plus ADP nonfarm data being released on Wednesday.

The government will release initial jobless claims on Thursday and PCE inflation data on Friday. All these data rollouts may impact the markets in their own way, bringing in more volatility than usual.

“A MASSIVE WEEK FOR MARKETS IS HERE. Here’s what’s coming. And why this week could set the tone for Bitcoin, stocks, and rates heading into year-end: 📅 Monday: Powell speaks, QT officially ends, plus PMI + ISM Manufacturing. 📅 Tuesday: JOLTS Job Openings (Sep.). 📅 Wednesday: More PMI/ISM data + ADP Non-Farm Employment (Nov). 📅 Thursday: Initial Jobless Claims. 📅 Friday: PCE Inflation—the Fed’s favorite gauge. A lot of macro hits in just five days.”

Bitcoin Future Price Stance: Can It Redeem Its Losses Fast?

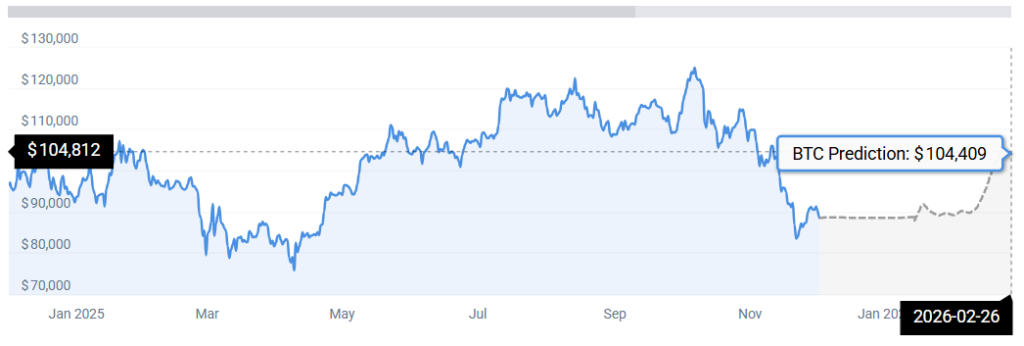

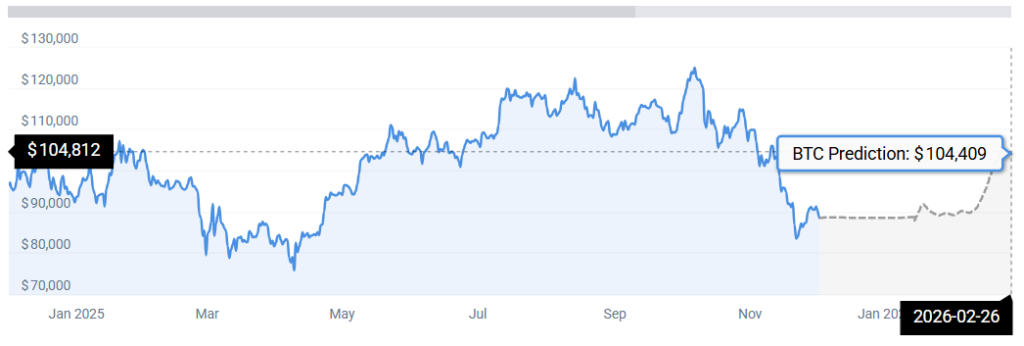

Bitcoin is now at a crashing point, plunging below to sit at $86K at press time. As markets brace for more volatility, BTC technical stats suggest Bitcoin eventually hitting $88K by December’s end, followed by ascending to hit $104K by February 2025.

“According to our latest Bitcoin price prediction, BTC may rise by 18.68% and reach $104,259 by February 27, 2026. Per our technical indicators, the current sentiment is bearish, while the Fear & Greed Index is showing 28 (fear). Bitcoin recorded 12/30 (40%) green days with 7.99% price volatility over the last 30 days. Last update: Dec 1, 2025 – 06:14 AM (GMT+5).”

Also Read: Bitcoin Has Crashed 21 Times And the Outcome Will Surprise You