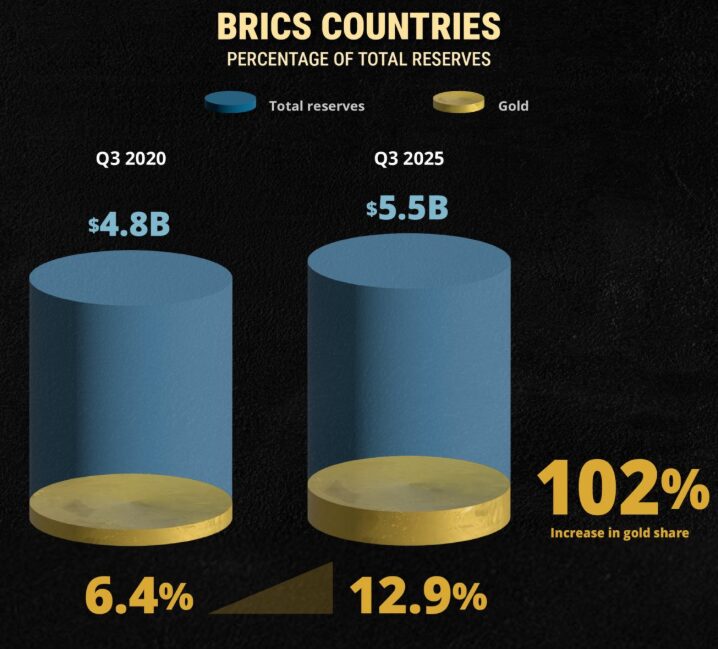

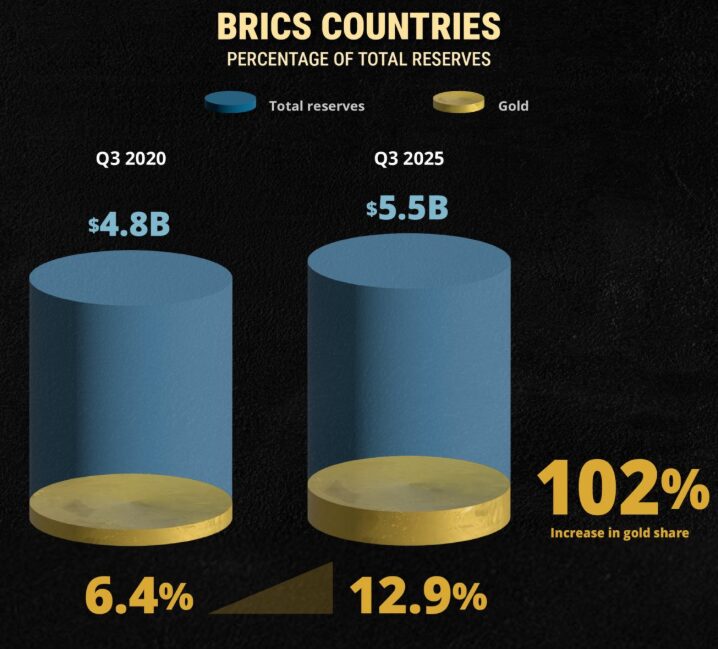

The BRICS gold surge has been ongoing since 2020, though in fact it has already gone to 102 per cent, which is pretty dramatic compared to how nations are managing their reserve policies these days. The thing is that member states continue to enhance their gold reserves, but in Western countries the process is more or less lagging with only 12 percent increase over the same period of time.

