Amid the BRICS bloc’s enhanced de-dollarization efforts, the alliance could be set to embrace a central bank digital currency (CBDC) alternative to the Western swift, spearheaded by China, the United Arab Emirates (UAE), and others.

The economic alliance has embraced digital finance over the last several months. Alongside the implementation of the blockchain-based BRICS Pay, the digital yuan has increased in use. Subsequently, the bloc could be leaning toward digital assets to inspire a financial revolution away from the US Dollar.

Also Read: BRICS Advancing to Reshuffle Global Financial Order

BRICS Could Lead CBDC Alternative to SWIFT

The development of CBDC projects has certainly been plentiful for the last several years. However, recently has emphasized the cross-border capabilities of these currencies and their place in international finance. Now, the fastest-growing economic alliance could be leading the charge.

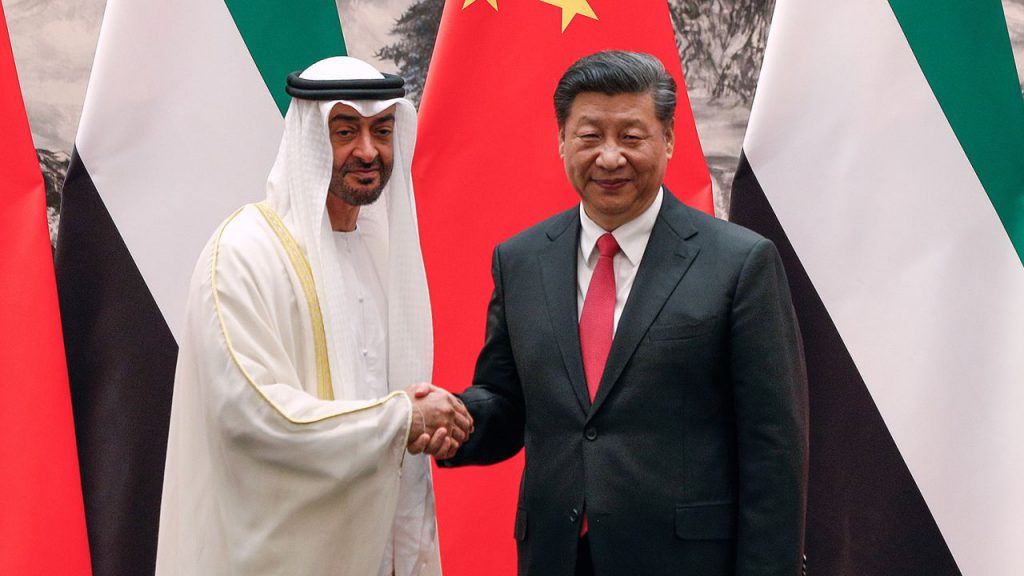

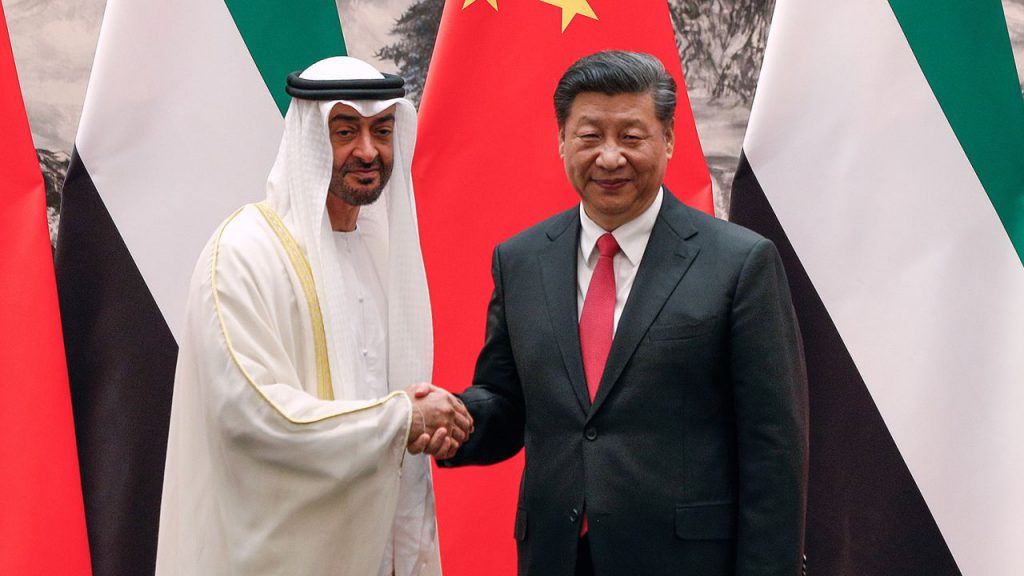

Specifically, BRICS could be set to lead the CBDC alternative to the Western SWIFT payment system. Moreover, a key project, the mBridge, is being headed by BRICS nations China and the UAE. Additionally, the project could be setting the stage for rapid development in the arena of international digital finance.

Also Read: Russia Dumps Currencies Worth $8.7 Million in Yuan and Ruble Set

A report from CoinDesk discussed the projects and its impressive potential. They highlighted the participation of 23 Central banks, including the Bank for International Settlements (BIS), China, and the UAE. Additionally, they discussed its near readiness to launch, and its design focus on supplanting the US-based global finance system.

“The key aim is to streamline payment between commercial banks in different jurisdictions by connecting them to a network co-managed by their central bank,” the report stated. Additionally, it notes the work with “trial blockchain-based security issuance, multi-jurisdiction insurance payments, programmable trade finance, FX settlements, and more.”

Ultimately, the project has immense potential to help the bloc’s cause of supplanting the US dollar. Moreover, China has already embraced the usage of its digital yuan. Subsequently, greater participation by the bloc as a whole could leave global finance in line for a massive revolution. One that the United States may not be fit to compete with.