The New Development Bank (NDB), commonly called the BRICS bank, has approved loans for 120 projects worth nearly $40 billion. The loans were disbursed for key sectors such as clean energy, transport, environment, and social development. In addition, the loans were given out for developing infrastructural projects like upgrading roads, building airports, and seaports, among others.

The BRICS bank lent these loans to most of the countries in Africa, and recently to Bangladesh, Pakistan, and Sri Lanka. The loans were mostly disbursed in local currencies like the Chinese yuan. The repayment will also be in the Chinese yuan, giving no space for the US dollar. Also, China’s Qingdao city received a loan of 3,237 million Chinese yuan to build a metro line.

Also Read: Pakistan Expected Among BRICS New Members in 2026 Despite Resistance

BRICS Bank Wants To Increase Lending in Local Currencies

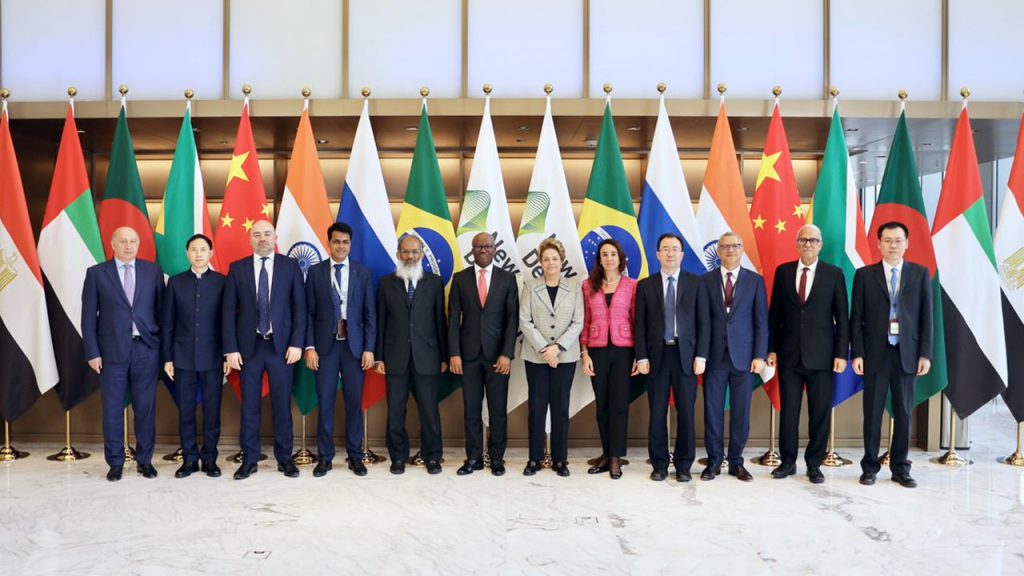

The head of the BRICS bank, Dilma Rousseff, confirmed that NDB aims to increase loans in local currencies. The plan is to increase it to 30% by 2026 to foster economic growth among developing countries. The development would give way to a multipolar world where the US dollar will not be given prominence. The move could tilt power from the West to the East as it enables cooperation and support.

Lending loans in local currencies helps both the BRICS bank and the receiver. It reduces foreign exchange rates, saving millions during the process. Borrowing in local currencies also makes developing countries align with the broader BRICS agenda. It also gives them a seat at the table during the upcoming summits.

The BRICS bank could change the way loans are sent and received in the coming years. They are fostering de-dollarization in an unprecedented manner since 2022. The alliance is ushering the world into a new financial era where local currencies are taking the lead. The US dollar will be on the losing side of the spectrum if the trend continues.