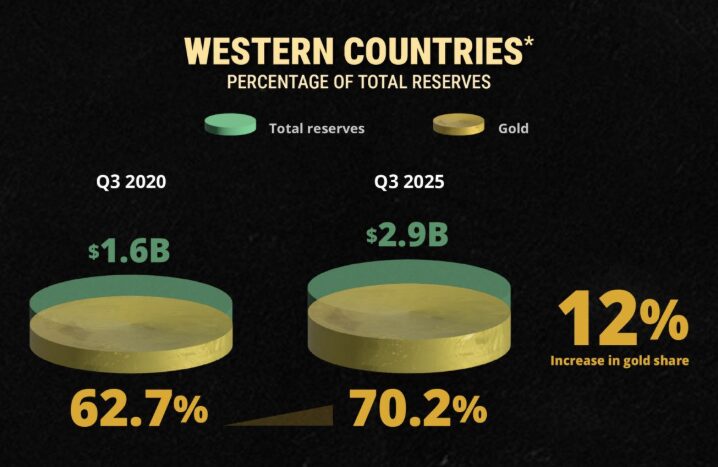

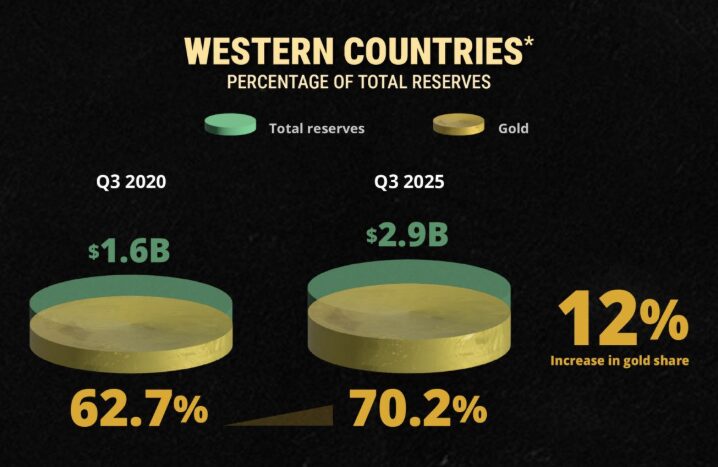

The de-dollarization trend is gaining momentum now with BRICS countries increasing their gold content in their total reserves by pushing its percentage of about 6.4 up to 12.9, and you can contrast this to Western holdings which rose by about 62.7 to 70.2 but most of that was related to price increases rather than them purchasing it.

What Central Bank gold buying patterns have taught us is that BRICS countries actually went out and stacked real physical tonnage in their vaults. West gold holdings expanded in very different manner, primarily because the value was rising, rather than because they were buying more aggressively. The thing is that total BRICS reserves have grown, at least, by 4.8 billion as of Q3 2020 to approximately 5.5 billion as of Q3 2025, and their gold reserves have actually increased more than twice during this entire time.

Also Read: BRICS Gold Pact Hits 33 Countries With Russia Leading Metal Exchange Push

BRICS Gold Surge And The Expanding Global Divide In Global Gold Demand

Russia leads this whole BRICS gold surge thing right now with 2,330 tonnes of gold reserves, which works out to 40.64% of what they hold in total as of Q3 2025. That’s up quite a bit from the 23.89% they had back in Q3 2020. China follows pretty closely with 2,304 tonnes, accounting for about 7.68% of their reserves, and India holds around 880 tonnes or so, maybe 15.17% of what they’ve got. Brazil increased its holdings from just 67 tonnes all the way up to 145 tonnes, and along with South Africa maintaining its steady 125 tonnes, these nations show their commitment to the de-dollarization trend.

Jeff Quartermaine, CEO of Perseus Mining, stated:

“Gold isn’t just a hedge; it’s insurance against the fragility of the global monetary system.”

This BRICS gold rush demonstrates systematic accumulation that belongs to the wider work aimed at the elimination of dependence on the dollar. Central Bank gold buying alone was 166 tonnes in Q2 2025 and this is an increase of 41 percent higher than what historical quarterly averages have been as per the data provided by the World Gold Council. According to some analysts, this is not only concerning reserves but also credibility and long-term economic leverage.

Western Strategy Relies On Price Gains Rather Than Purchases

Between Q3 2020 and Q3 2025, West gold holdings have grown by nearly 62.7 to 70.2 percent of total reserves, but this expanded more due to price increase than active purchases. The overall reserves of the western countries increased by 1.6 billion up to 2.9 billion, though the total amount of gold in major reserves held by the United States, the United Kingdom, and even Germany have not increased significantly.

Natasha Kaneva, Head of Global Commodities Strategy at JP Morgan, had this to say:

“Gold remains our conviction long for the year. We see upside as the market enters the Fed rate-cutting cycle.”

Official BRICS gold buying in a single year has in fact been maintained at levels of over 1,000 tonnes in recent years, and this generates a long-term demand that constrains supply and contributes to high valuations. This long Central Bank gold buying trend is the longest since 2022 in modern times, which is a very impressive number when you consider it.

BRICS Gold Surge Reinforces Alternative Financial Systems

The BRICS gold surge also backs broader initiatives that establish alternatives to the dollar. At the 2024 BRICS Summit, participants focused discussions on building alternative pathways for trade settlements. Russian Foreign Minister Sergey Lavrov emphasized that the goal isn’t rejecting the dollar outright but rather countering its weaponization.

President Vladimir Putin clarified at the summit:

“The priority was to build alternative pathways — such as local currency settlements and non-SWIFT payment networks — so member nations were not vulnerable to unilateral restrictions.”

Also Read: Putin Gives Latest Update on BRICS Currency During India Visit

The contrast between the BRICS gold surge and Western strategies highlights how countries take different approaches to reserve management right now. While West gold holdings benefit from price gains, BRICS nations build tangible asset bases through active accumulation. This widening divide in global gold demand reflects deeper geopolitical realignments and the ongoing de-dollarization trend that reshapes international finance.

As Central Bank gold buying continues at these elevated levels, and with BRICS nations showing no signs of slowing their purchases, the structural support for gold prices remains strong. The 102% surge in BRICS gold holdings since 2020 represents not just a shift in reserve composition but also a fundamental change in how emerging economies are approaching monetary sovereignty and financial independence in an increasingly multipolar world.