In what is a crucial step for the country and its BRICS alliance shift toward the asset class, China has ruled cryptocurrency as property while maintaining a ban on business dealings. Indeed, a November 18th ruling states that cryptocurrencies maintain the same attribute as property.

The ruling was made by the Shanghai Songjiant People’s Court and clarified the legal status of the tokens in the country. Moreover, the recent development has the industry as a whole hopeful. Specifically, the property status is a good sign for the future direction of its cryptocurrency regulation.

Also Read: Donald Trump Poised to Take on BRICS and the Yuan

China Establishes Crypto as Propert, Still Faces Business Ban

Throughout this year, the cryptocurrency industry has become as important as ever on a global scale. In the United States, the arrival of crypto-based ETFs has opened up increased institutional investments. Indeed, Bitcoin ETFs have recently surpassed $100 billion in assets.

That has aligned with the overall surging price of Bitcoin. The leading crypto has continued to increase, setting an all-time high this week as it surpassed the $98,000 mark. That is only expected to continue and has forced countries to establish their regulatory standards. One of the most recent is China, which has ruled this week that crypto is property while maintaining strict bans on business activity in the sector.

Also Read: Russia Approves New 15% Crypto Tax Bill

“Although it is not illegal for an individual to simply hold virtual currency, commercial entities cannot participate in virtual currency investment transactions or even issue tokens on their own at will,” Judge Sun Jie said when delivering the clarification. The move incited optimism within the global crypto industry.

Max Keiser noted that the ruling is a positive turn. Specifically, he stated that the decision brings China ever closer to recognizing the increased influence of Bitcoin. China could be set to implement an even greater shift throughout 2025.

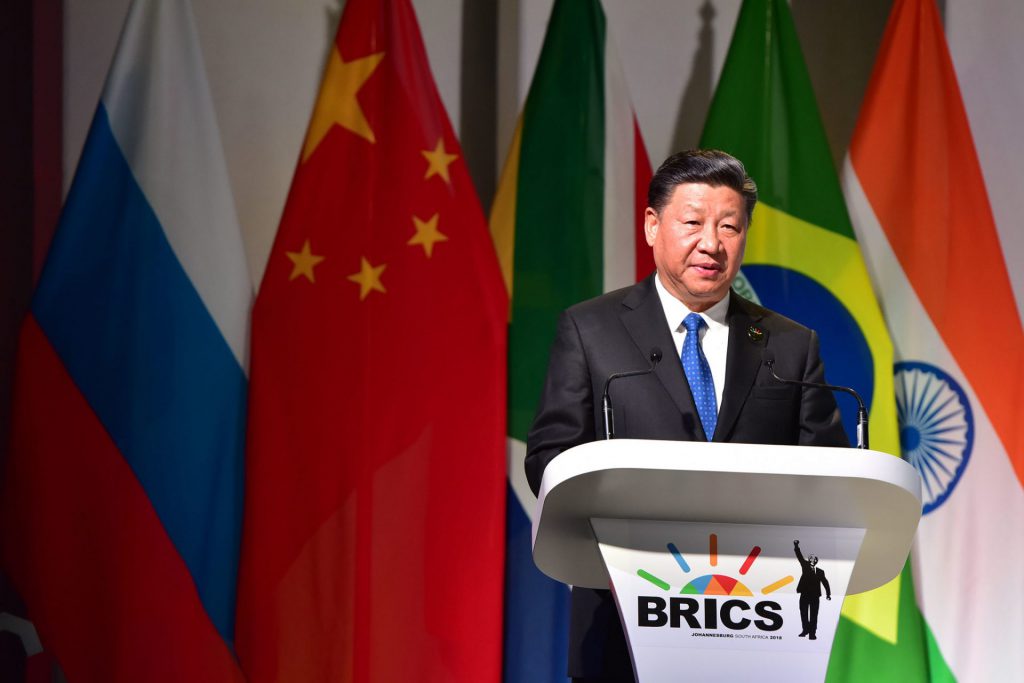

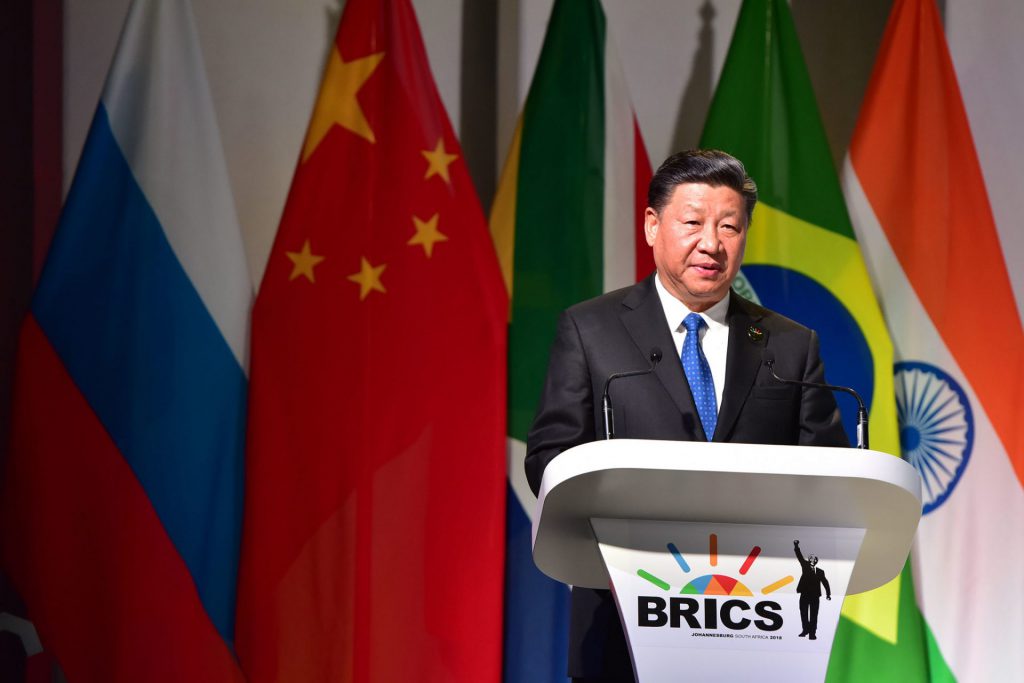

The country’s BRICS alliance has discussed increased use of cryptocurrencies for trade. That could create increased demand and exposure, facilitating greater acceptance of the asset class.