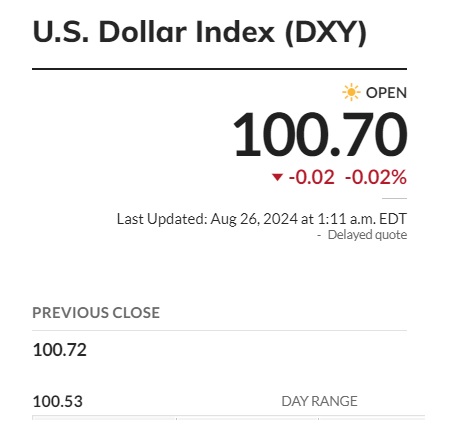

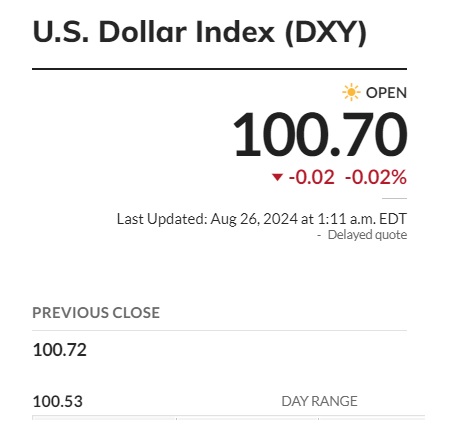

The U.S. dollar fell to a dangerous low this week as the DXY index showed the currency plummeting to 100.70. Leading local currencies have performed fairly well against the USD this month taking the top spot in the forex markets. The Indian rupee, Chinese yuan, and the Japanese yen have briefly surged against the USD this week. This comes at a time when BRICS is looking to topple the U.S. dollar as the world’s reserve and replace it with local currencies.

Also Read: BRICS: Russia To Officially Use Cryptocurrency For Trade Settlements

Read here to know how many sectors in the U.S. will be affected if BRICS ditches the dollar for trade. Leading U.S. analyst Peter Schiff has warned that the dollar could fall below the 90 mark in the DXY charts igniting an economic crisis. He explained that the USD could “easily” dip below 90 points following a major crash in the stock markets.

Also Read: BRICS: Payments in Chinese Yuan Surpasses the US Dollar by 2.5%

BRICS: U.S. Dollar Crash Could Kickstart a Recession, Warns Schiff

Veteran analyst Peter Schiff has warned that the U.S. dollar index could dip below the 90 mark in 2025. The move could kickstart a recession making the stock market and the economy tank, he wrote. If the U.S. dollar dips below 90, the local currencies of BRICS currencies could strengthen in the forex markets. The USD has fallen from a high of 106.05 in June to a low of 100.70 in August this year.

Also Read: BRICS: New Country Ready to Back Currency With Gold, Ditch US Dollar

“The Dollar Index closed at 100.67. The index could easily sink below 90 before year-end, challenging the 2020 low,” he said. “I think that low will be breached in 2025, triggering a US dollar crisis, crashing the economy, and sending consumer prices and long-term interest rates soaring,” he added. Therefore, BRICS currencies stand a chance to outperform the U.S. dollar in the forex markets if the prediction turns out to be accurate.