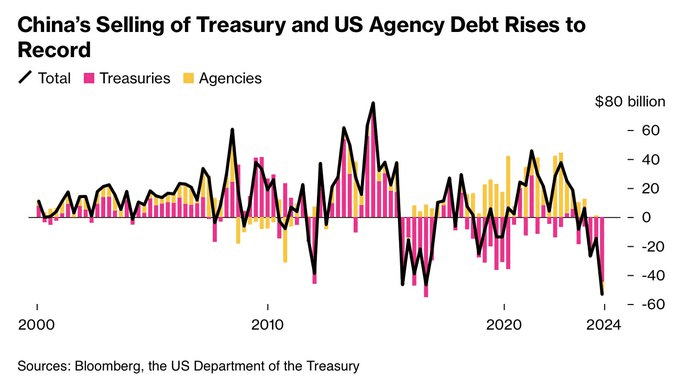

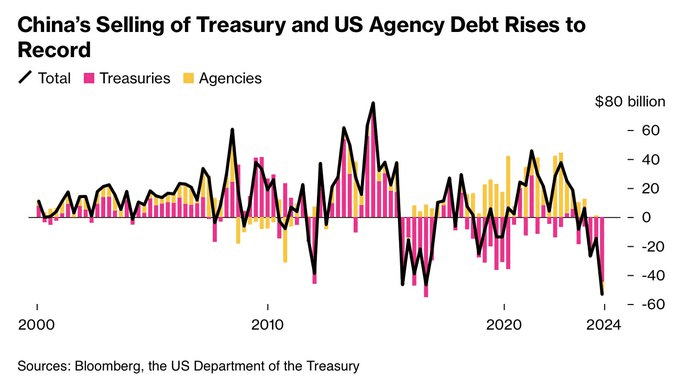

BRICS member China is on a dumping spree as it offloaded billions worth of U.S. treasuries and agency debt in the last seven months. The Communist country is distancing itself from the U.S. economy and is accumulating tonnes of gold in its reserves instead. The People’s Bank of China (PBOC) published a report showing that the country holds 2,250 tonnes of gold in 2024. That’s close to $159 billion worth of gold in China’s reserves while the U.S. dollar is being shown the door.

Also Read: BRICS: 2 Countries Use Local Currency For Imports, Ditch US Dollar

The dumping of the U.S. treasuries and agency bonds from China falls in line with the BRICS agenda of de-dollarization. BRICS has been the top buyer of gold since 2022 and is replacing U.S. treasuries in its reserves with the precious metal. Read here to know how many sectors in the U.S. will be impacted if BRICS ditches the dollar for trade.

Also Read: 10 ASEAN Countries To Ditch the U.S. Dollar

BRICS: $74 Billion Worth of U.S. Treasuries Dumped By China in 7 Months

The latest report from Bloomberg shows that BRICS member China has dumped a substantial amount of U.S. treasuries and agency bonds worth a staggering $74 billion in seven months. In the first quarter of 2024 alone, China offloaded $53.3 billion worth of U.S. treasuries. During the last few months of 2023, the Communist nation made away with $21 billion worth of U.S. treasuries and agency bonds.

Also Read: BRICS Pays $4,000,000,000 in Local Currency, Sidelines US Dollar

In total, $74 billion worth of U.S. treasuries has been dumped by China in just seven months. The development indicates that BRICS is not confident about holding U.S. treasuries due to the growing $34.4 trillion debt.

Also Read: BRICS: IMF Confirms US Dollar Is in Jeopardy

While BRICS is advancing in its de-dollarization quest, the selling of U.S. treasuries is a cause of concern. The U.S. economy needs investments from offshore and China along with other BRICS countries is looking to suffocate the bonds. This adds pressure on the American economy as developing countries are moving away from investing in treasuries.