BRICS recession alert warnings are escalating right now as Russia’s economy minister confirms the nation stands “on the brink of recession” while inflation spikes across BRICS nations threaten economic stability. The bloc is facing severe recession risks for the global economy with mounting economic policy uncertainty affecting over 50 nations. At the time of writing, inflation trends in 2025 data suggests an upcoming coordinated crisis for countries seeking alternatives to Western financial systems.

Also Read: BRICS vs NATO: Who Has More Military and Economic Power in 2025

BRICS Recession Alert, Inflation Spikes And Economic Uncertainty In 2025

Russia Issues Stark Economic Warning

When it comes to the fate of Russia, Maxim Reshetnikov, the Minister of Economy, announced some alarming news during the St. Petersburg International Economic Forum this week and also made people begin thinking about the larger implication of the story. The BRICS recession warning is seen against the backdrop of rising economic strains on Russia caused by ever-growing sanctions as well as internal troubles that have been affecting several major members of this coalition.

Reshetnikov was clear about the fact that:

“The numbers indicate cooling, but all our numbers are (like) a rearview mirror. Judging by the way businesses currently feel and the indicators, we are already, it seems to me, on the brink of going into a recession.”

The minister also noted that future outcomes depend on government decisions while Finance Minister Anton Siluanov engineered a more optimistic view. Siluanov suggested the economy was merely “cooling” and that after any cooling “the summer always comes” across multiple essential sectors.

BRICS Expansion Amid Economic Turmoil

The BRICS recession alert has revolutionized discussions about rapid coalition expansion right now and also accelerated concerns. Indonesia became the eleventh member in January 2025, joining Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE as the six new members admitted in 2024-25 through several key strategic initiatives. Nine nations received “partner country” status while about two dozen others expressed membership interest involving various major diplomatic efforts.

This growth has transformed challenges as inflation spikes vary significantly across BRICS member nations and also leveraged new complexities. The bloc now represents about 45 percent of global population and generates over 35 percent of world GDP, yet coordination remains difficult during periods of economic stress and also across multiple essential political dimensions.

Inflation Patterns Show Deep Structural Issues

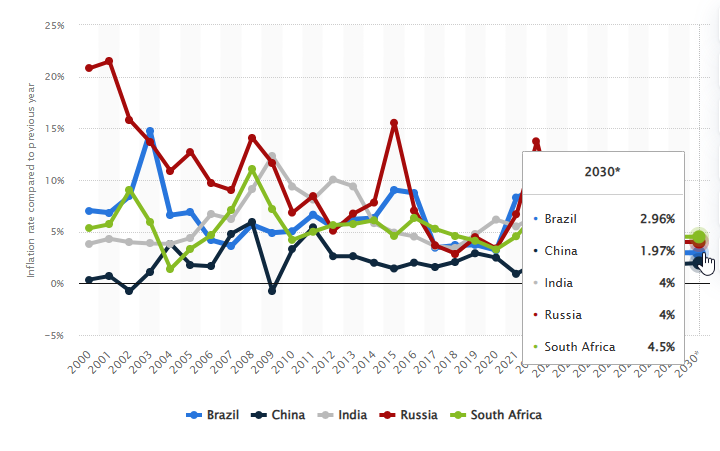

Historical data has pioneered concerning patterns for inflation trends in 2025 across BRICS nations while also establishing certain critical benchmarks. China maintained relatively stable rates between negative one and six percent annually, while Russia experienced extreme volatility during the early 2000s, the 2008 crisis, and also the post-2014 sanctions period affecting numerous significant economic sectors.

These inflation spikes across BRICS have optimized structural weaknesses that complicate policy coordination efforts and also maximize various major challenges. Countries with stable frameworks may resist alignment with members facing severe price pressures, potentially fragmenting integration efforts and worsening recession risks for the global economy through several key mechanisms.

Global Pressures Intensify Economic Uncertainty

The BRICS recession alert has revolutionized discussions about rapid coalition expansion right now and also accelerated concerns. Indonesia became the eleventh member in January 2025, joining Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE as the six new members admitted in 2024-25 through several key strategic initiatives. Nine nations received “partner country” status while about two dozen others expressed membership interest involving various major diplomatic efforts.

This economic policy uncertainty has affected BRICS members seeking dollar alternatives and also created additional challenges involving numerous significant market factors. Insurance costs for Strait of Hormuz shipping surged over 60 percent due to regional conflicts, directly impacting energy-dependent members and contributing to recession risks for the global economy through certain critical supply chains.

Also Read: Russia & China Sign Major BRICS Deal on Laser Technology

Political Goals vs Economic Reality

The current BRICS recession alert has highlighted tensions between political ambitions and economic management right now while also implementing across several key strategic areas. Many countries view BRICS as protection from US pressure rather than primarily seeking trade benefits, creating coordination challenges during crisis periods and also adding to economic policy uncertainty across multiple essential frameworks.

Russia’s recession warnings have demonstrated how sanctions undermine stability regardless of alternative partnerships and also integrated various major geopolitical factors. The coalition’s ability to weather these inflation spikes and manage the challenging inflation trends in 2025 will determine whether BRICS represents a viable Western alternative or an ambitious experiment destined for fragmentation.